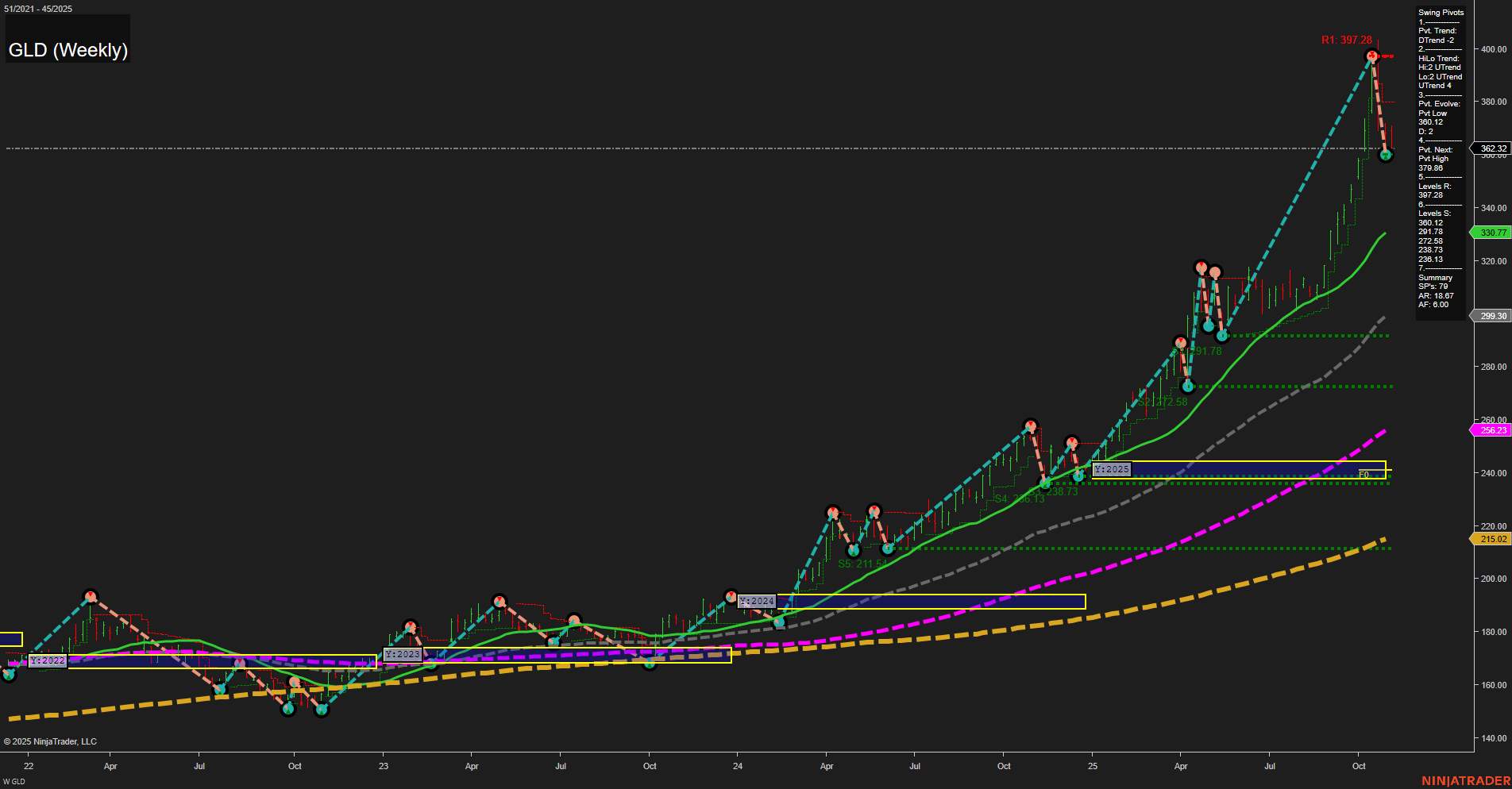

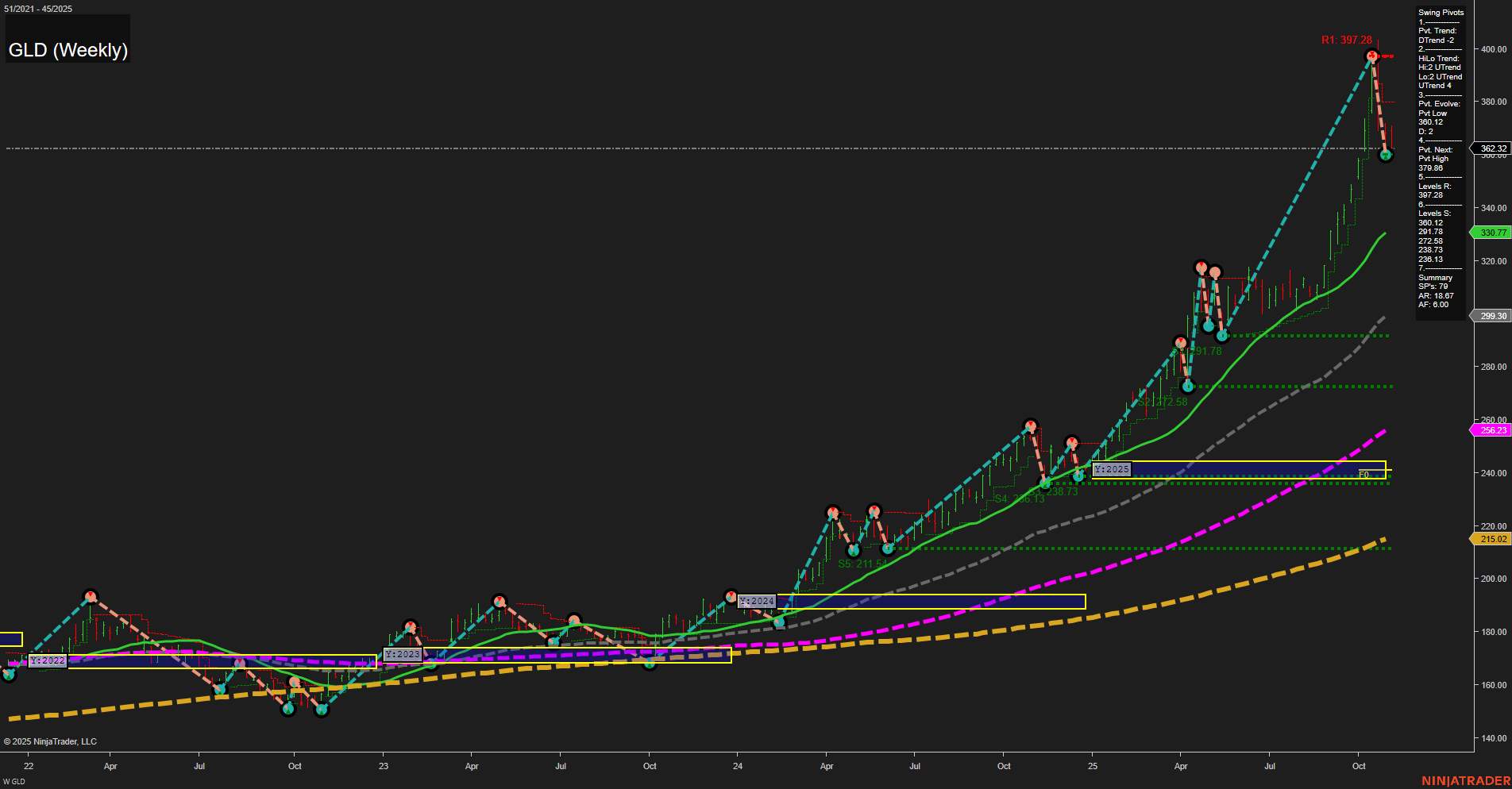

GLD SPDR Gold Shares Weekly Chart Analysis: 2025-Nov-05 07:13 CT

Price Action

- Last: 362.32,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 330.12,

- 4. Pvt. Next: Pvt high 397.88,

- 5. Levels R: 397.28, 379.88,

- 6. Levels S: 330.12, 299.30, 278.78, 256.23, 215.02.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 362.32 Down Trend,

- (Intermediate-Term) 10 Week: 330.77 Up Trend,

- (Long-Term) 20 Week: 299.30 Up Trend,

- (Long-Term) 55 Week: 256.23 Up Trend,

- (Long-Term) 100 Week: 215.02 Up Trend,

- (Long-Term) 200 Week: 187.67 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

GLD has experienced a sharp rally to new highs, with recent weekly bars showing large ranges and fast momentum, indicating heightened volatility. The short-term swing pivot trend has shifted to a downtrend, suggesting a corrective phase or pullback after the recent surge. However, the intermediate and long-term trends remain firmly bullish, supported by rising moving averages and higher swing lows. Key resistance is at 397.28 and 379.88, while support levels are layered below at 330.12, 299.30, and further down. The price is currently above all major long-term benchmarks, reflecting strong underlying strength, but the short-term correction could lead to further consolidation or a retest of lower support before any renewed advance. The overall structure points to a market in a bullish cycle with a short-term pause or retracement, typical after a strong breakout and rally phase.

Chart Analysis ATS AI Generated: 2025-11-05 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.