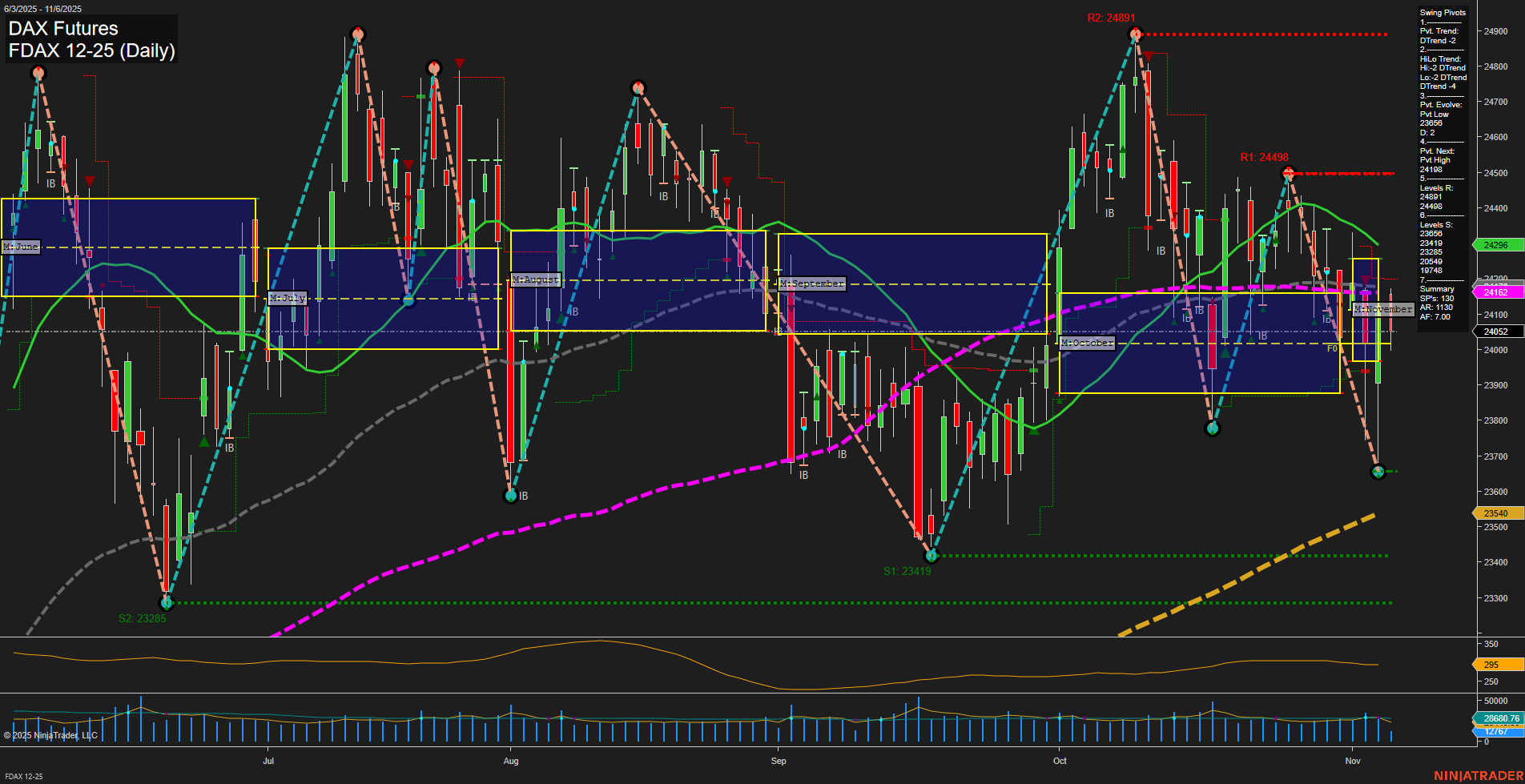

The FDAX is currently showing a mixed technical picture. Price action has recently bounced from a swing low at 23540, with medium-sized bars and average momentum, indicating a stabilization after a recent pullback. Both the weekly and monthly session fib grids (WSFG, MSFG) show price holding above their respective NTZ/F0% levels, supporting an upward bias in the short and intermediate term. However, swing pivot trends are down (DTrend) for both short and intermediate timeframes, with resistance at 24498 and 24891, and support at 23540 and below, suggesting the market is in a corrective phase within a broader uptrend. Short-term and intermediate-term moving averages (5, 10, 20 Day) are trending down, reflecting recent weakness, while the 55, 100, and 200 Day MAs remain in uptrends, highlighting underlying long-term strength. Recent trade signals have triggered new long entries, aligning with the bounce from support and the overall bullish long-term structure. Volatility (ATR) and volume (VOLMA) are moderate, indicating neither extreme fear nor exuberance. Overall, the market is consolidating after a pullback, with short and intermediate-term trends neutralizing, but the long-term trend remains bullish. The setup suggests the market is at a decision point, with potential for either a continuation higher if resistance is broken, or further consolidation if resistance holds.