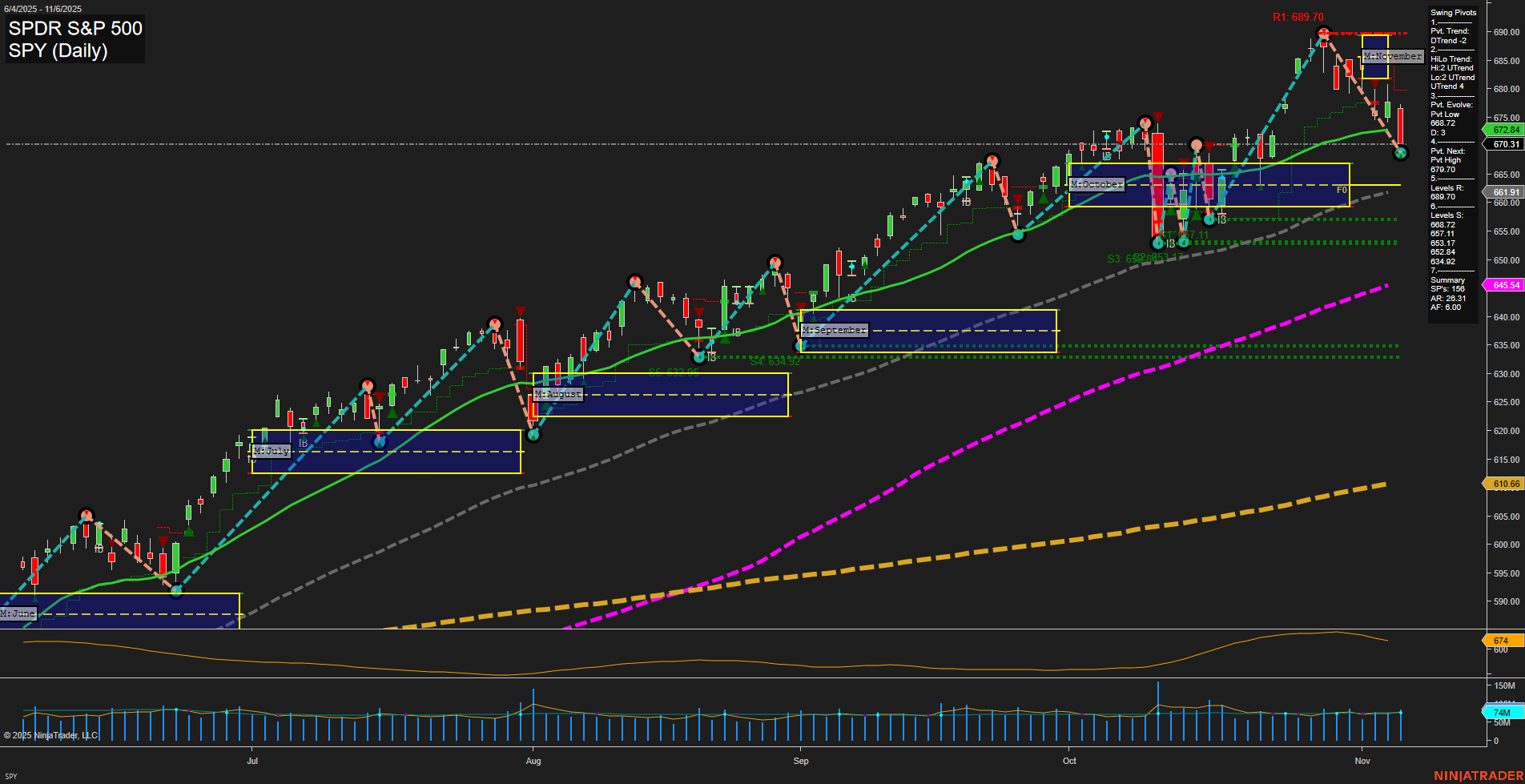

The SPY daily chart shows a recent shift in short-term momentum, with the price pulling back from the recent swing high at 689.70 to a current level of 670.31. The short-term swing pivot trend has turned down (DTrend), and both the 5-day and 10-day moving averages are in a downtrend, confirming short-term weakness. However, the intermediate-term HiLo trend remains up, and the 20-day MA is just below price but also turning down, suggesting a possible transition or consolidation phase. Long-term moving averages (55, 100, 200-day) remain in strong uptrends, indicating the broader bullish structure is intact. The ATR remains elevated, reflecting ongoing volatility, while volume is moderate. Key resistance is overhead at 677.44, 681.75, and 689.70, with support at 672.84 and 661.91. The market appears to be in a corrective phase within a larger uptrend, with short-term bearish signals dominating, but intermediate and long-term trends still supportive of the broader bull cycle. No clear breakout or breakdown is evident, and the price is consolidating within the monthly NTZ. This environment is typical of a pullback or retracement within a primary uptrend, with the potential for further choppy or range-bound action in the near term.