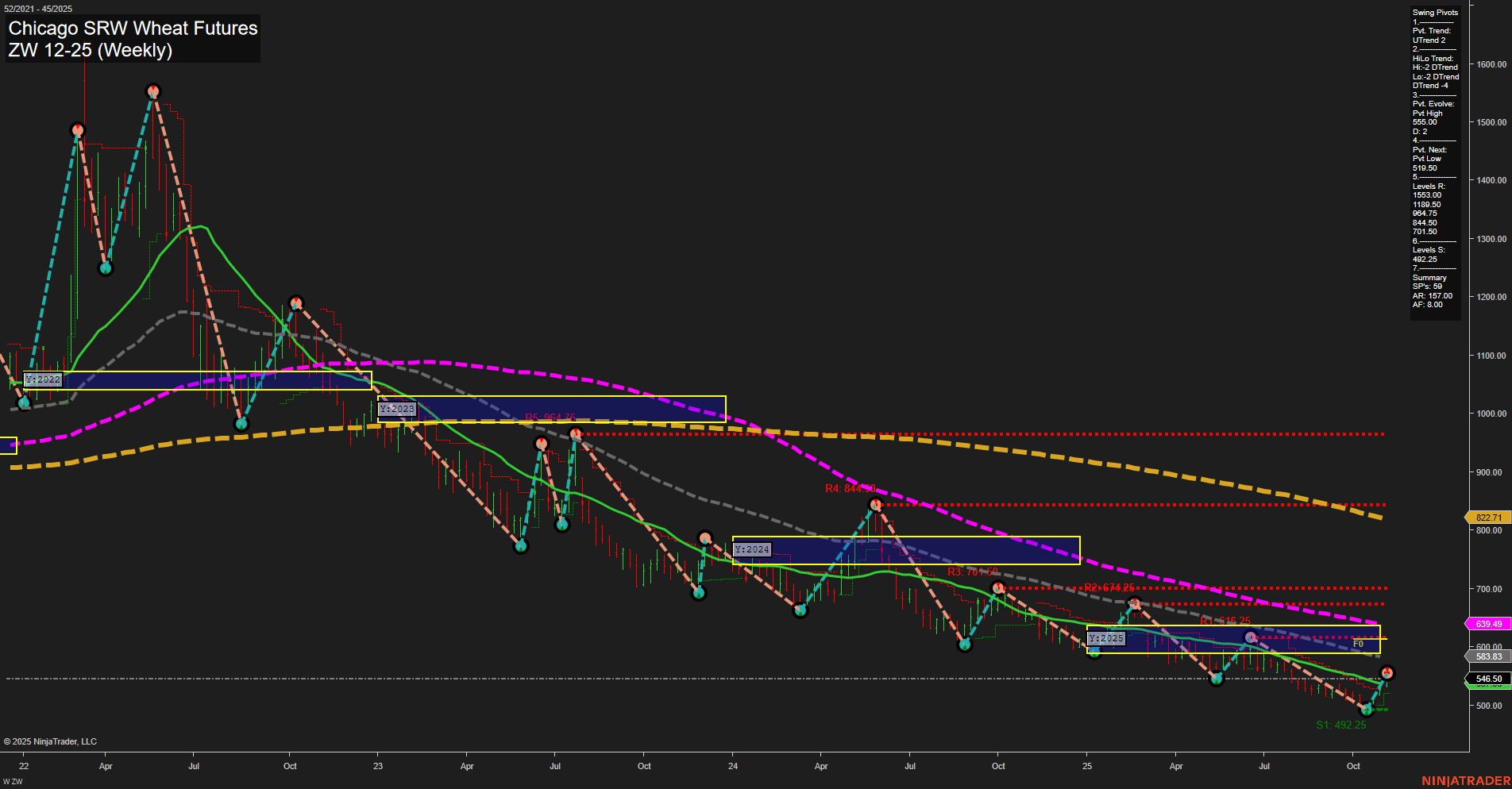

The ZW Chicago SRW Wheat Futures weekly chart shows a market that has been in a persistent downtrend, with both short-term and intermediate-term swing pivots confirming a dominant downward trend. Price action is subdued, with small bars and slow momentum, indicating a lack of strong buying or selling pressure at current levels. While the Weekly and Monthly Session Fib Grids (WSFG, MSFG) show price above their respective NTZ/F0% levels and an upward trend, this appears to be a short-term retracement or bounce within a broader bearish context, as the Yearly Session Fib Grid (YSFG) remains firmly in a downtrend with price below its NTZ/F0%. Swing pivot resistance levels are stacked well above current price, with the nearest support at 492.25, suggesting limited downside before a potential test of support. All key moving averages (5, 10, 20, 55 week) are trending down, reinforcing the longer-term bearish structure. The most recent trade signal was a short entry, aligning with the prevailing trend. Overall, the market is showing signs of a possible short-term pause or minor recovery, but the intermediate and long-term outlook remains bearish, with rallies likely to encounter significant resistance. The technical setup suggests the market is in a corrective phase within a larger downtrend, with volatility subdued and no clear breakout or reversal pattern evident at this time.