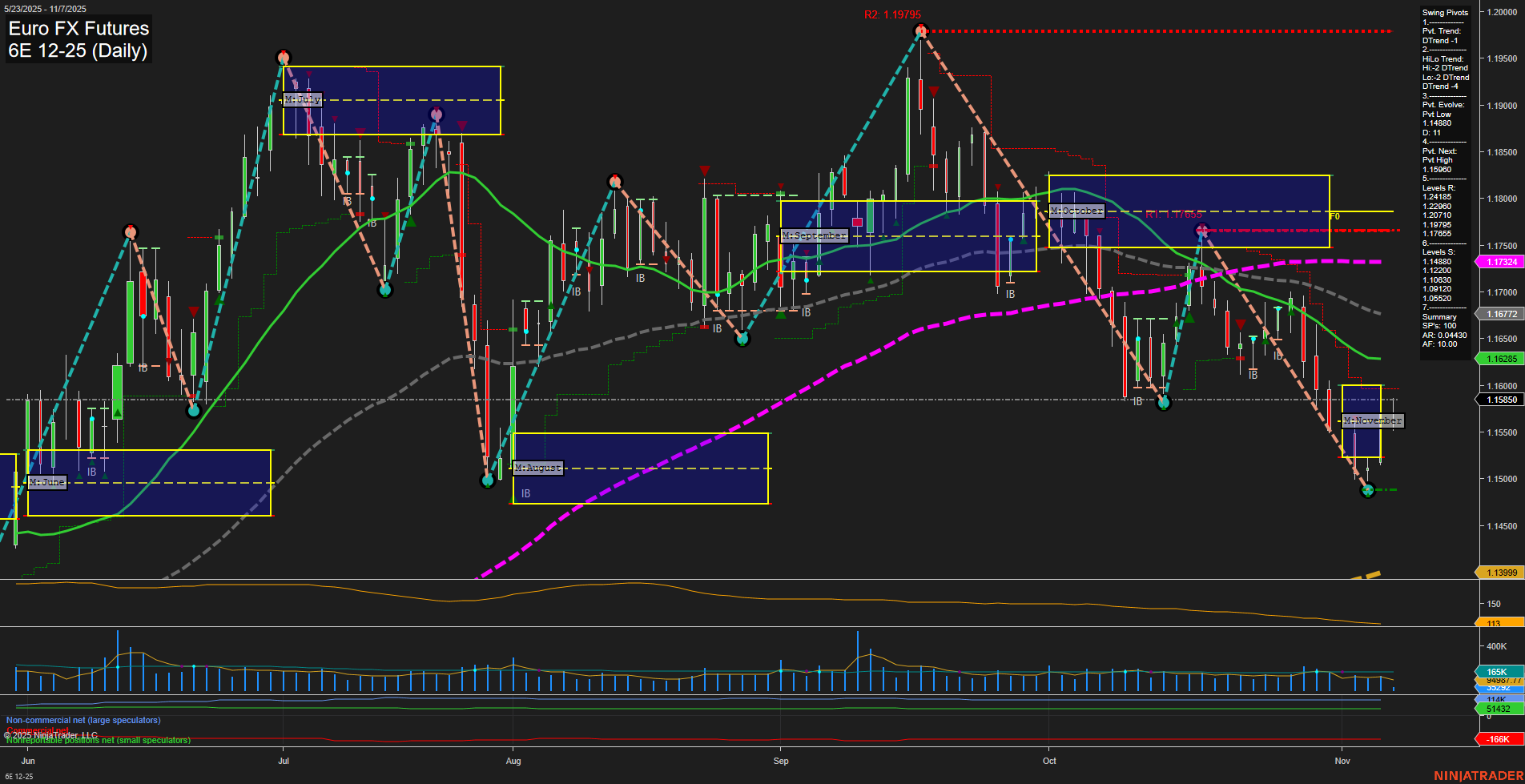

The Euro FX futures contract is currently experiencing a short- and intermediate-term downtrend, as indicated by both the swing pivot structure and the alignment of all key short- and intermediate-term moving averages trending lower. Price action has been characterized by medium-sized bars and slow momentum, suggesting a lack of strong conviction in either direction. The most recent swing pivot has established a new low at 1.14880, with the next potential reversal level at 1.15960, highlighting a possible area for a short-term bounce or retracement. Despite the prevailing bearish tone in the short and intermediate timeframes, the long-term trend remains bullish, supported by the yearly session fib grid and the 200-day moving average, which is still in an uptrend. This suggests that while the market is currently correcting, the broader bullish structure is intact. The ATR and volume metrics indicate moderate volatility and participation, with no signs of extreme moves or exhaustion. Recent trade signals have triggered long entries, possibly in anticipation of a short-term mean reversion or a test of resistance levels. However, with price still below the monthly fib grid and most moving averages, any upside may face significant overhead resistance. The market appears to be in a corrective phase within a larger bullish cycle, with potential for further consolidation or a base-building process before any sustained rally resumes.