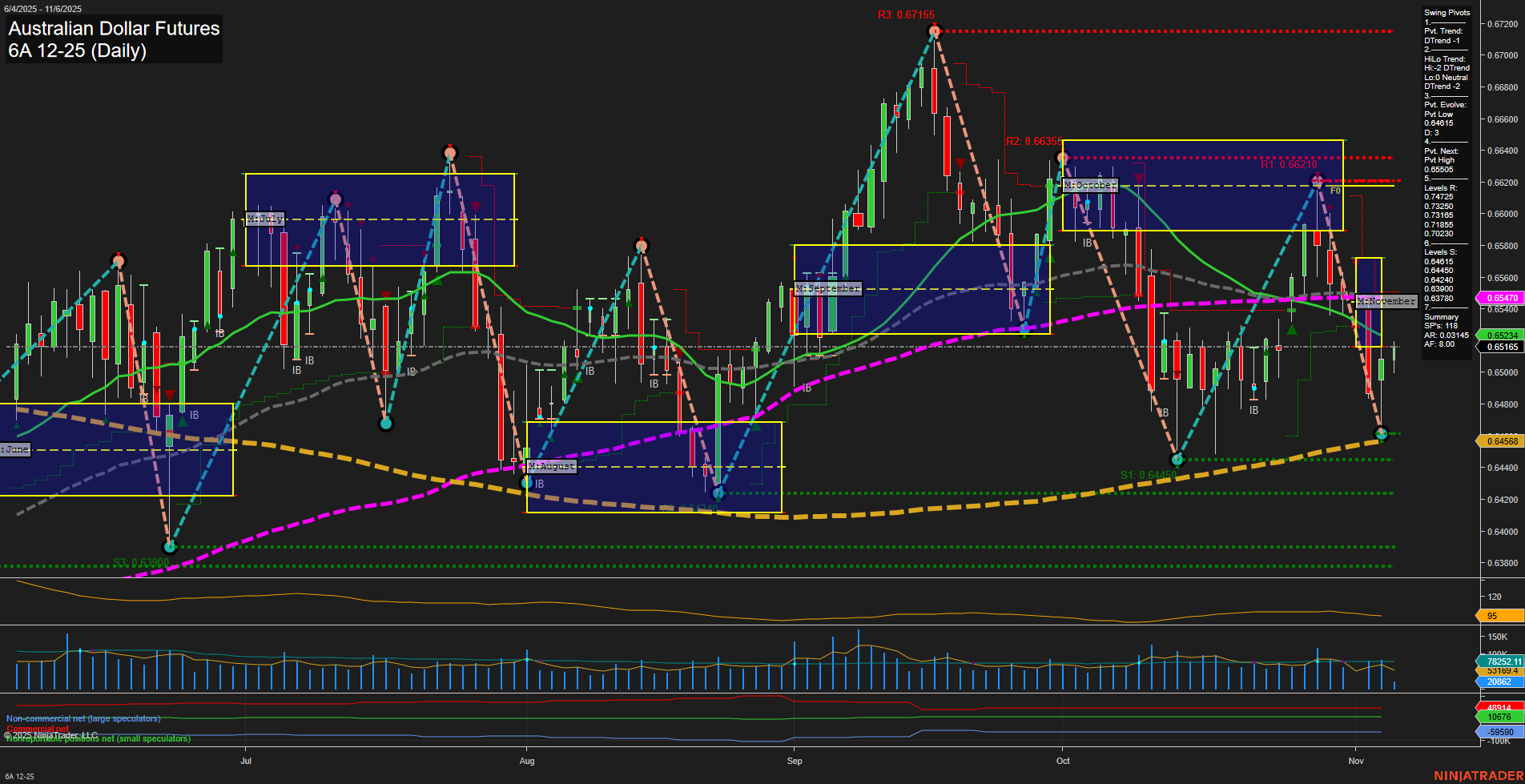

The 6A Australian Dollar Futures daily chart shows a market in a corrective phase, with price action characterized by medium-sized bars and slow momentum. Both short-term and intermediate-term swing pivot trends are down (DTrend), and all key moving averages except the 200-day are in a downtrend, reinforcing a bearish bias in the short and intermediate timeframes. The 200-day MA, however, remains in an uptrend, suggesting that the longer-term structure is still holding above major support. Recent price action has seen a test and bounce from the 0.64658 swing low support, with resistance levels overhead at 0.66210, 0.66355, and 0.67155. The market is currently trading near the lower end of the recent range, with volatility (ATR) at moderate levels and volume (VOLMA) steady. The neutral readings on the session fib grids (weekly, monthly, yearly) indicate a lack of strong directional conviction from broader market participants. A recent long signal (USAR.TR120) suggests a potential for a short-term bounce or retracement, but the prevailing trend context remains bearish until a reversal above the next swing high resistance is confirmed. The overall environment is one of consolidation within a broader corrective move, with the potential for further choppy price action unless a decisive breakout occurs.