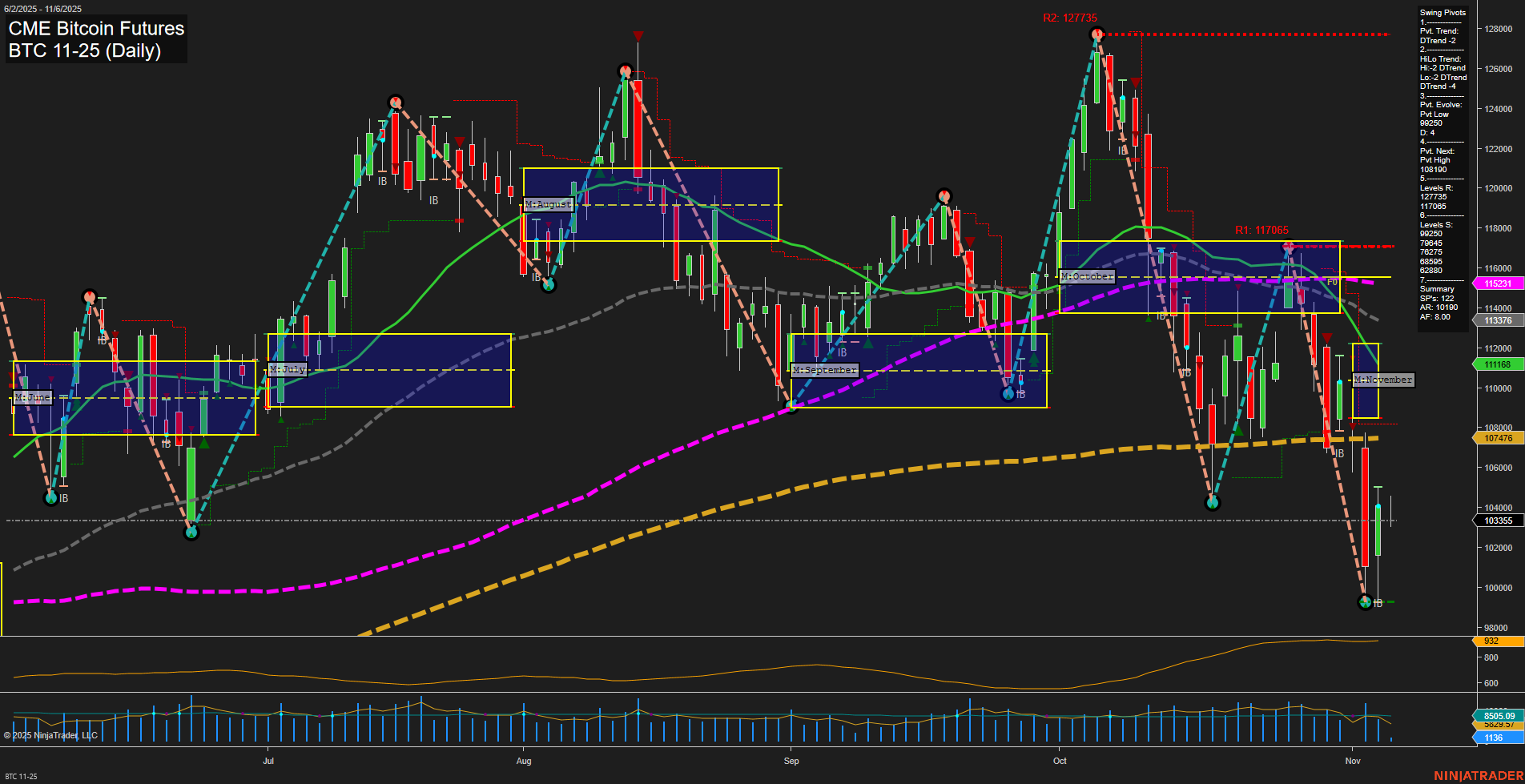

BTC CME Bitcoin Futures are currently experiencing strong downward momentum, as evidenced by large, fast-moving bars and a decisive break below both the weekly and monthly session fib grid neutral zones. Both short-term and intermediate-term swing pivot trends are in a clear downtrend, with the most recent pivot low at 104250 and the next potential reversal only above 119060. Resistance levels are stacked above, while support is thin and lower, suggesting further downside risk if current lows are breached. All key daily moving averages (5, 10, 20, 55, 100) are trending down, reinforcing the bearish structure, though the 200-day remains in an uptrend, providing some longer-term support. Volatility is elevated (ATR 1025), and volume remains robust, indicating active participation during this selloff. The long-term yearly trend is still up, but the current price action is dominated by aggressive selling, likely driven by a combination of technical breakdowns and possible macro or news-driven catalysts. The market is in a corrective phase, with potential for further downside or a sharp reversal only if a significant pivot high is established above resistance. Overall, the environment is bearish in the short and intermediate term, with the long-term trend at risk of shifting if support levels do not hold.