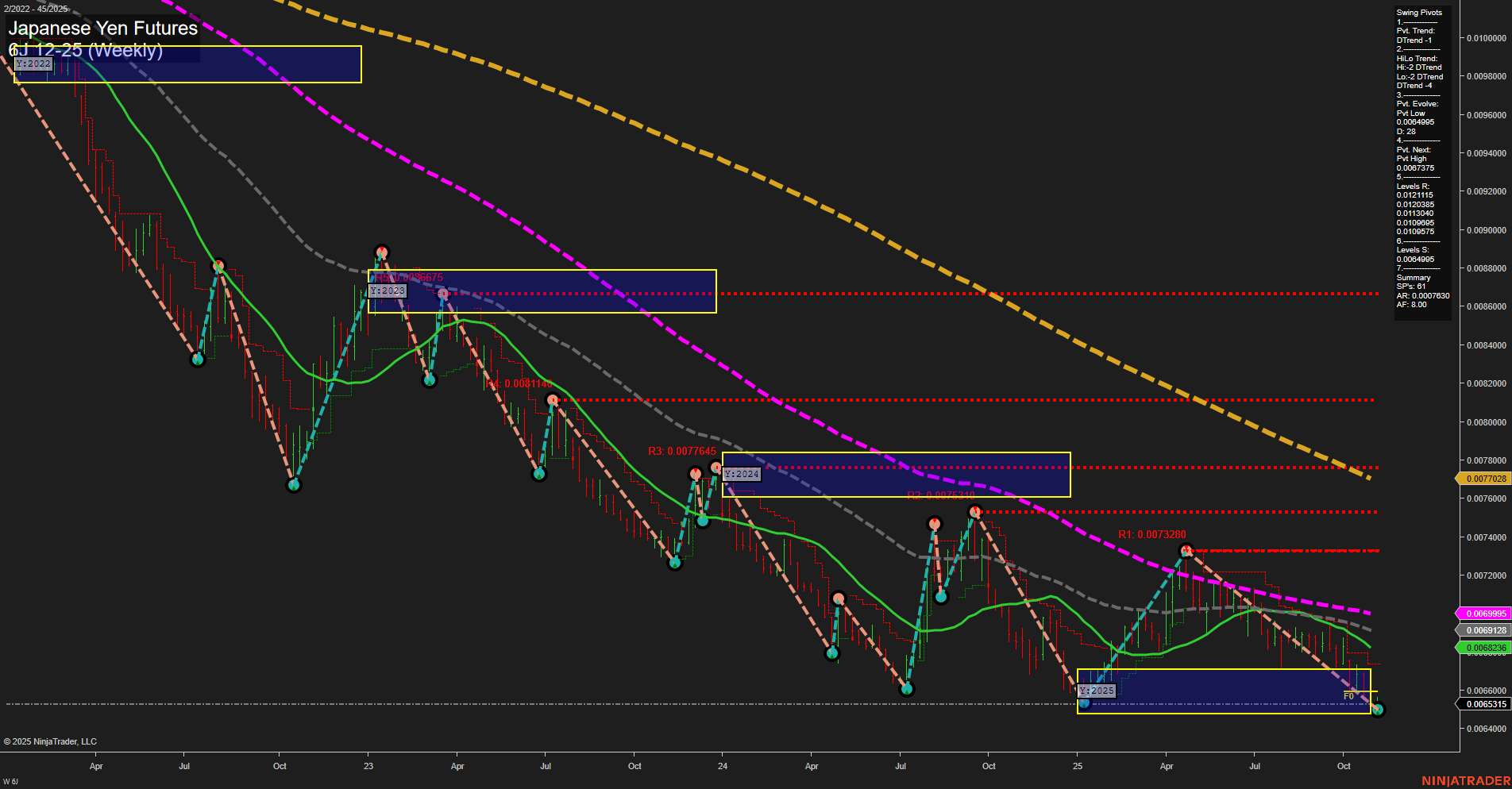

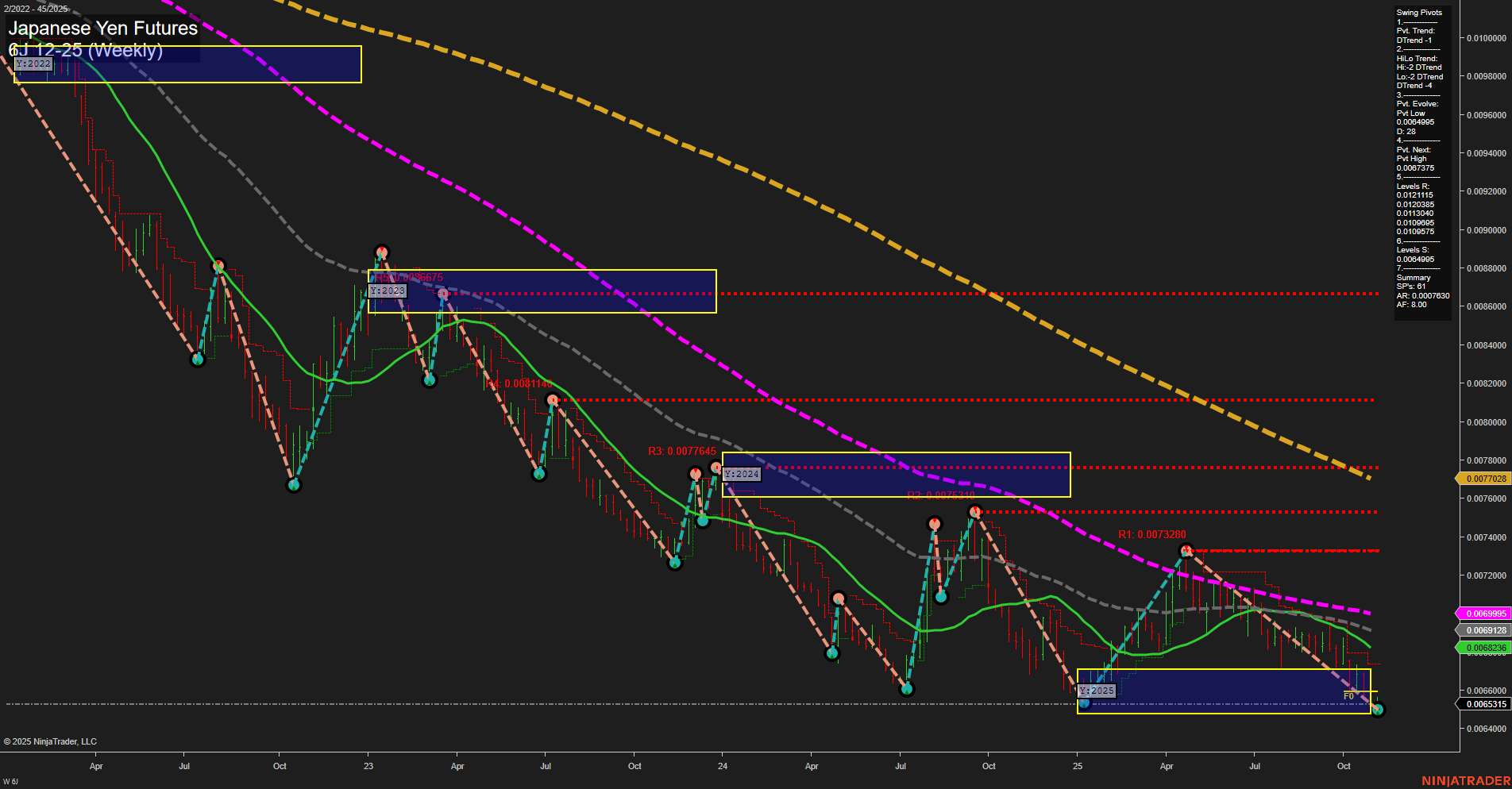

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Nov-06 07:03 CT

Price Action

- Last: 0.0065315,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -125%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.0064095,

- 4. Pvt. Next: Pvt High 0.0067375,

- 5. Levels R: 0.0122115, 0.0120345, 0.0113845, 0.011034, 0.0101875, 0.0100985, 0.009985,

- 6. Levels S: 0.0064095.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0069236 Down Trend,

- (Intermediate-Term) 10 Week: 0.0069128 Down Trend,

- (Long-Term) 20 Week: 0.0069955 Down Trend,

- (Long-Term) 55 Week: 0.0077508 Down Trend,

- (Long-Term) 100 Week: 0.0077028 Down Trend,

- (Long-Term) 200 Week: 0.0081100 Down Trend.

Recent Trade Signals

- 06 Nov 2025: Long 6J 12-25 @ 0.006536 Signals.USAR-WSFG

- 05 Nov 2025: Short 6J 12-25 @ 0.0065145 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The Japanese Yen futures (6J) weekly chart shows a market in a persistent long-term and intermediate-term downtrend, as confirmed by the downward direction of all major moving averages (20, 55, 100, 200 week) and the negative bias on both the monthly and yearly session fib grids. The short-term WSFG trend has recently turned up, with price just above the NTZ center, but momentum remains slow and the swing pivot trend is still down, suggesting any bounce is tentative. The most recent swing pivot is a new low at 0.0064095, with the next resistance pivot at 0.0067375. Multiple resistance levels remain overhead, while support is thin and defined by the recent low. Recent trade signals show mixed short-term direction, reflecting choppy price action and possible attempts at a short-term reversal, but the broader context remains bearish. The overall structure suggests the market is in a potential basing or consolidation phase after an extended decline, but has not yet confirmed a sustained reversal. Swing traders should note the risk of further downside if support fails, while also watching for signs of a more durable bottom if price can hold above the recent lows and reclaim higher resistance levels.

Chart Analysis ATS AI Generated: 2025-11-06 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.