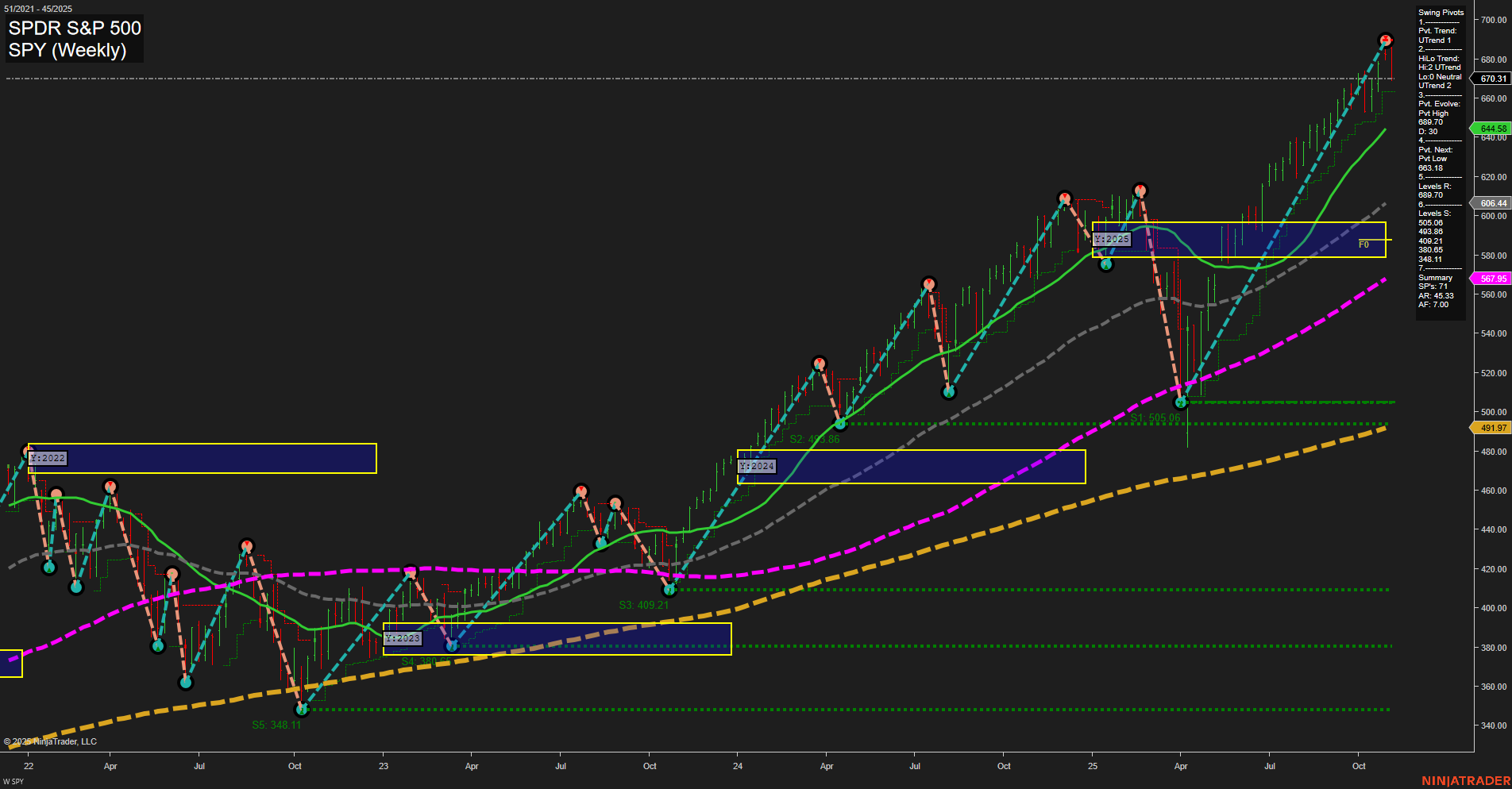

The SPY weekly chart shows a strong and persistent uptrend across all timeframes, with price recently making new highs at 670.31. Momentum is fast and bars are large, indicating robust buying interest and possible volatility expansion. All benchmark moving averages (5, 10, 20, 55, 100, 200 week) are trending upward, confirming the strength of the trend and providing multiple layers of dynamic support. Swing pivot analysis highlights the most recent pivot high at current levels, with the next significant support at 609.18 and further below at 595.95, 409.21, and 348.11. The neutral bias in the session fib grids suggests price is extended above key equilibrium zones, with no immediate reversal signals. From a futures swing trader’s perspective, the market is in a mature bullish phase, with higher highs and higher lows dominating the structure. The environment favors trend continuation setups, but the large bars and fast momentum also warrant awareness of potential sharp pullbacks or volatility spikes, especially as price is well above long-term support zones. The overall technical landscape remains bullish, with no major signs of exhaustion or reversal at this time.