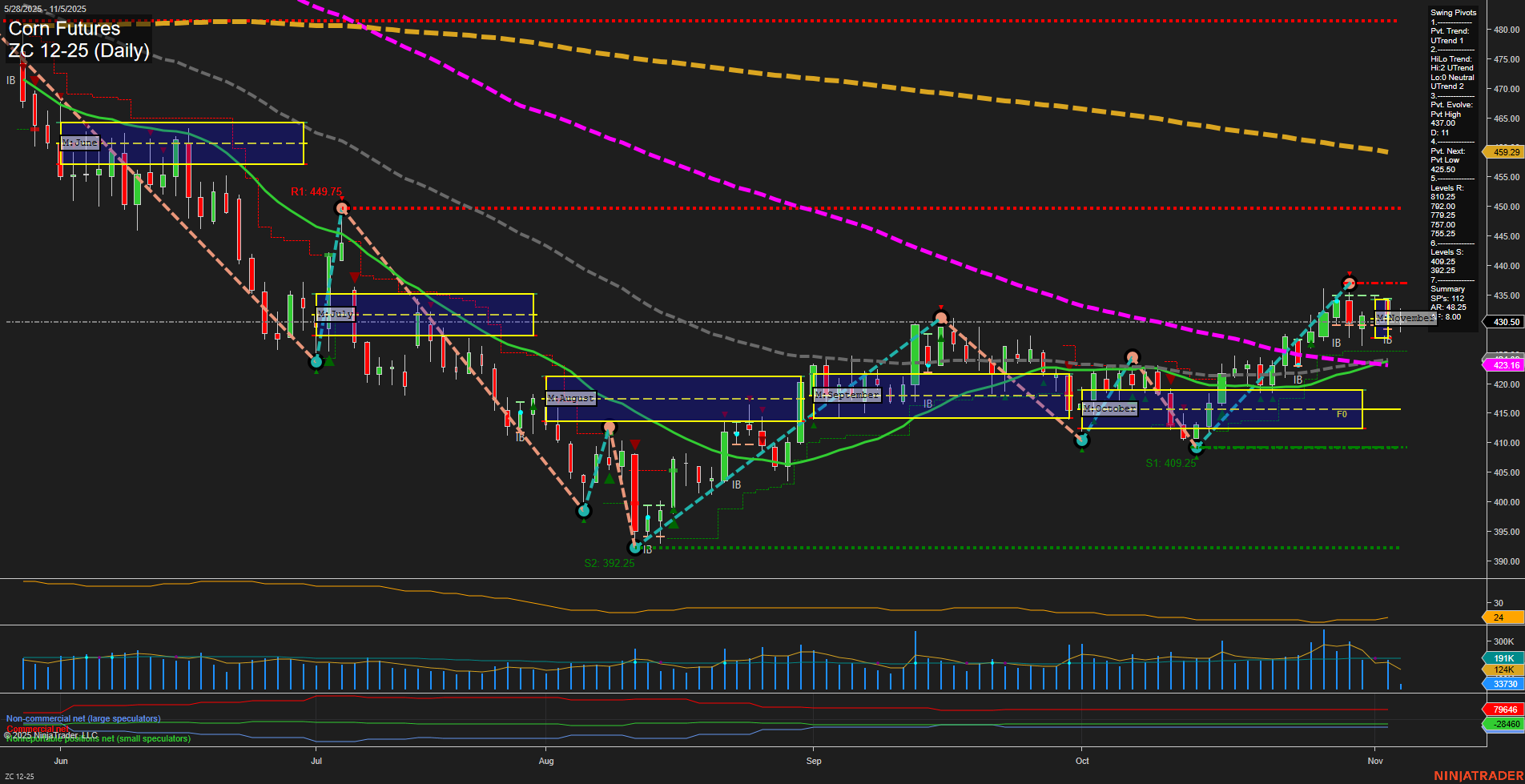

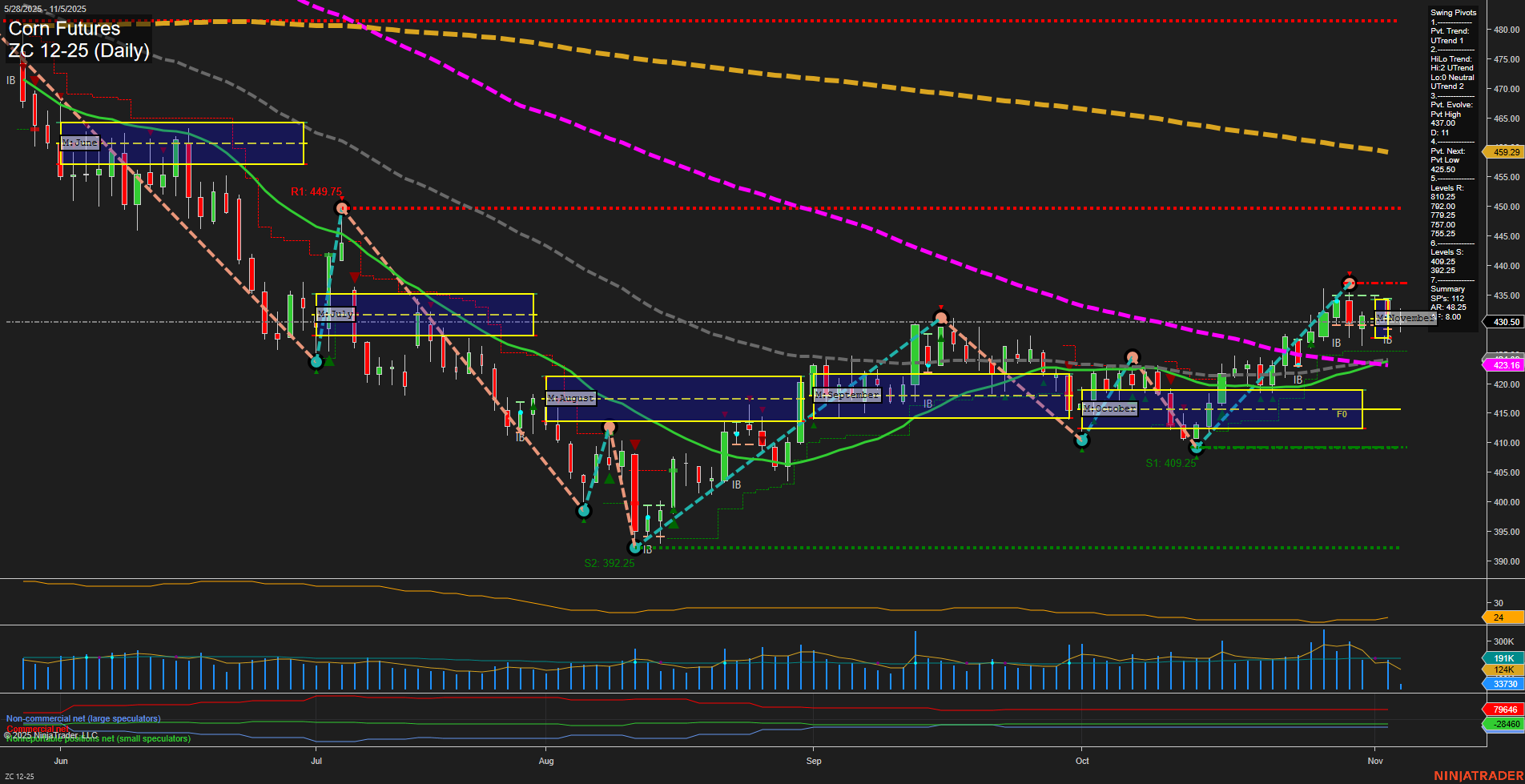

ZC Corn Futures Daily Chart Analysis: 2025-Nov-05 07:25 CT

Price Action

- Last: 430.50,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 77%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -41%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 440.11,

- 4. Pvt. Next: Pvt low 425.00,

- 5. Levels R: 449.75, 440.11, 432.25,

- 6. Levels S: 409.25, 392.25.

Daily Benchmarks

- (Short-Term) 5 Day: 432.25 Up Trend,

- (Short-Term) 10 Day: 423.16 Up Trend,

- (Intermediate-Term) 20 Day: 423.16 Up Trend,

- (Intermediate-Term) 55 Day: 423.16 Up Trend,

- (Long-Term) 100 Day: 459.29 Down Trend,

- (Long-Term) 200 Day: 478.00 Down Trend.

Additional Metrics

Recent Trade Signals

- 03 Nov 2025: Long ZC 12-25 @ 432.5 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

Corn futures have shifted into a clear short- and intermediate-term uptrend, with price action holding above both the weekly and monthly session fib grid NTZs and all short/intermediate moving averages trending higher. The most recent swing pivot is a high at 440.11, with the next potential pivot low at 425.00, suggesting a possible pullback zone if momentum stalls. Resistance is layered above at 440.11 and 449.75, while support is well below at 409.25 and 392.25, indicating a wide trading range. The long-term trend remains bearish, as price is still below the 100- and 200-day moving averages, but the recent breakout and higher lows signal a possible trend transition. Volatility is moderate, and volume remains supportive of the current move. The recent long signal aligns with the prevailing short-term momentum, but the market is approaching key resistance, so price action around these levels will be critical for the next swing direction.

Chart Analysis ATS AI Generated: 2025-11-05 07:25 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.