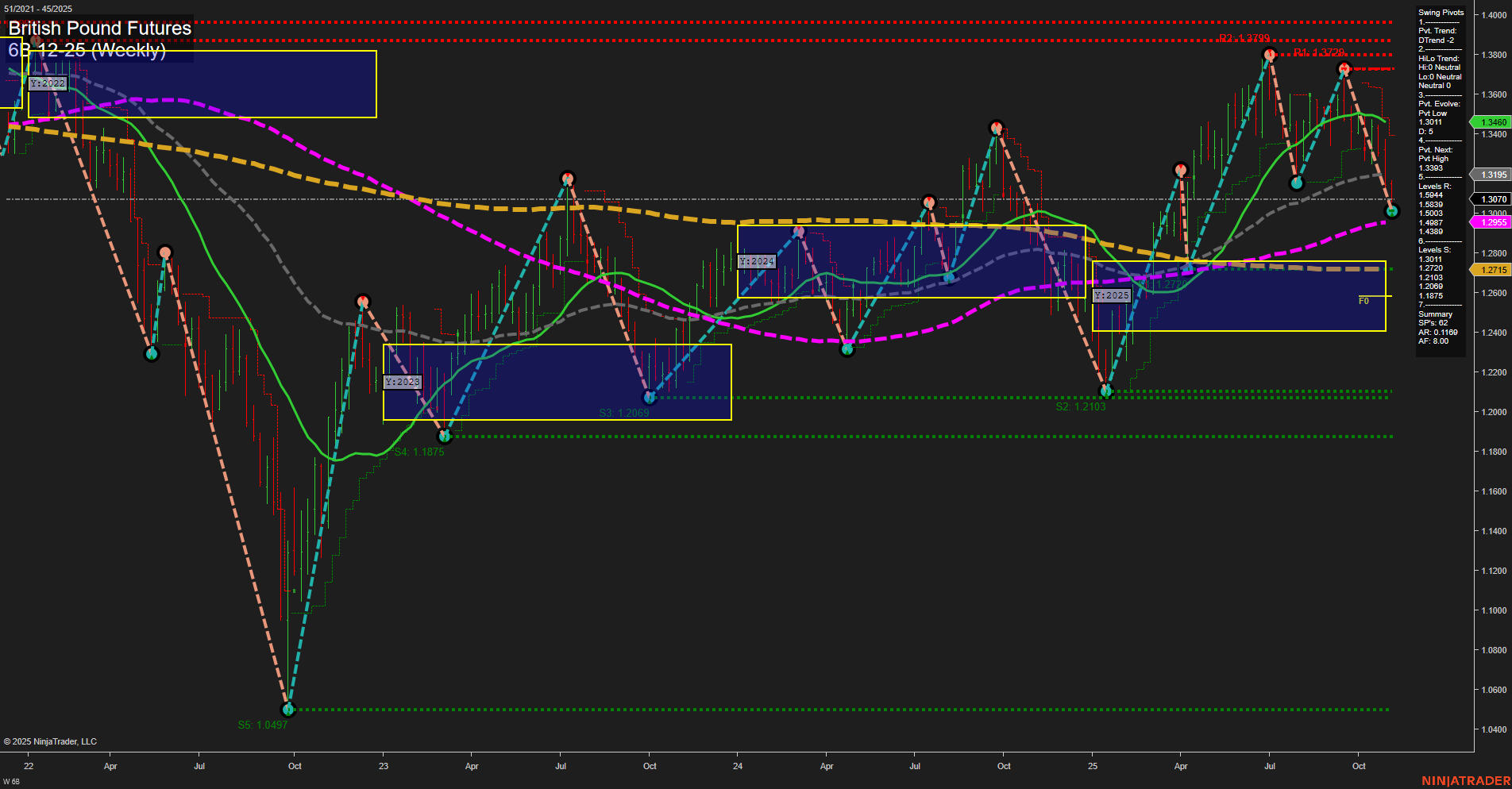

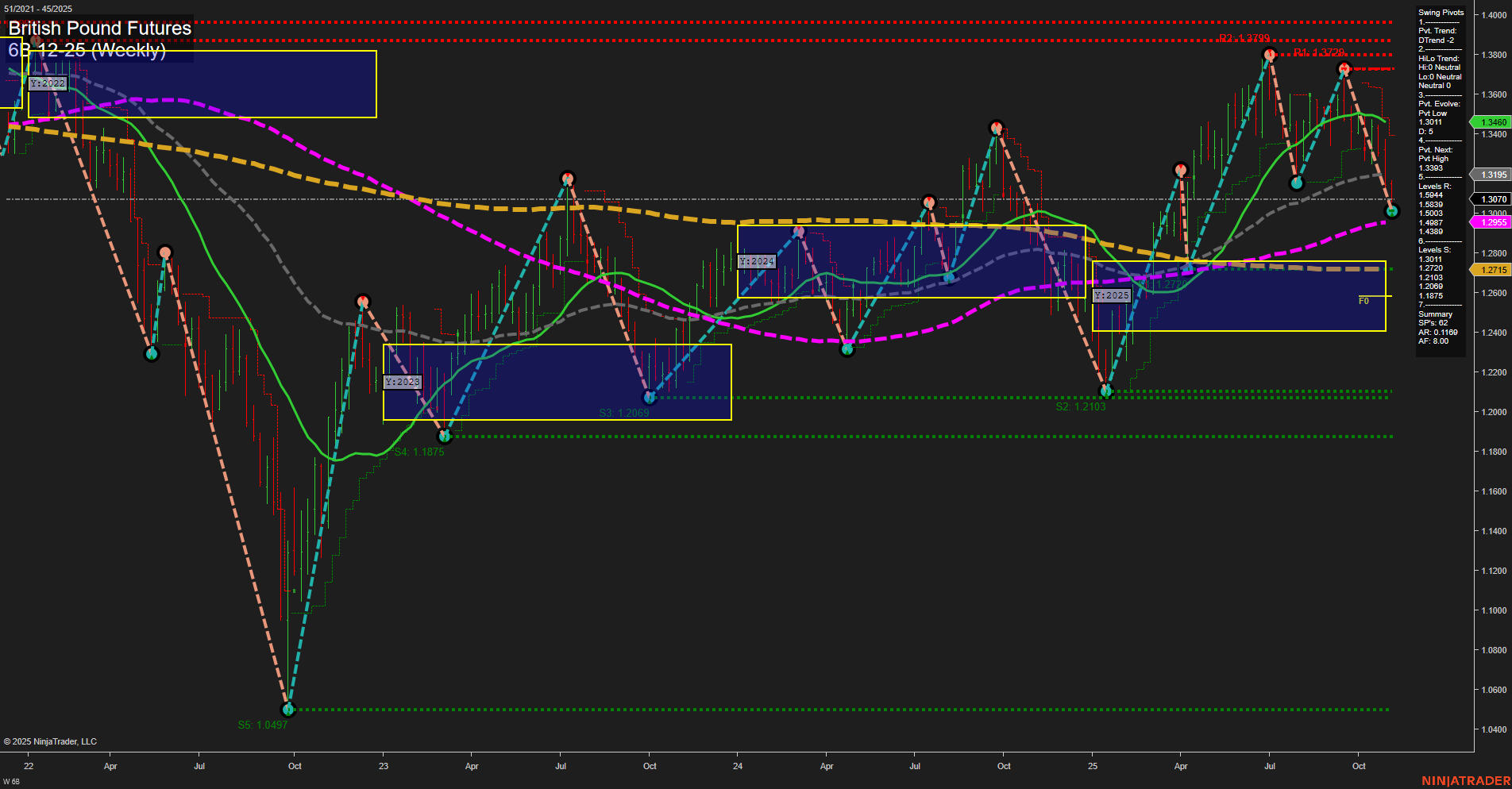

6B British Pound Futures Weekly Chart Analysis: 2025-Nov-06 07:01 CT

Price Action

- Last: 1.3070,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -24%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -80%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 29%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.3070,

- 4. Pvt. Next: Pvt low 1.3070,

- 5. Levels R: 1.3799, 1.3728, 1.3460, 1.3195,

- 6. Levels S: 1.2715, 1.2069, 1.1875, 1.1210, 1.0497.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.3195 Down Trend,

- (Intermediate-Term) 10 Week: 1.3083 Down Trend,

- (Long-Term) 20 Week: 1.3460 Down Trend,

- (Long-Term) 55 Week: 1.2905 Up Trend,

- (Long-Term) 100 Week: 1.2951 Up Trend,

- (Long-Term) 200 Week: 1.3273 Down Trend.

Recent Trade Signals

- 06 Nov 2025: Long 6B 12-25 @ 1.3079 Signals.USAR.TR120

- 04 Nov 2025: Short 6B 12-25 @ 1.3124 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The British Pound Futures (6B) weekly chart shows a market under pressure in the short and intermediate term, with both the WSFG and MSFG trends pointing down and price trading below their respective NTZ/F0% levels. Swing pivots confirm a dominant downtrend, with the most recent pivot low at 1.3070 and resistance levels stacked well above current price, suggesting overhead supply. The moving averages reinforce this bearish bias in the short and intermediate term, as the 5, 10, and 20-week benchmarks are all trending down and above last price, while the longer-term 55 and 100-week MAs are still up but flattening, and the 200-week MA is turning down. Recent trade signals show mixed short-term action, with a quick reversal from short to long, indicating possible volatility or a test of support. The long-term YSFG trend remains up, but with price action currently consolidating below key resistance and above major support at 1.2715. Overall, the market is in a corrective or retracement phase within a larger uptrend, with risk of further downside if support levels fail, but potential for a bounce if buyers defend the current swing low.

Chart Analysis ATS AI Generated: 2025-11-06 07:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.