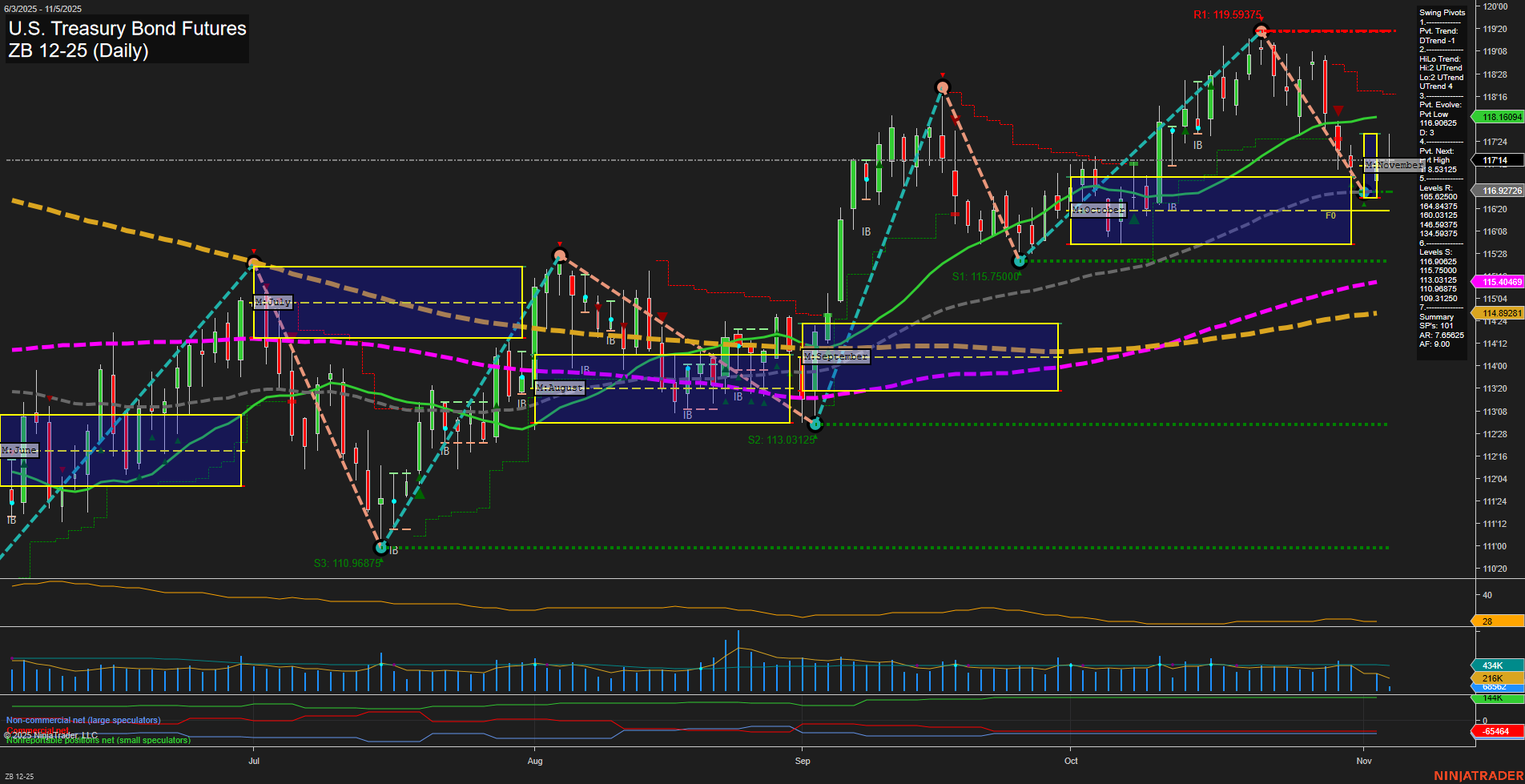

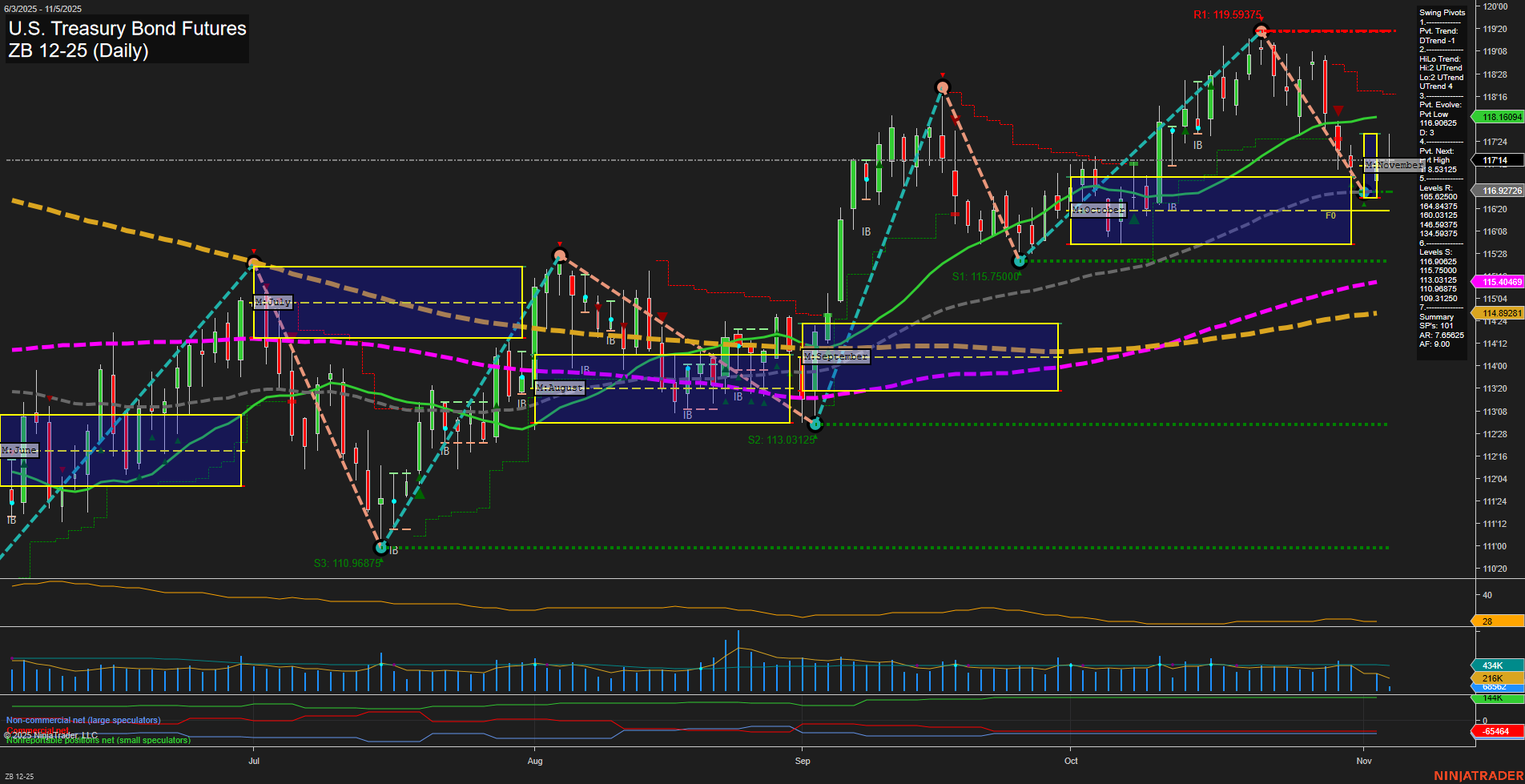

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Nov-05 07:24 CT

Price Action

- Last: 115.83125,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 115.75000,

- 4. Pvt. Next: Pvt high 118.16984,

- 5. Levels R: 119.59375, 118.16984, 116.92726,

- 6. Levels S: 115.75000, 114.84375, 113.03125, 110.96875.

Daily Benchmarks

- (Short-Term) 5 Day: 116.09 Down Trend,

- (Short-Term) 10 Day: 116.48 Down Trend,

- (Intermediate-Term) 20 Day: 118.17 Down Trend,

- (Intermediate-Term) 55 Day: 115.40 Up Trend,

- (Long-Term) 100 Day: 114.88 Up Trend,

- (Long-Term) 200 Day: 115.40 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in transition. Price action has slowed with medium-sized bars and a recent momentum drop, indicating a pause after the prior selloff. The short-term swing pivot trend is down, with the most recent pivot low at 115.75 acting as immediate support, while resistance is stacked above at 116.93, 118.17, and 119.59. Both the 5-day and 10-day moving averages are trending down, confirming short-term bearishness, while intermediate and long-term moving averages are flat to slightly up, suggesting a neutral to stabilizing longer-term outlook. The ATR remains moderate, and volume is steady, showing no signs of panic or exuberance. The market is consolidating near the lower end of the recent range, with no clear breakout or breakdown, and the monthly and weekly session fib grids are neutral. This environment is typical of a market digesting recent moves, with traders watching for a decisive move above resistance or a breakdown below support to signal the next directional swing.

Chart Analysis ATS AI Generated: 2025-11-05 07:24 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.