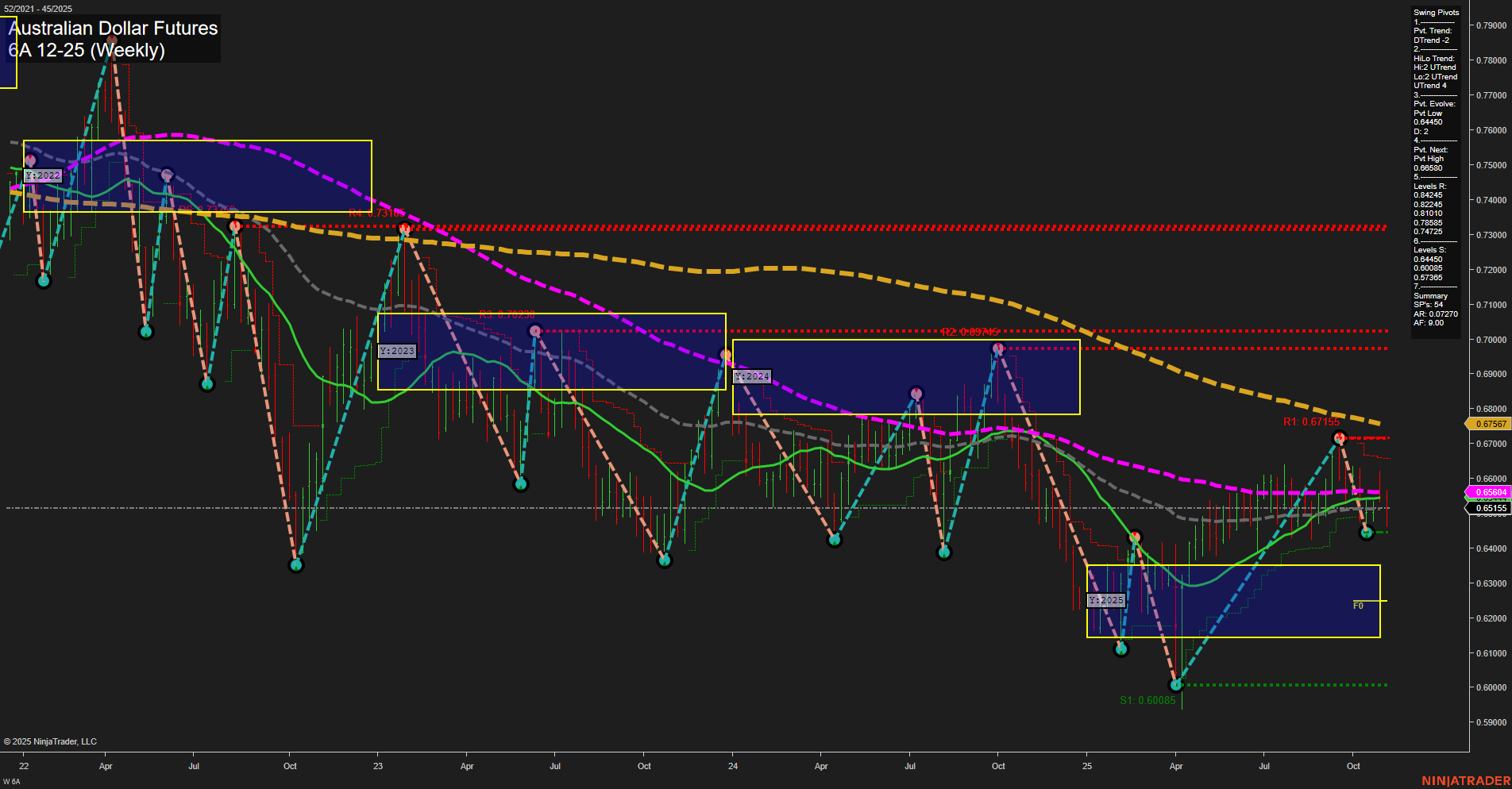

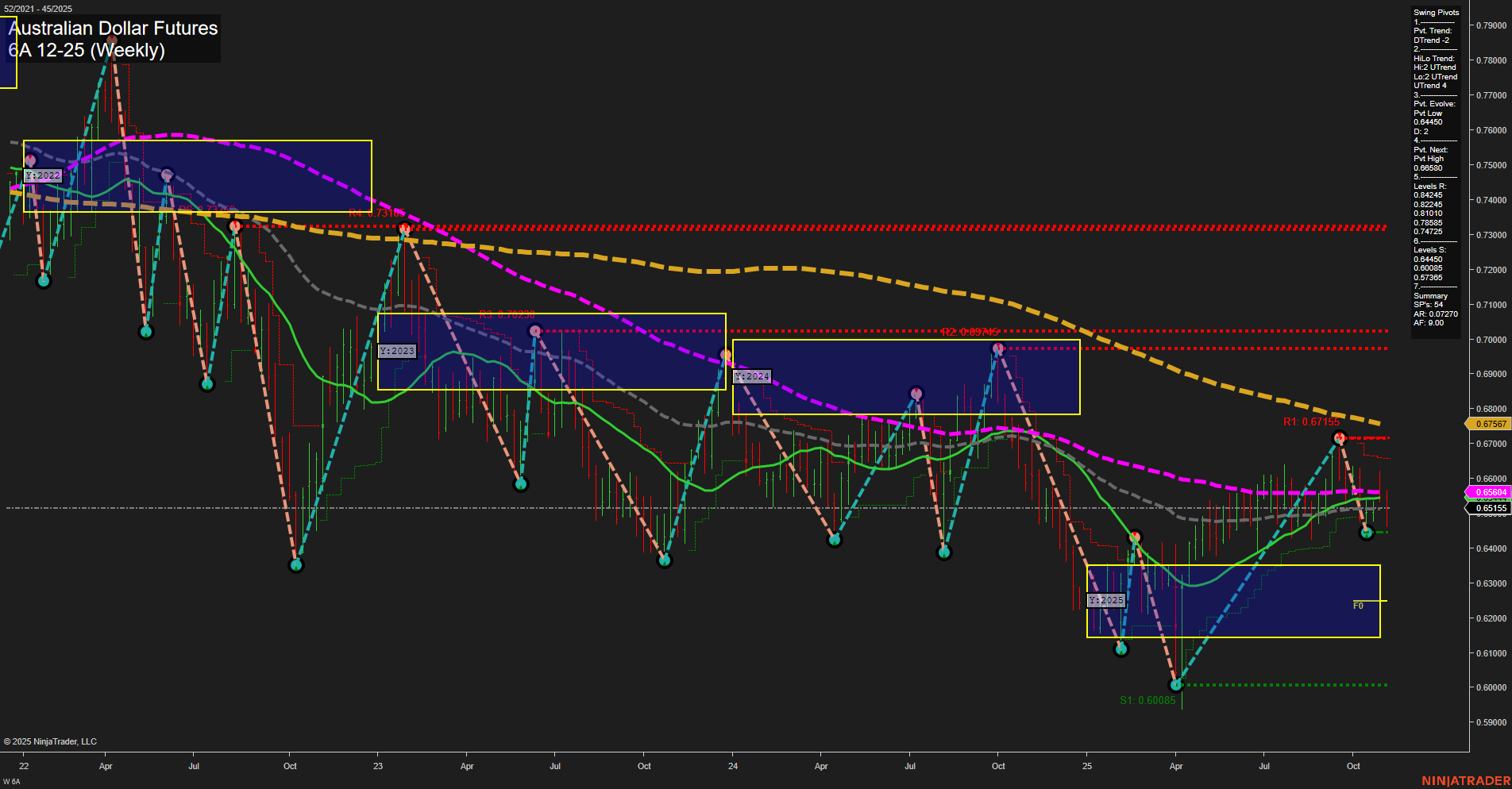

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Nov-06 07:00 CT

Price Action

- Last: 0.65185,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.65155,

- 4. Pvt. Next: Pvt high 0.67155,

- 5. Levels R: 0.67155, 0.68425, 0.70275, 0.72845,

- 6. Levels S: 0.65155, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65504 Down Trend,

- (Intermediate-Term) 10 Week: 0.65515 Down Trend,

- (Long-Term) 20 Week: 0.65767 Down Trend,

- (Long-Term) 55 Week: 0.66504 Down Trend,

- (Long-Term) 100 Week: 0.67557 Down Trend,

- (Long-Term) 200 Week: 0.70270 Down Trend.

Recent Trade Signals

- 06 Nov 2025: Long 6A 12-25 @ 0.65185 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in consolidation after a recent swing low at 0.65155, with price action exhibiting medium-sized bars and average momentum. The short-term swing pivot trend has turned down, while the intermediate-term HiLo trend remains up, indicating a possible transition phase. All major moving averages (5, 10, 20, 55, 100, 200 week) are trending down, reinforcing a bearish long-term structure. Price is currently near a key support at 0.65155, with resistance overhead at 0.67155 and higher. The neutral bias across the session fib grids (weekly, monthly, yearly) suggests indecision, with no clear directional conviction. The recent long signal at support hints at a potential bounce, but the prevailing downtrend in benchmarks and pivots keeps the overall outlook cautious. The market is likely in a corrective phase within a broader bearish context, with traders watching for either a breakdown below support or a reversal toward resistance.

Chart Analysis ATS AI Generated: 2025-11-06 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.