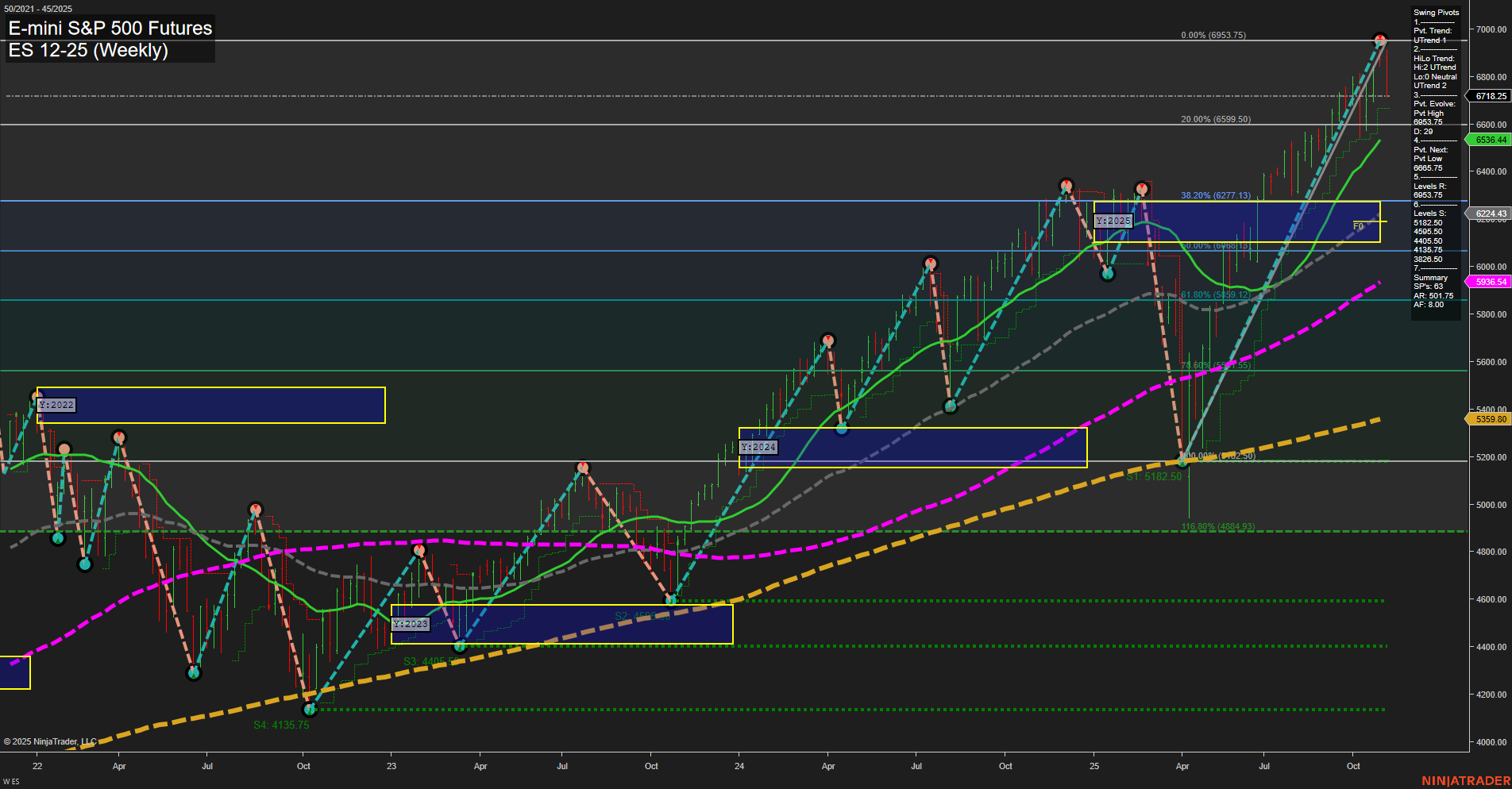

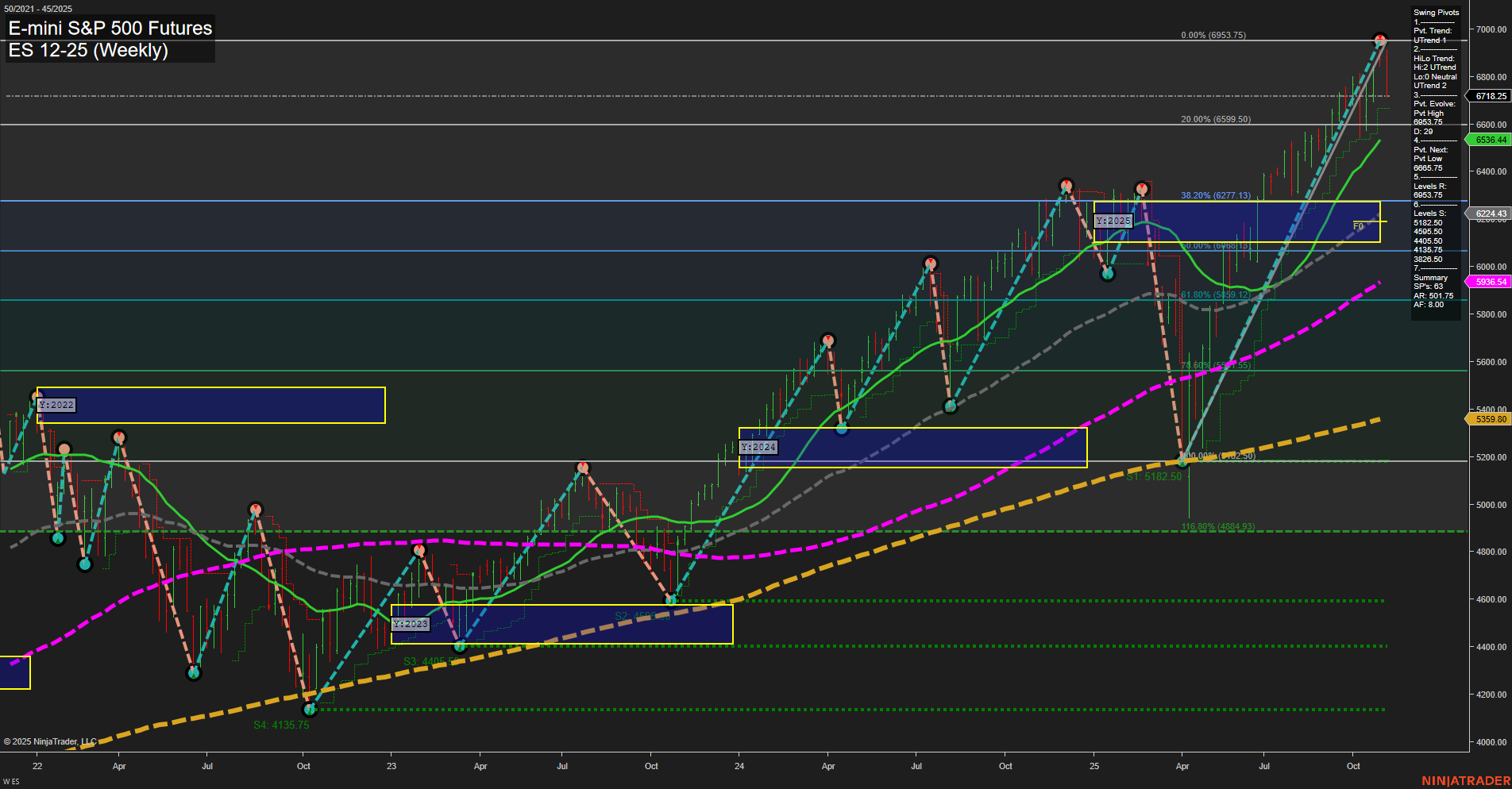

ES E-mini S&P 500 Futures Weekly Chart Analysis: 2025-Nov-07 07:07 CT

Price Action

- Last: 6536.44,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -83%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 3%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 61%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 6953.75,

- 4. Pvt. Next: Pvt low 6292,

- 5. Levels R: 6953.75, 6599.50, 6277.13,

- 6. Levels S: 6292, 5903.12, 5182.50, 4135.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 6718.25 Down Trend,

- (Intermediate-Term) 10 Week: 6536.44 Down Trend,

- (Long-Term) 20 Week: 6224.43 Up Trend,

- (Long-Term) 55 Week: 5903.54 Up Trend,

- (Long-Term) 100 Week: 5359.80 Up Trend,

- (Long-Term) 200 Week: 5093.54 Up Trend.

Recent Trade Signals

- 06 Nov 2025: Short ES 12-25 @ 6762.25 Signals.USAR.TR120

- 06 Nov 2025: Short ES 12-25 @ 6738.75 Signals.USAR.TR720

- 04 Nov 2025: Short ES 12-25 @ 6830 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The ES E-mini S&P 500 Futures weekly chart shows a market that has recently experienced a strong upward move, reaching a new swing high at 6953.75 before pulling back sharply. Short-term momentum has shifted to the downside, as indicated by the fast momentum, large bars, and a downtrend in both the WSFG and short-term swing pivots. Recent trade signals have also triggered short entries, confirming the short-term bearish tone. However, the intermediate and long-term trends remain bullish, with price holding above key long-term moving averages and the yearly and monthly session fib grids still trending up. The market is currently testing support levels around 6292 and 6224, with further support at 5903 and 5182 if the pullback deepens. This setup suggests a corrective phase within a broader uptrend, with volatility elevated and the potential for further swings as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-11-07 07:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.