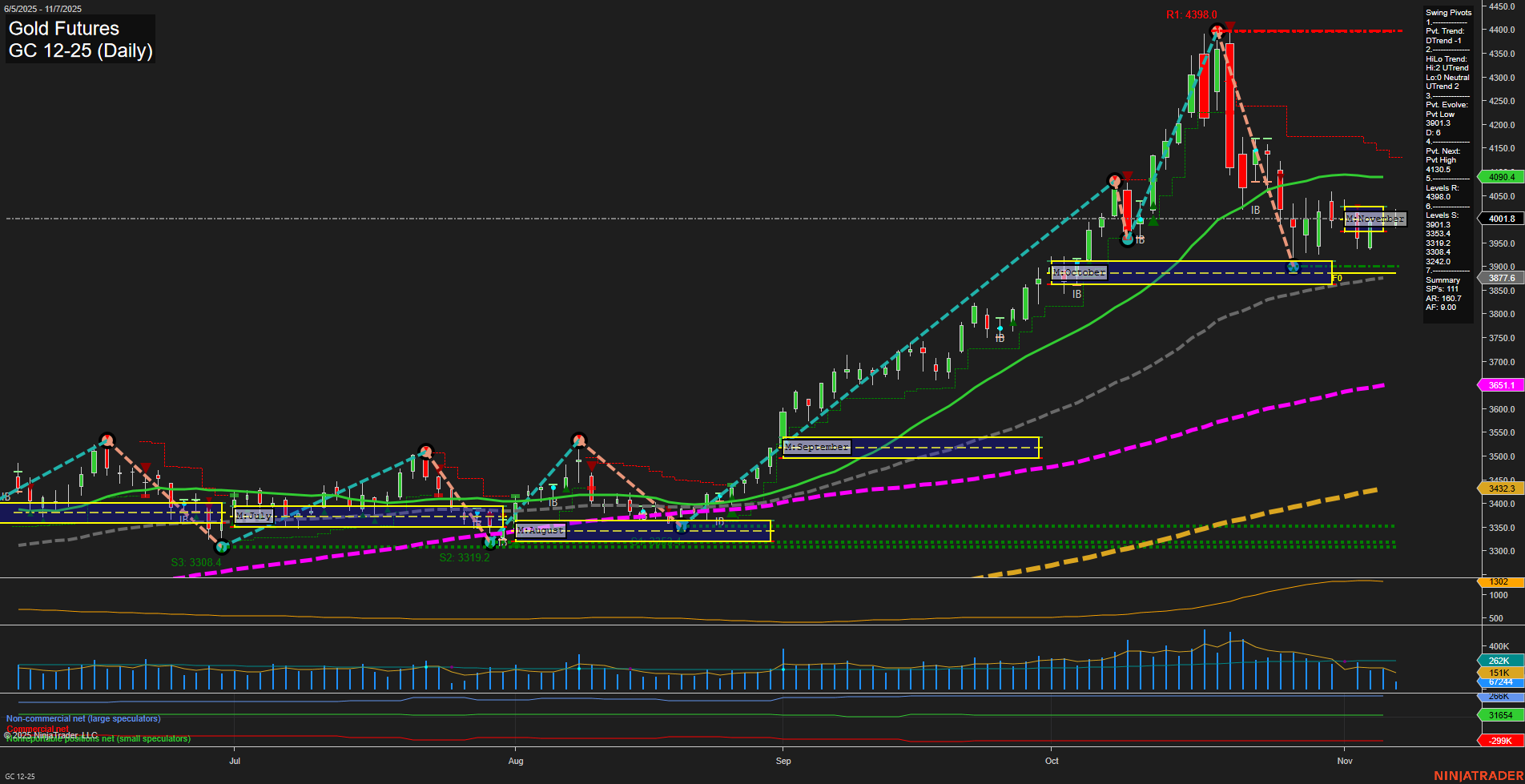

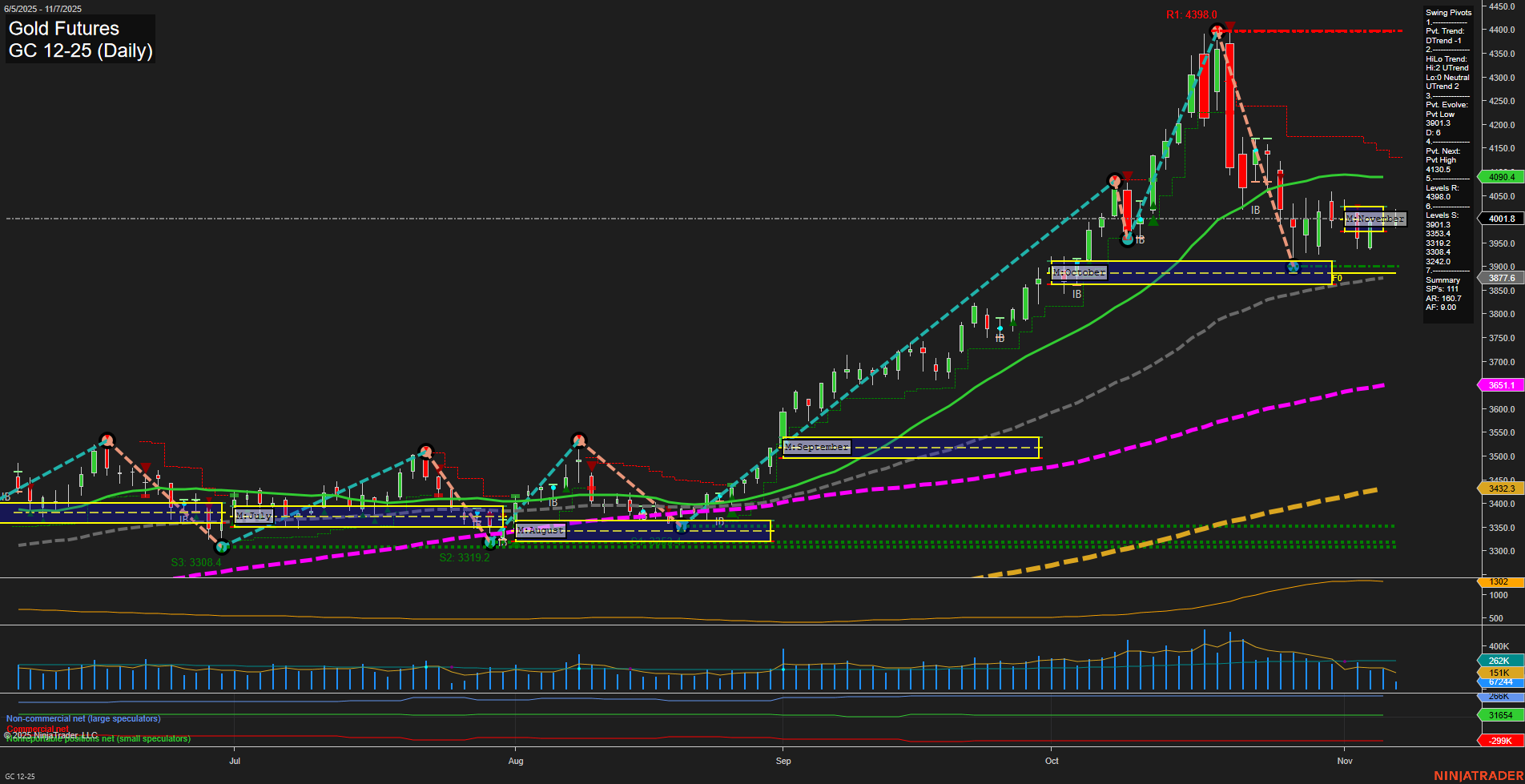

GC Gold Futures Daily Chart Analysis: 2025-Nov-07 07:10 CT

Price Action

- Last: 4001.8,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -4%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 44%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 352%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 3913.4,

- 4. Pvt. Next: Pvt high 4130.5,

- 5. Levels R: 4130.5, 4398.0,

- 6. Levels S: 3913.4, 3877.6, 3839.0, 3339.2, 3319.2, 3308.4.

Daily Benchmarks

- (Short-Term) 5 Day: 4007.2 Down Trend,

- (Short-Term) 10 Day: 4017.6 Down Trend,

- (Intermediate-Term) 20 Day: 4099.4 Down Trend,

- (Intermediate-Term) 55 Day: 3877.6 Up Trend,

- (Long-Term) 100 Day: 3651.1 Up Trend,

- (Long-Term) 200 Day: 3423.3 Up Trend.

Additional Metrics

Recent Trade Signals

- 06 Nov 2025: Long GC 12-25 @ 4017.6 Signals.USAR.TR120

- 05 Nov 2025: Short GC 12-25 @ 3973.6 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Gold futures have recently experienced a sharp retracement from the highs near 4400, with price action now consolidating around the 4000 level. The short-term trend has shifted to the downside, as indicated by the DTrend in swing pivots and both the 5-day and 10-day moving averages trending lower. However, the intermediate and long-term outlooks remain constructive, with the 55, 100, and 200-day moving averages all in uptrends and price holding well above these longer-term supports. The monthly and yearly session fib grids also show price above their respective NTZ centers, supporting the broader uptrend. Key support is clustered around 3913–3877, while resistance is overhead at 4130 and 4398. Volatility remains elevated (ATR 347), and volume is moderate. The market is currently in a corrective phase within a larger uptrend, with recent signals showing both long and short activity, reflecting choppy, two-way trade as the market digests the recent rally and tests support.

Chart Analysis ATS AI Generated: 2025-11-07 07:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.