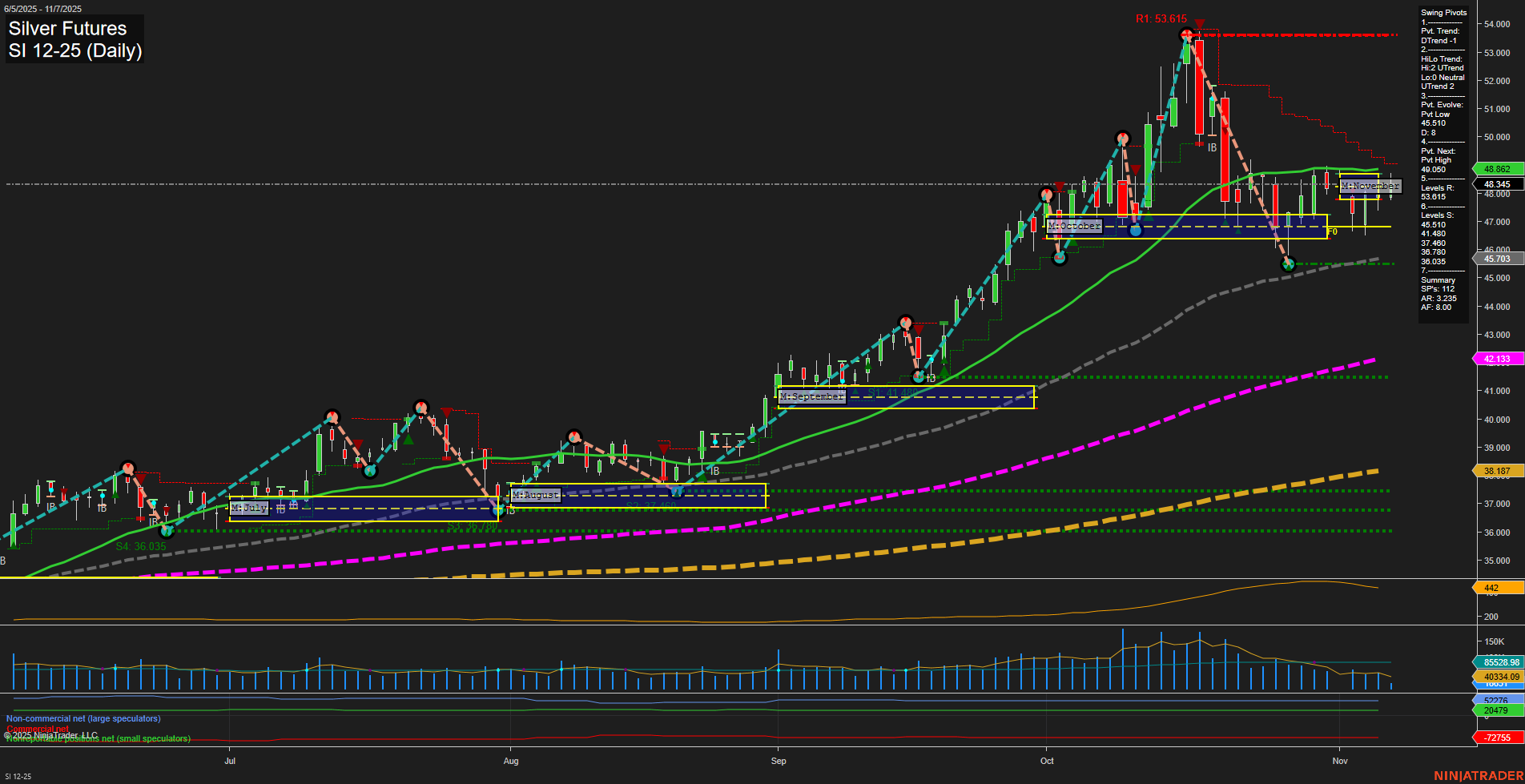

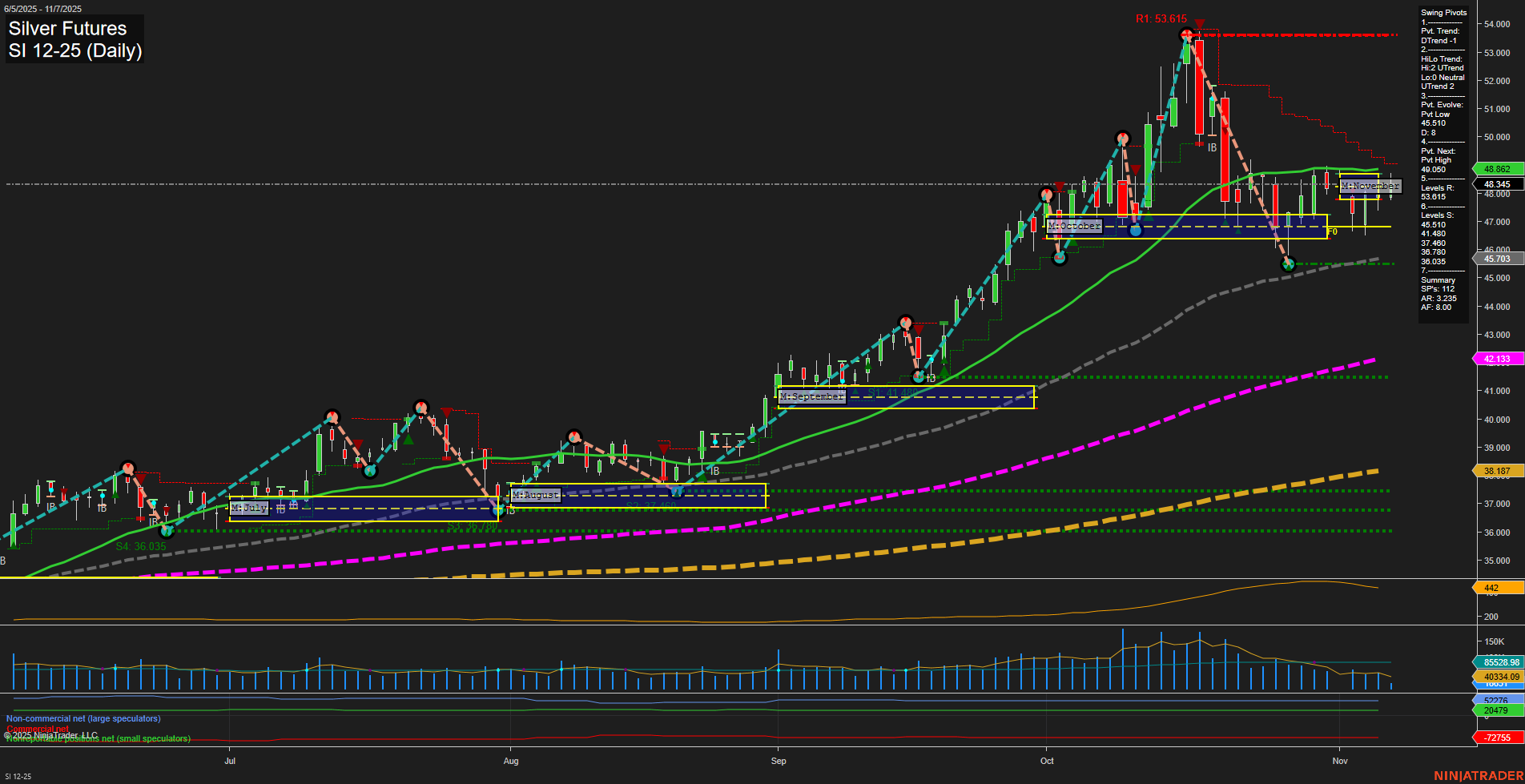

SI Silver Futures Daily Chart Analysis: 2025-Nov-07 07:17 CT

Price Action

- Last: 48.462,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 220%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 46.910,

- 4. Pvt. Next: Pvt high 50.650,

- 5. Levels R: 53.615, 50.650, 49.015,

- 6. Levels S: 46.910, 45.345, 41.780, 37.460, 36.035.

Daily Benchmarks

- (Short-Term) 5 Day: 48.345 Down Trend,

- (Short-Term) 10 Day: 48.015 Down Trend,

- (Intermediate-Term) 20 Day: 48.325 Down Trend,

- (Intermediate-Term) 55 Day: 47.460 Up Trend,

- (Long-Term) 100 Day: 42.133 Up Trend,

- (Long-Term) 200 Day: 38.187 Up Trend.

Additional Metrics

Recent Trade Signals

- 07 Nov 2025: Long SI 12-25 @ 48.48 Signals.USAR-MSFG

- 06 Nov 2025: Short SI 12-25 @ 47.665 Signals.USAR-WSFG

- 04 Nov 2025: Short SI 12-25 @ 47.37 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Silver futures are currently consolidating after a sharp retracement from the recent swing high at 53.615, with price action stabilizing above key support at 46.910. The short-term trend is mixed, as indicated by a downtrend in the swing pivot and short-term moving averages, but the intermediate and long-term trends remain firmly bullish, supported by the uptrend in the 55, 100, and 200-day moving averages. The price is holding above the monthly and yearly session fib grid centers, suggesting underlying strength despite recent volatility. Recent trade signals reflect this choppy environment, with both short and long entries triggered in the past week. Volatility remains elevated (ATR 165), and volume is moderate. The market is in a corrective phase within a broader uptrend, with potential for further upside if resistance at 49.015 and 50.650 is cleared, while a break below 46.910 would signal deeper retracement risk. Overall, the structure favors a bullish bias on intermediate and long-term horizons, while the short-term outlook is neutral as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-11-07 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.