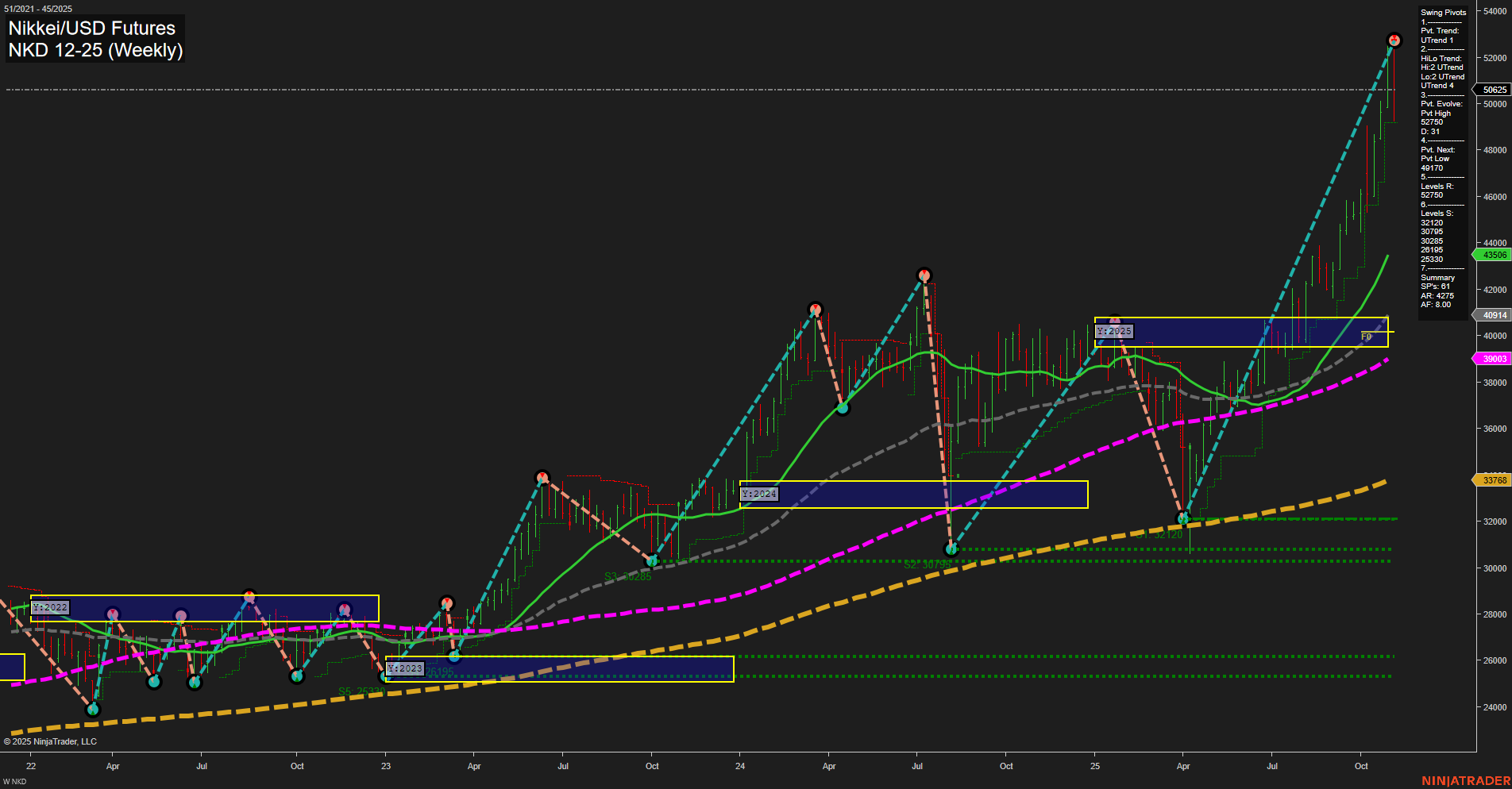

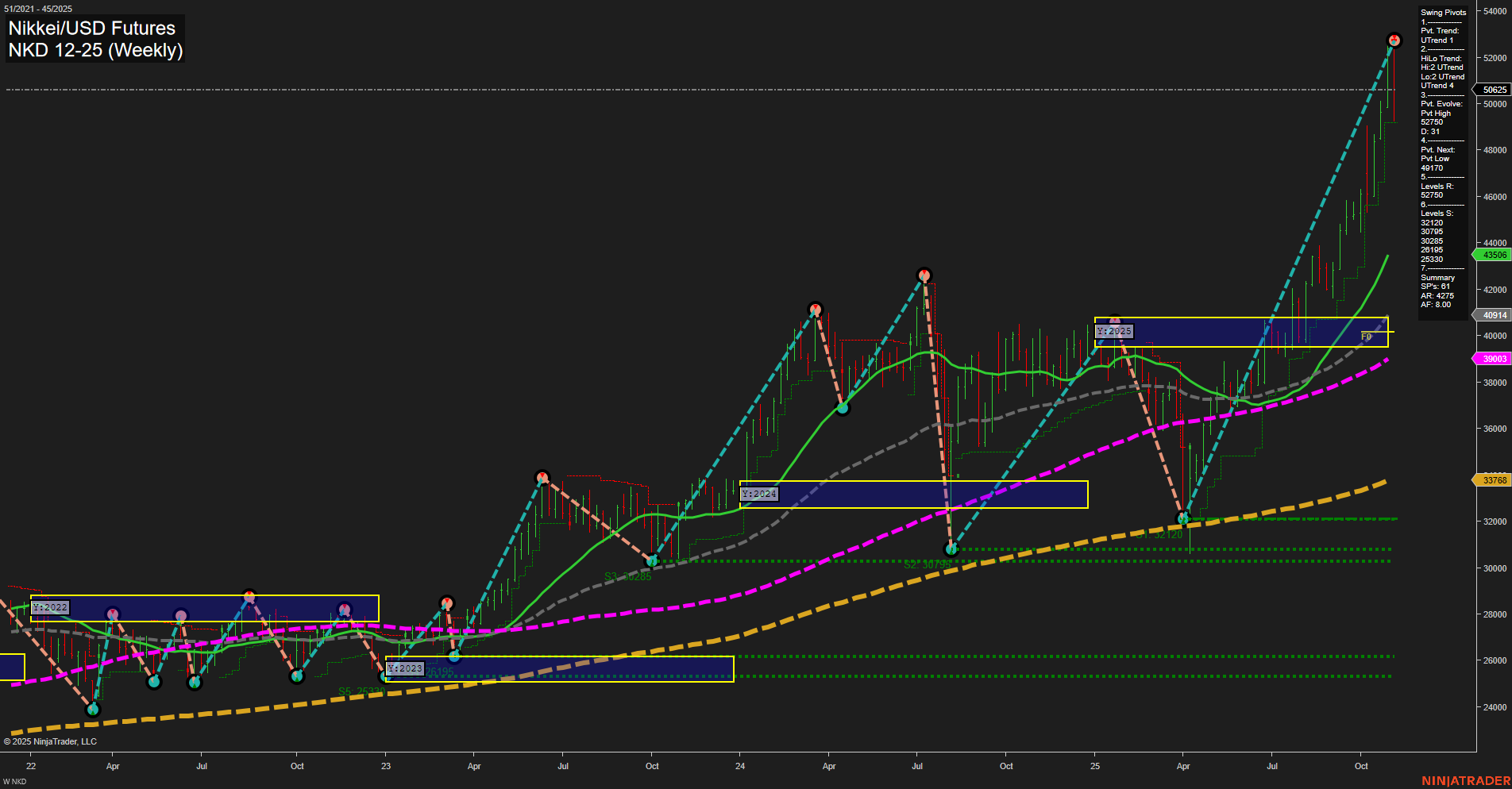

NKD Nikkei/USD Futures Weekly Chart Analysis: 2025-Nov-05 07:14 CT

Price Action

- Last: 51945,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -59%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 159%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 163%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 51945,

- 4. Pvt. Next: Pvt low 40710,

- 5. Levels R: 51945,

- 6. Levels S: 40710, 39205, 39035, 37025, 28330.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 49014 Up Trend,

- (Intermediate-Term) 10 Week: 45365 Up Trend,

- (Long-Term) 20 Week: 40914 Up Trend,

- (Long-Term) 55 Week: 39003 Up Trend,

- (Long-Term) 100 Week: 33768 Up Trend,

- (Long-Term) 200 Week: 33768 Up Trend.

Recent Trade Signals

- 04 Nov 2025: Short NKD 12-25 @ 51945 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD Futures market is exhibiting strong bullish momentum on the intermediate and long-term timeframes, as evidenced by the persistent uptrend in all major moving averages and the upward trajectory of both the MSFG and YSFG grids. The most recent price action has produced large, fast-moving bars, culminating in a new swing high at 51945. However, the short-term WSFG trend is down, with price currently below the weekly NTZ center, suggesting a possible short-term pullback or consolidation phase after a rapid advance. Swing pivot analysis confirms the uptrend, but with the next significant support level far below at 40710, any retracement could be substantial. The recent short signal (USAR-WSFG) aligns with this short-term caution, even as the broader trend remains robustly bullish. Overall, the market is in a strong uptrend with potential for short-term volatility or correction, but the underlying structure remains supportive of higher prices over the intermediate and long term.

Chart Analysis ATS AI Generated: 2025-11-05 07:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.