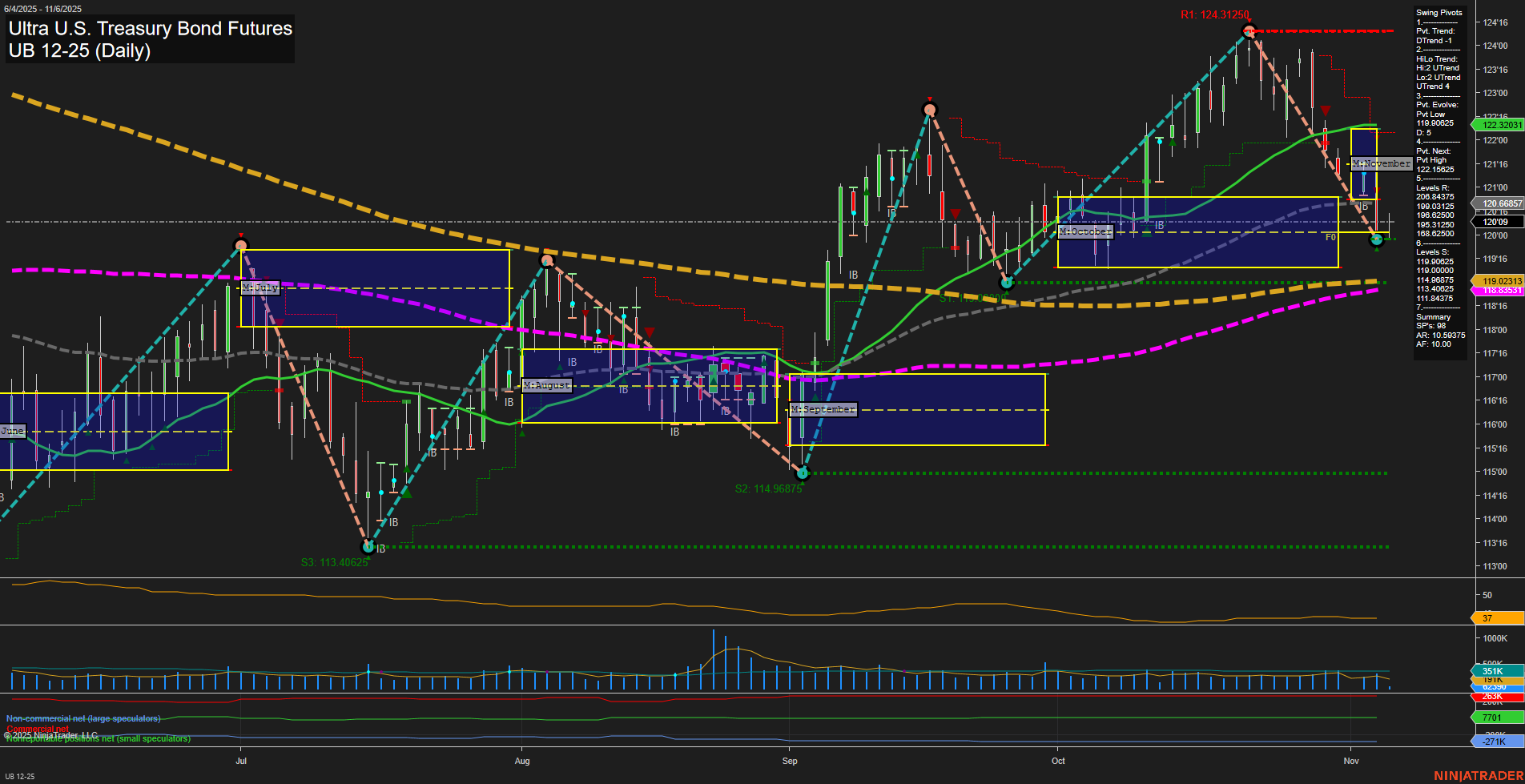

The UB Ultra U.S. Treasury Bond Futures daily chart currently reflects a mixed environment across timeframes. Short-term momentum is slow and price action is trending down, with the last price at 119.0313 and recent bars showing medium size, indicating a controlled but persistent move lower. The WSFG (weekly) trend is down, with price below the NTZ, reinforcing short-term bearishness. This is supported by the 5-day and 10-day moving averages, both trending down, and recent short trade signals. Intermediate-term (monthly) signals are more neutral to slightly bullish, as the MSFG trend is up and price is above the monthly NTZ, but the 20-day moving average is still in a downtrend. The swing pivot structure shows a developing low at 119.0313, with the next potential reversal at 122.15625, suggesting a possible area for a counter-trend bounce if support holds. Long-term (yearly) structure remains bullish, with the YSFG trend up and price above the yearly NTZ. The 55-day, 100-day, and 200-day moving averages are all in uptrends, indicating that the broader trend is still constructive despite recent weakness. ATR and volume metrics suggest moderate volatility and steady participation. The market is currently testing key support at the recent swing low, with resistance levels above at 122.15625 and 124.3125. The overall setup points to a short-term bearish bias within a longer-term bullish context, with the potential for a reversal or consolidation if support holds and momentum shifts.