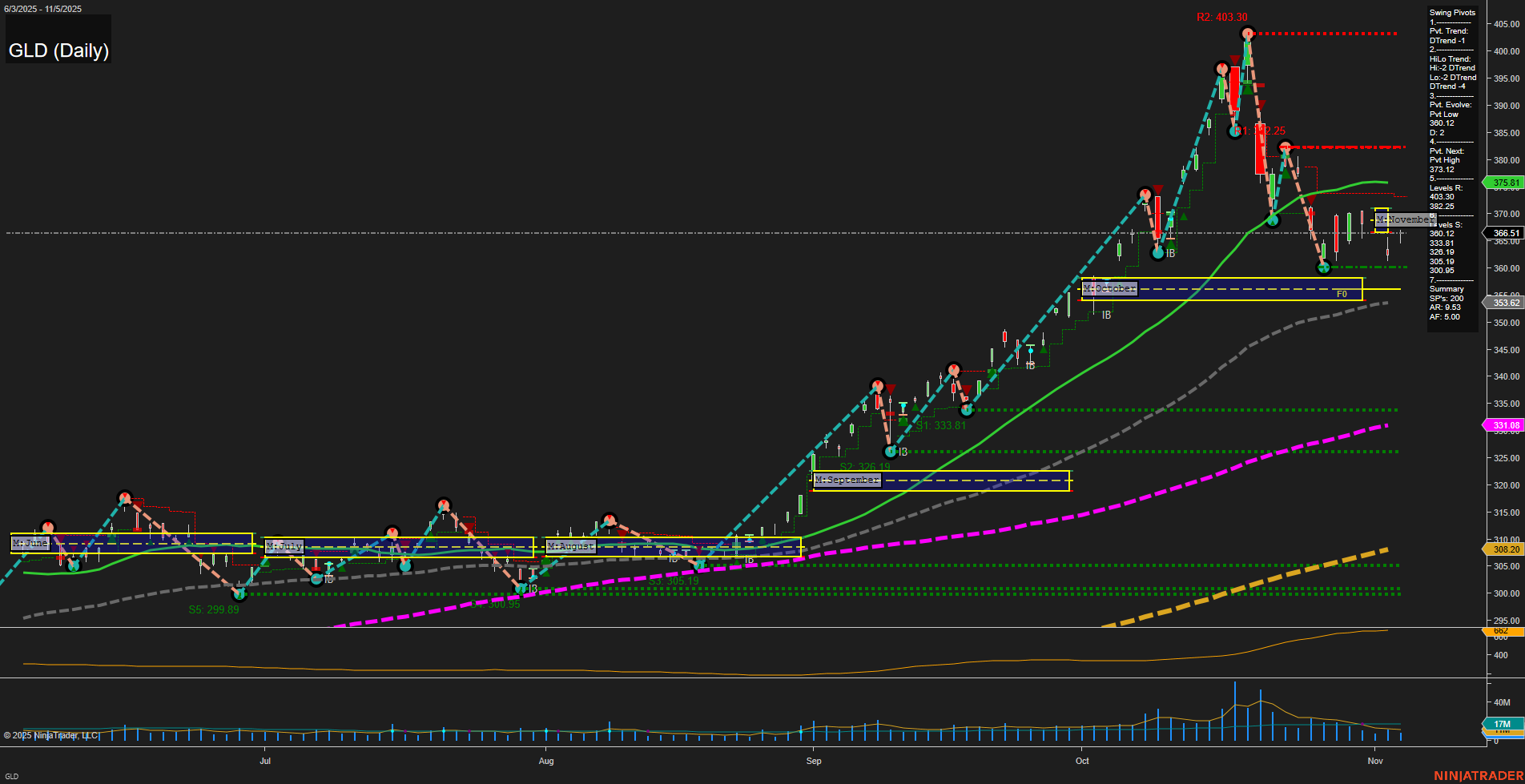

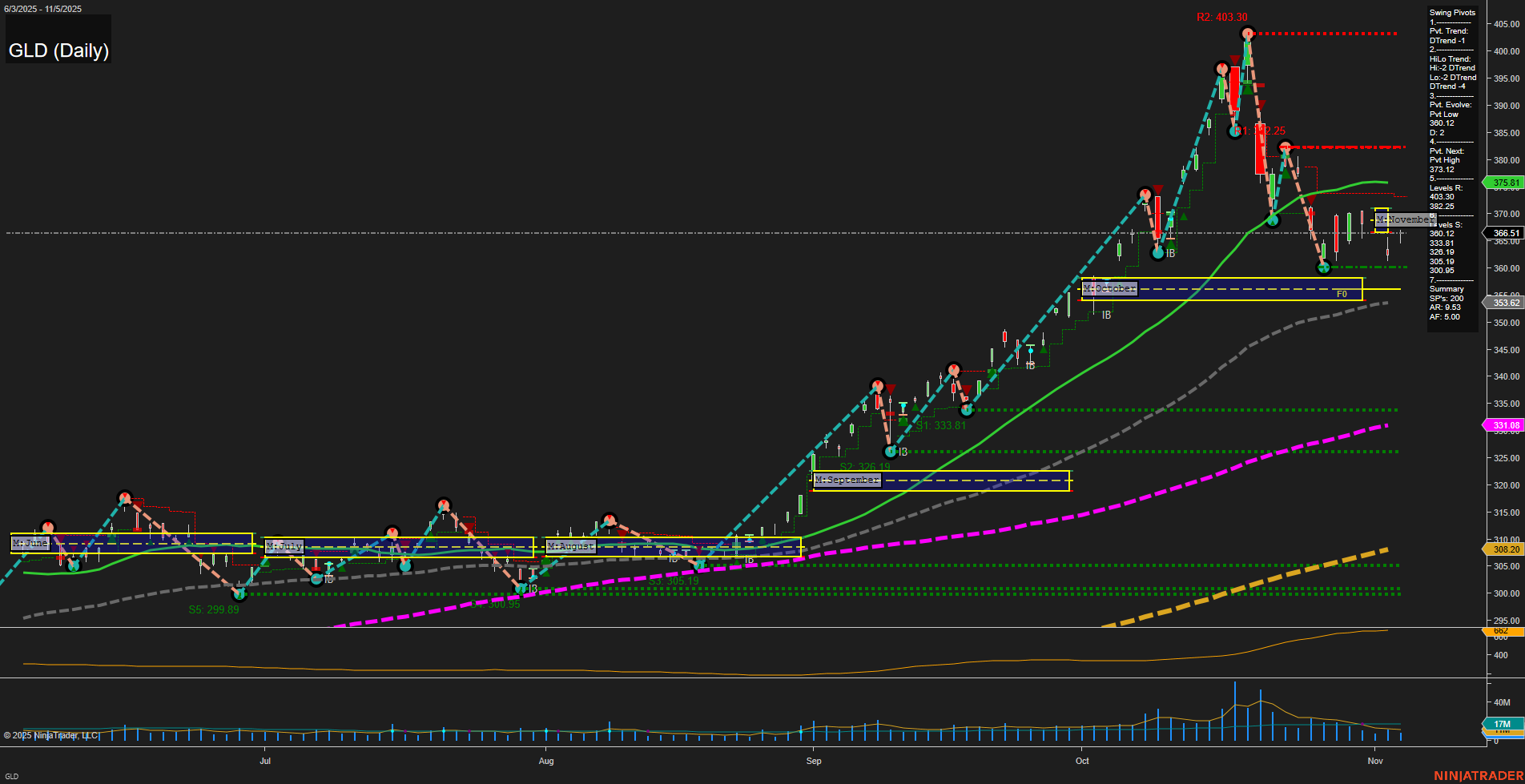

GLD SPDR Gold Shares Daily Chart Analysis: 2025-Nov-06 07:12 CT

Price Action

- Last: 366.51,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 362.12,

- 4. Pvt. Next: Pvt high 373.12,

- 5. Levels R: 403.30, 392.25, 382.25,

- 6. Levels S: 362.12, 333.81, 300.95.

Daily Benchmarks

- (Short-Term) 5 Day: 366.51 Down Trend,

- (Short-Term) 10 Day: 368.40 Down Trend,

- (Intermediate-Term) 20 Day: 375.81 Down Trend,

- (Intermediate-Term) 55 Day: 353.62 Up Trend,

- (Long-Term) 100 Day: 331.08 Up Trend,

- (Long-Term) 200 Day: 311.00 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

GLD has recently experienced a sharp pullback from its highs, with price action now consolidating below the 20-day moving average and just above a key swing support at 362.12. Both short-term and intermediate-term swing pivot trends are down, confirmed by the downward direction of the 5, 10, and 20-day moving averages. However, the longer-term 55, 100, and 200-day moving averages remain in uptrends, indicating that the broader bullish structure is still intact despite the recent correction. Volatility, as measured by ATR, remains elevated, and volume has normalized after the recent selloff spike. The market is currently in a neutral zone on both the weekly and monthly session fib grids, suggesting indecision and a potential for further consolidation or a base-building phase. Key resistance levels are overhead at 373.12 and 382.25, while support is clustered at 362.12 and 333.81. The overall structure suggests a corrective phase within a larger uptrend, with the potential for either a continuation of the pullback or a resumption of the bullish trend if support holds and momentum returns.

Chart Analysis ATS AI Generated: 2025-11-06 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.