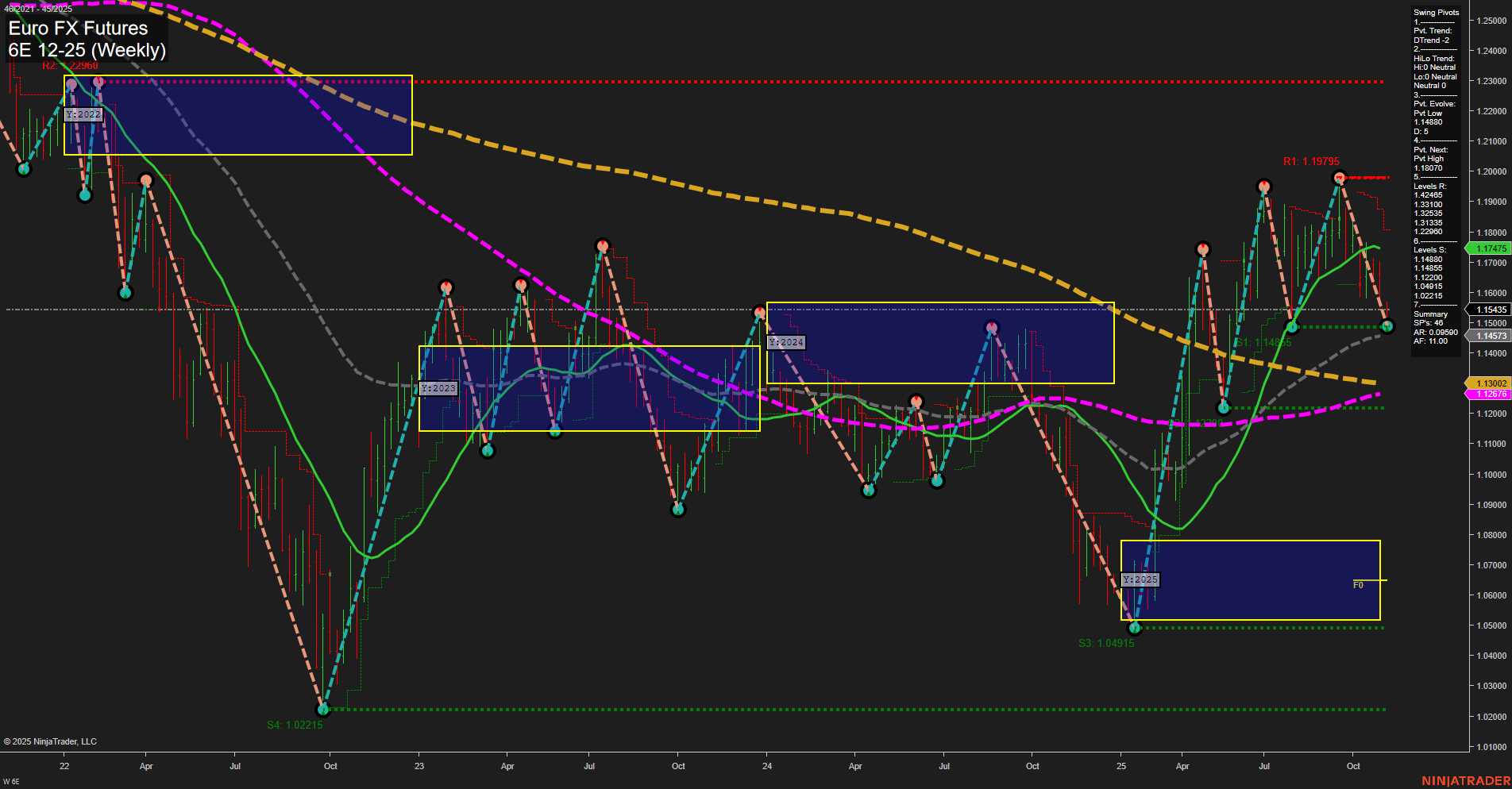

The 6E Euro FX Futures weekly chart shows a market under short- and intermediate-term pressure, with both the WSFG and MSFG trends pointing down and price action below their respective NTZ/F0% levels. Momentum is slow, and the most recent bars are of medium size, indicating a lack of strong conviction in either direction. Swing pivot analysis confirms a dominant downtrend in both short- and intermediate-term timeframes, with the most recent pivot low at 1.14575 acting as immediate support and resistance levels above at 1.15405, 1.17475, and 1.19775. Weekly benchmarks are mixed: the 5- and 10-week moving averages are trending down, reinforcing the bearish short- and intermediate-term outlook, while the 20- and 55-week averages are up, suggesting some underlying long-term support. However, the 100- and 200-week moving averages remain in a downtrend, tempering any bullish long-term bias. The YSFG (yearly) trend is up, with price above the yearly NTZ/F0%, but this is not yet reflected in the shorter timeframes. Recent trade signals show both long and short entries in close proximity, highlighting a choppy, indecisive environment. Overall, the market is consolidating after a prior rally, with a bias toward further downside in the near term unless key resistance levels are reclaimed. The long-term trend remains neutral as the market tests the balance between support and resistance, awaiting a decisive breakout or breakdown.