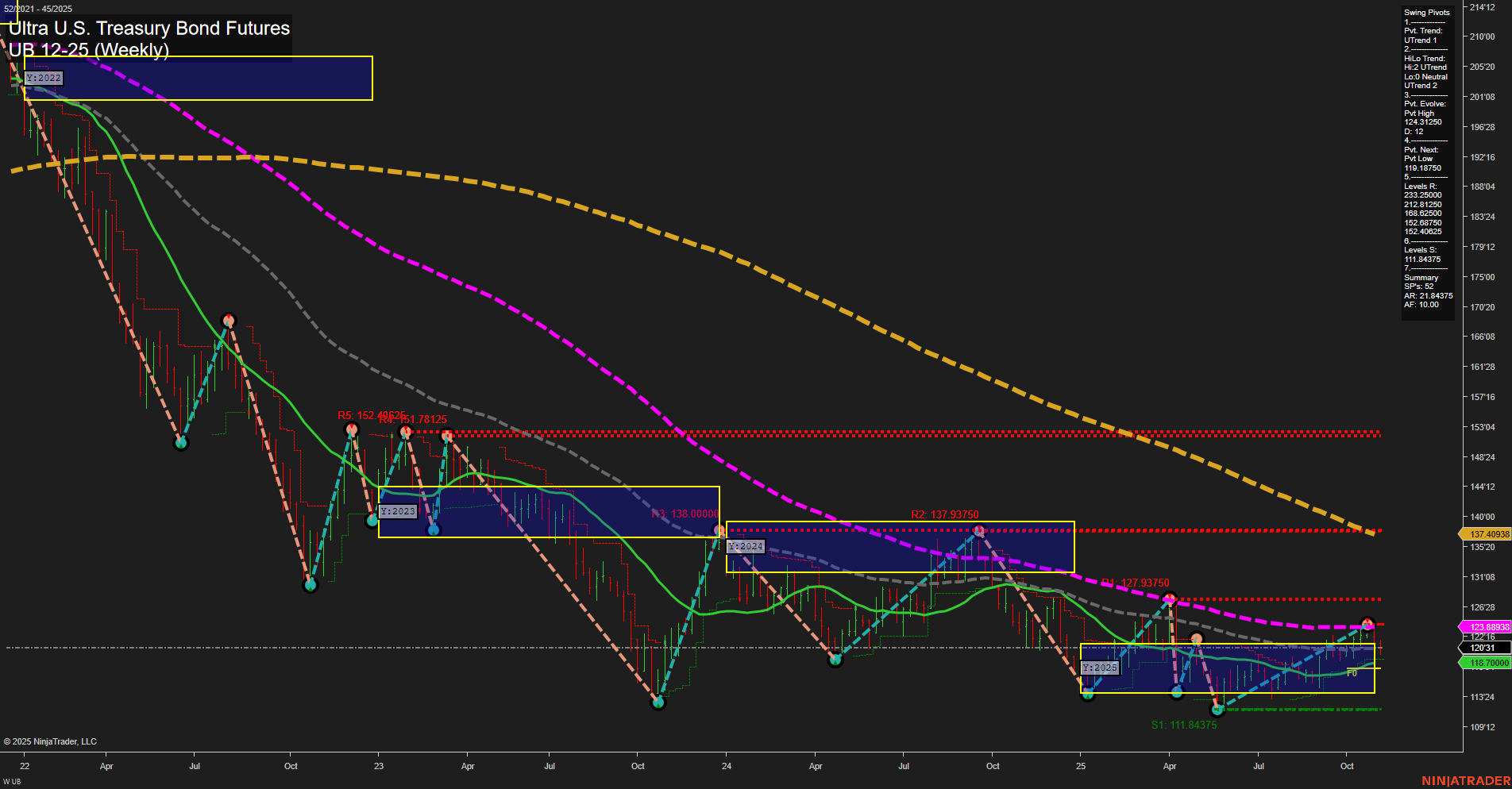

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently at 121.15625 with medium-sized bars and average momentum, indicating neither strong acceleration nor deceleration. The short-term Weekly Session Fib Grid (WSFG) trend remains down, with price below the NTZ center, but the swing pivot trend has shifted to an uptrend, suggesting a possible short-term base or reversal attempt. Intermediate-term signals are more constructive: the Monthly Session Fib Grid (MSFG) trend is up, price is above the NTZ, and both the 5- and 10-week moving averages are trending higher. The long-term Yearly Session Fib Grid (YSFG) also shows an uptrend, but price remains well below the 55-, 100-, and 200-week moving averages, which are all in downtrends, highlighting significant overhead resistance and a market still recovering from a prolonged decline. Swing pivot resistance levels cluster above current price, with the nearest at 124.31 and major resistance at 127.93 and 137.94, while support is found at 120.31 and 118.70. Recent trade signals reflect this mixed environment, with both long and short signals triggered in the past week, underscoring the choppy, range-bound nature of the current market. Overall, the short-term outlook is neutral as the market tests the boundaries of a developing base, the intermediate-term is bullish with improving structure and moving averages, and the long-term remains neutral as price works to overcome entrenched resistance. This environment is characterized by consolidation, potential for further retracement rallies, and the need for confirmation of a sustained trend change.