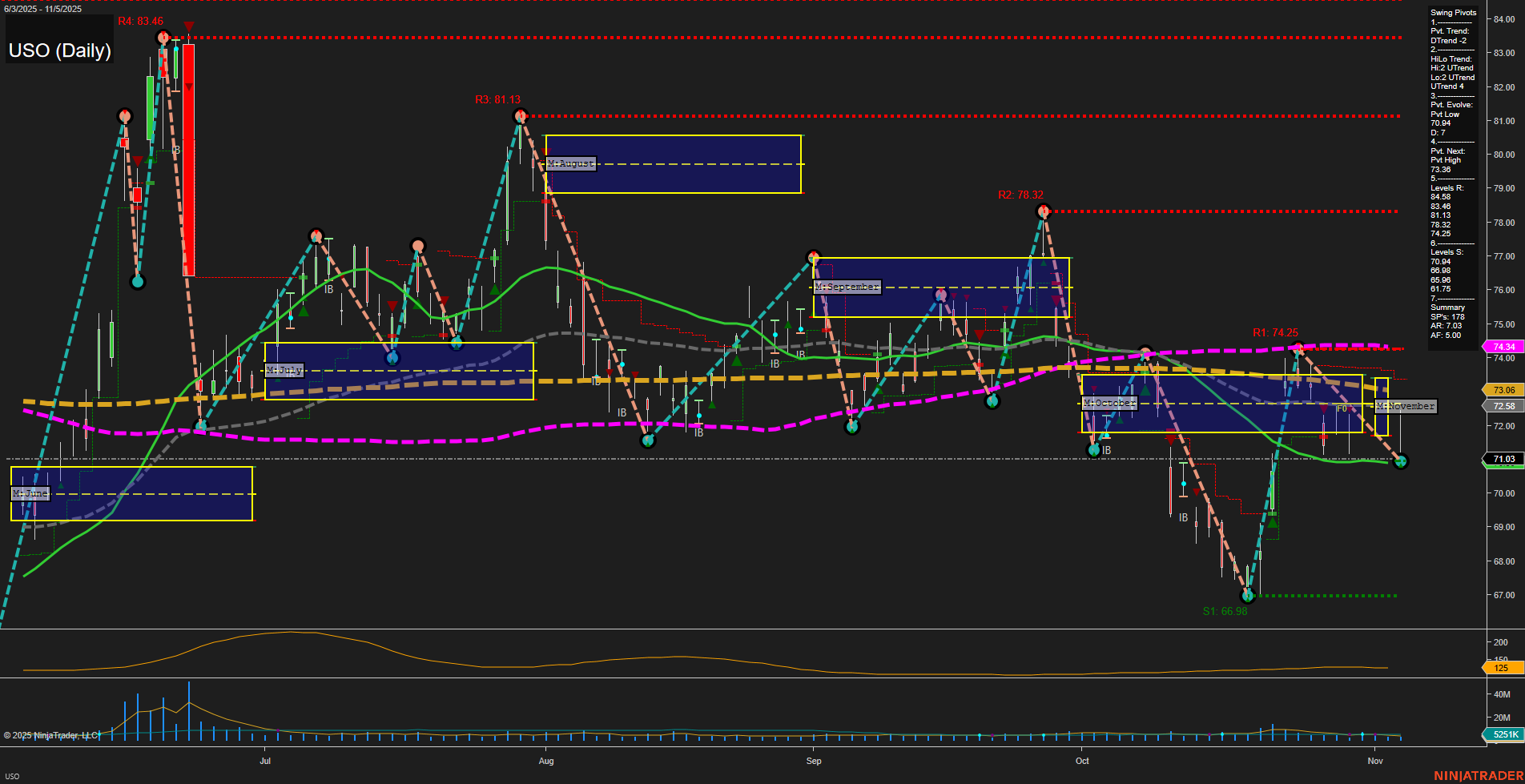

USO is currently exhibiting a slow momentum environment with medium-sized bars, reflecting a period of consolidation after a recent swing low at 71.03. The short-term swing pivot trend is down (DTrend), while the intermediate-term HiLo trend remains up (UTrend), indicating a possible transition phase or a corrective move within a broader uptrend. All benchmark moving averages (5, 10, 20, 55, 100, 200 day) are trending down and positioned above the current price, reinforcing a bearish bias for both short- and long-term perspectives. Resistance levels are clustered significantly higher (74.25 to 83.46), while support is found at 66.98 and 66.65, suggesting a wide range for potential price action. The ATR indicates moderate volatility, and volume remains steady. The overall technical structure points to a market that is digesting prior losses, with no clear breakout or reversal signal yet. The neutral stance on the session fib grids (weekly, monthly, yearly) further supports a wait-and-see approach, as the market could be setting up for either a continuation lower or a base-building phase. Swing traders should note the potential for choppy, range-bound action until a decisive move through key resistance or support levels occurs.