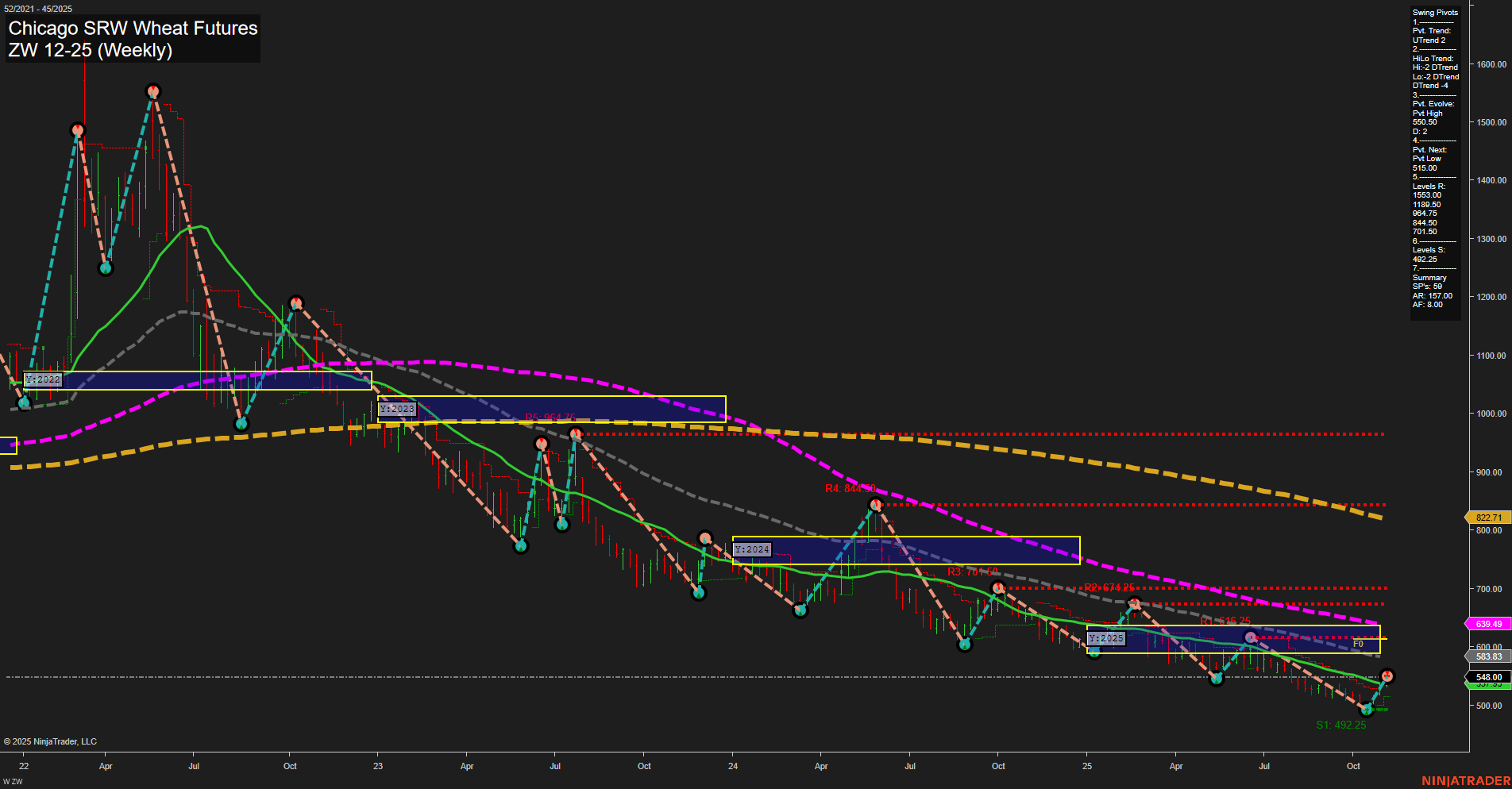

The ZW Chicago SRW Wheat Futures weekly chart shows a market that has been in a persistent downtrend, with both short-term and intermediate-term swing pivots confirming a dominant downward trend. Price action is subdued, with small bars and slow momentum, indicating a lack of strong buying or selling pressure at current levels. While the Weekly and Monthly Session Fib Grids (WSFG, MSFG) show a short-term and intermediate-term upward bias as price is above their respective NTZ/F0% levels, the long-term Yearly Session Fib Grid (YSFG) remains negative, with price well below the yearly NTZ/F0% and the trend still down. Swing pivot resistance levels are stacked well above current price, with the nearest support at 492.25. All visible moving averages (5, 10, 20, 55 week) are trending down, reinforcing the broader bearish structure. The most recent trade signal was a short entry, aligning with the prevailing downtrend. Overall, the market is showing some short-term stabilization or potential for a technical bounce, but the intermediate and long-term outlooks remain bearish, with rallies likely to encounter significant resistance. The chart reflects a market in a prolonged corrective phase, with any upside likely to be corrective within a larger bearish context.