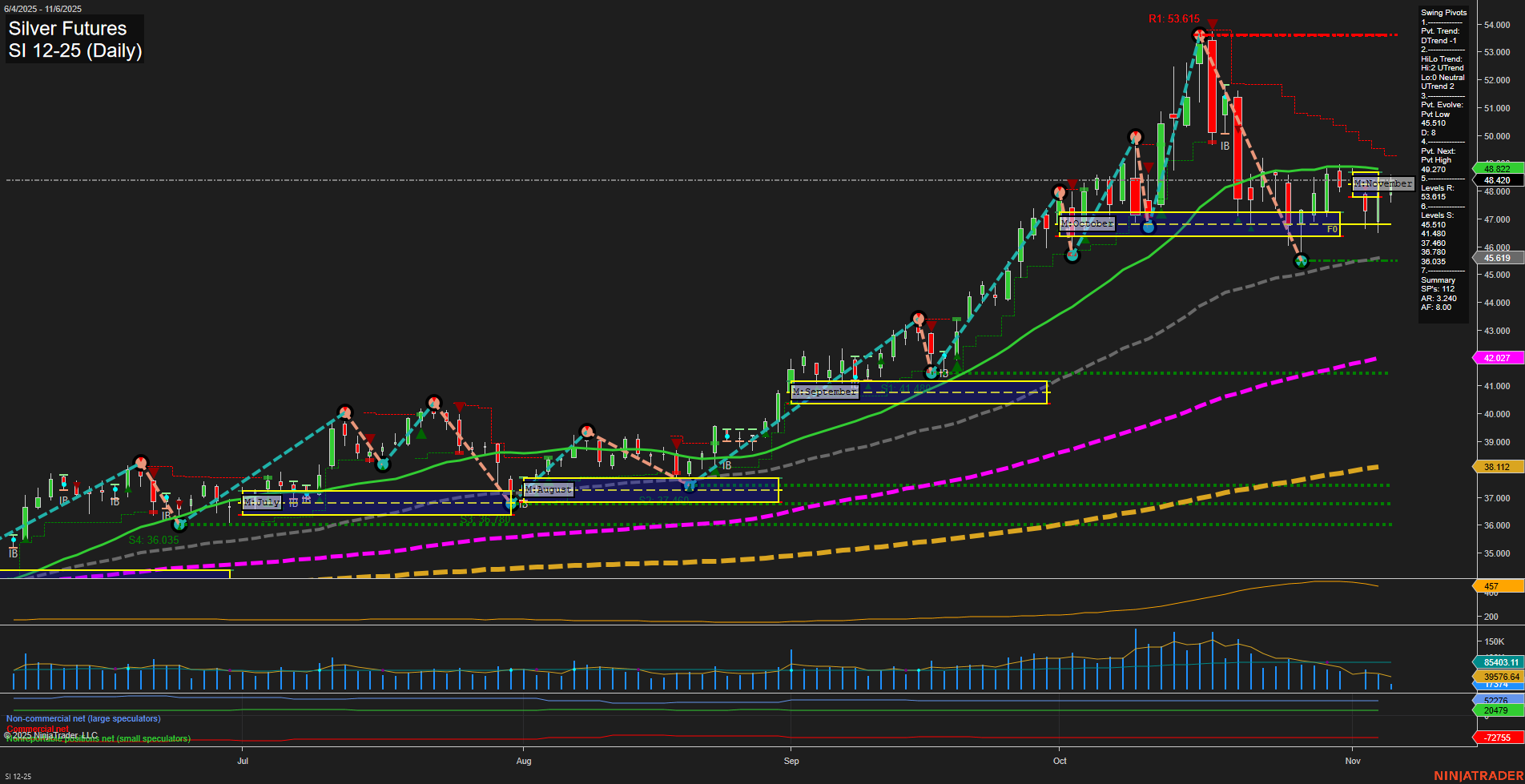

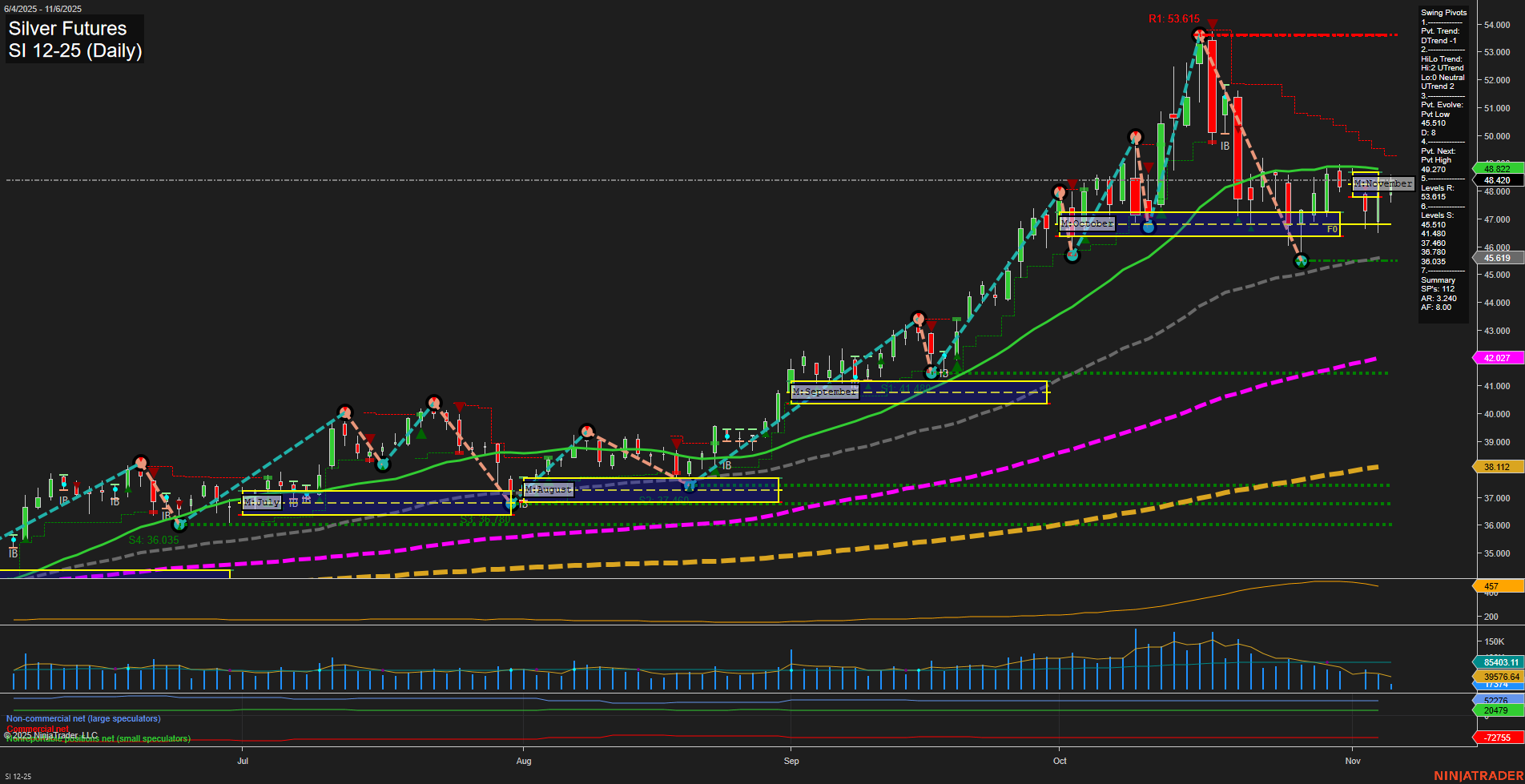

SI Silver Futures Daily Chart Analysis: 2025-Nov-06 07:17 CT

Price Action

- Last: 48.42,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 21%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 220%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt. High 48.270,

- 4. Pvt. Next: Pvt. Low 45.619,

- 5. Levels R: 53.615, 48.270, 47.460, 47.380, 47.160,

- 6. Levels S: 45.619, 43.460, 41.860, 41.340, 41.060.

Daily Benchmarks

- (Short-Term) 5 Day: 47.95 Down Trend,

- (Short-Term) 10 Day: 48.13 Down Trend,

- (Intermediate-Term) 20 Day: 48.82 Up Trend,

- (Intermediate-Term) 55 Day: 46.02 Up Trend,

- (Long-Term) 100 Day: 42.03 Up Trend,

- (Long-Term) 200 Day: 38.11 Up Trend.

Additional Metrics

Recent Trade Signals

- 06 Nov 2025: Long SI 12-25 @ 48.17 Signals.USAR-MSFG

- 05 Nov 2025: Short SI 12-25 @ 47.425 Signals.USAR-WSFG

- 04 Nov 2025: Short SI 12-25 @ 47.37 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Silver futures are currently consolidating after a sharp retracement from the recent swing high at 53.615, with price action stabilizing above key intermediate and long-term moving averages. The short-term trend has shifted to a downtrend, as indicated by the swing pivot and both the 5-day and 10-day moving averages turning lower. However, the intermediate and long-term trends remain firmly bullish, supported by the 20, 55, 100, and 200-day moving averages all trending upward and price holding above the monthly and yearly session fib grid centers. The market is trading within a broad range, with resistance clustered near 48.27 and 47.46, and support at 45.62 and below. Volatility remains moderate, and volume is steady, suggesting a period of digestion after the recent sell-off. The mixed short-term signals, including both recent short and long trade triggers, reflect a choppy environment with potential for further consolidation or a base-building phase before the next directional move. The overall structure favors the bulls on a multi-week and multi-month basis, but short-term traders should be mindful of the ongoing retracement and the need for confirmation before a renewed uptrend.

Chart Analysis ATS AI Generated: 2025-11-06 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.