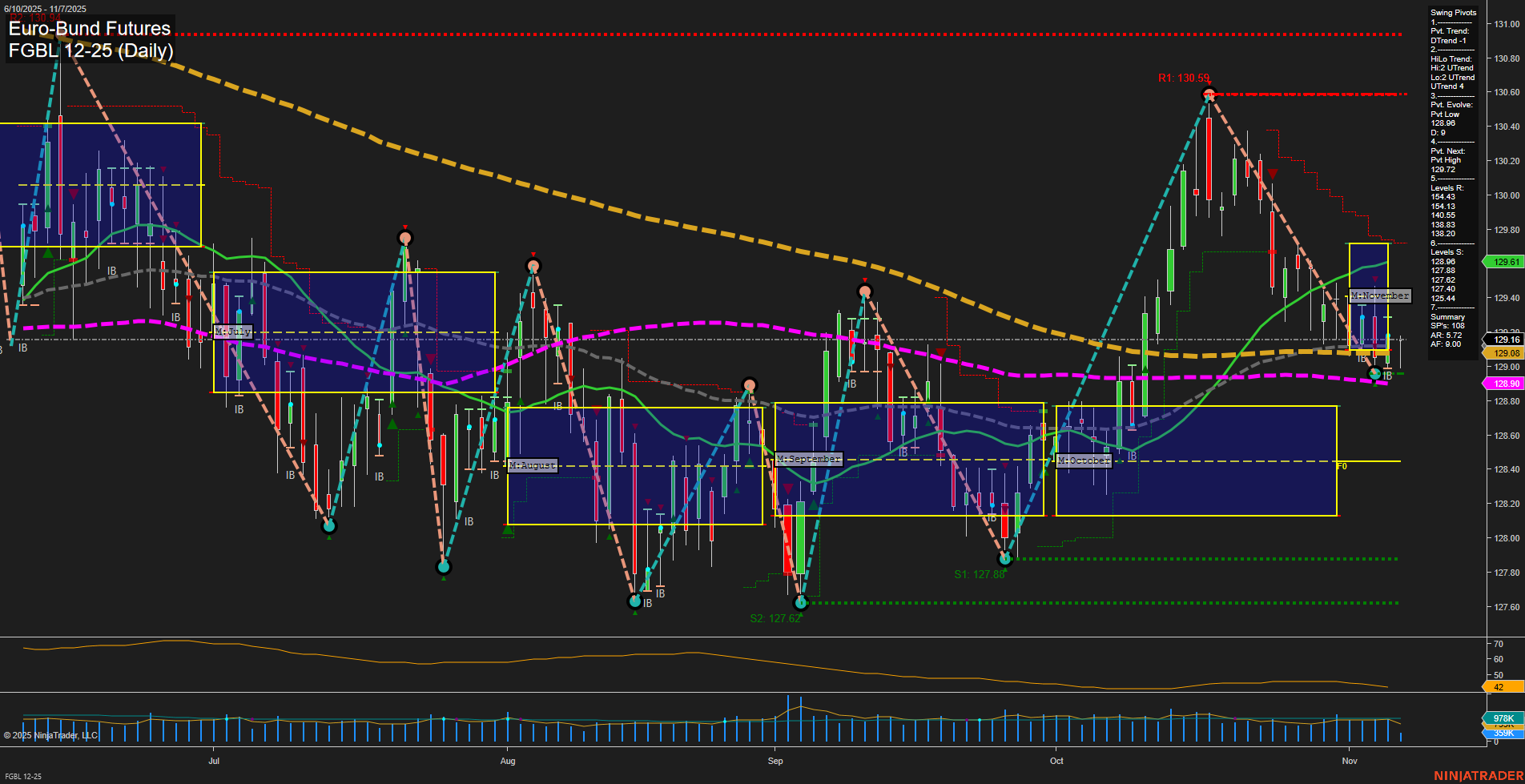

The FGBL Euro-Bund Futures daily chart shows a market in transition. Price action is currently subdued with medium-sized bars and slow momentum, reflecting a lack of strong directional conviction. The short-term (weekly) trend remains bearish, with price trading below the NTZ and all short-term moving averages trending down. However, the intermediate-term (monthly) MSFG trend is up, with price above the NTZ, suggesting a possible attempt at a recovery or consolidation phase. The swing pivot structure highlights a recent pivot low at 129.09, with the next potential reversal at 129.72, and resistance levels clustered just above current price, indicating overhead supply. Support is layered below, with key levels at 129.09 and 128.80. All benchmark moving averages across timeframes are in downtrends, reinforcing the broader bearish bias. Recent trade signals show mixed short-term activity, with both long and short entries triggered in the past week, reflecting the choppy and indecisive nature of the current market. Volatility (ATR) and volume (VOLMA) are moderate, not signaling any imminent breakout or breakdown. Overall, the market is in a corrective or consolidative phase, with short-term pressure to the downside, but some intermediate-term stabilization. Swing traders should note the potential for range-bound action between support and resistance, with no clear trend dominance at this stage.