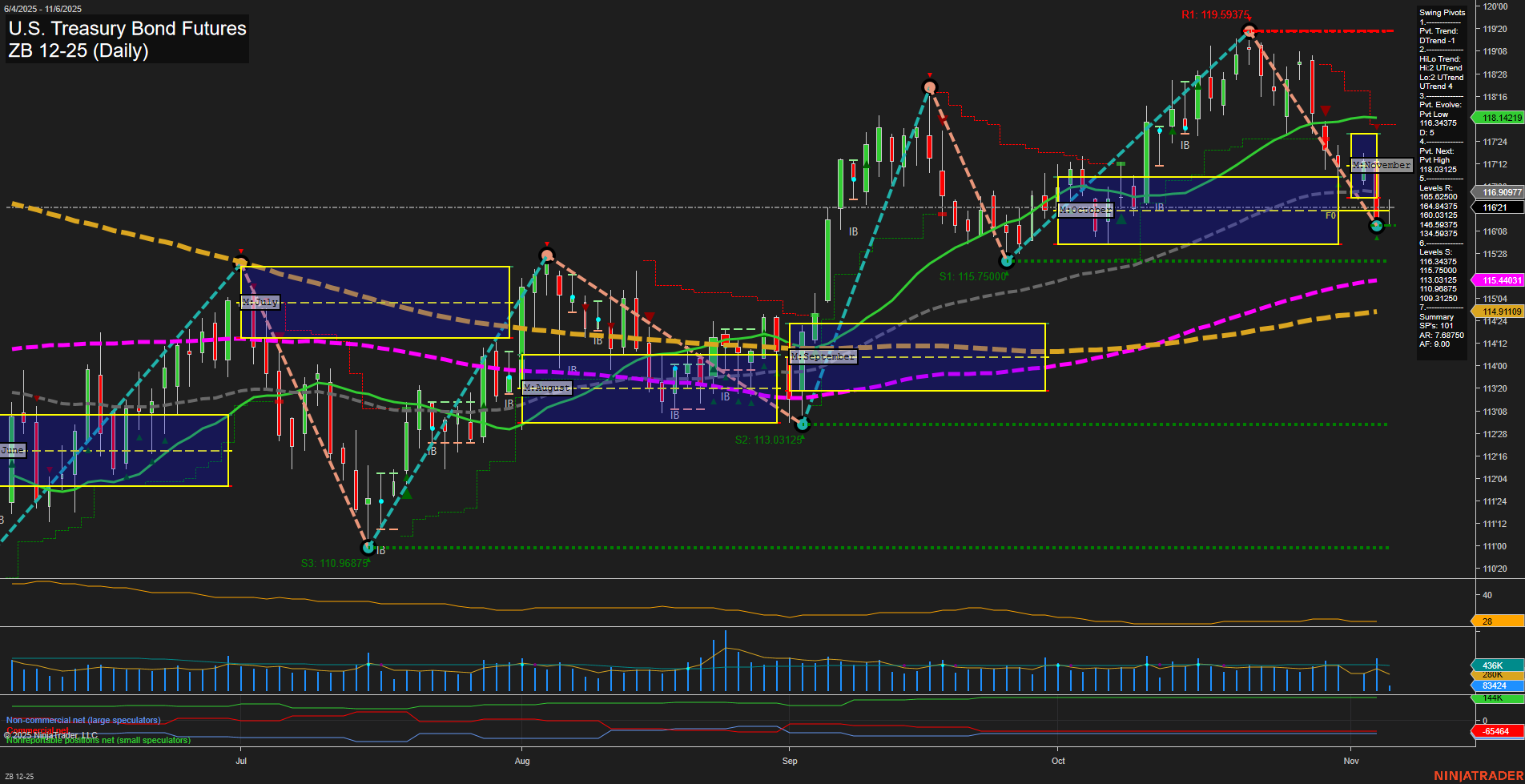

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in transition. Price action has slowed with medium-sized bars and a recent loss of momentum, suggesting a pause after the recent decline. The short-term swing pivot trend is down, with the most recent pivot low at 115'75 acting as immediate support, while resistance is layered above at 116'84, 118'16, and 119'59. Both the 5-day and 10-day moving averages are trending down, confirming short-term bearishness, while intermediate and long-term benchmarks are neutral to slightly positive, indicating underlying support but no clear directional conviction. The weekly and monthly session fib grids are neutral, and the market is consolidating within a broad range, lacking a strong directional bias. Volatility, as measured by ATR, is moderate, and volume remains robust, indicating active participation but no clear breakout. The intermediate-term HiLo trend remains up, suggesting that the broader move off the September lows is still intact, but the short-term pullback is dominant for now. Overall, the market is in a corrective phase within a larger consolidation, with short-term pressure to the downside but no decisive break of key support or resistance. Swing traders should note the potential for further choppy action as the market digests recent moves and awaits new catalysts.