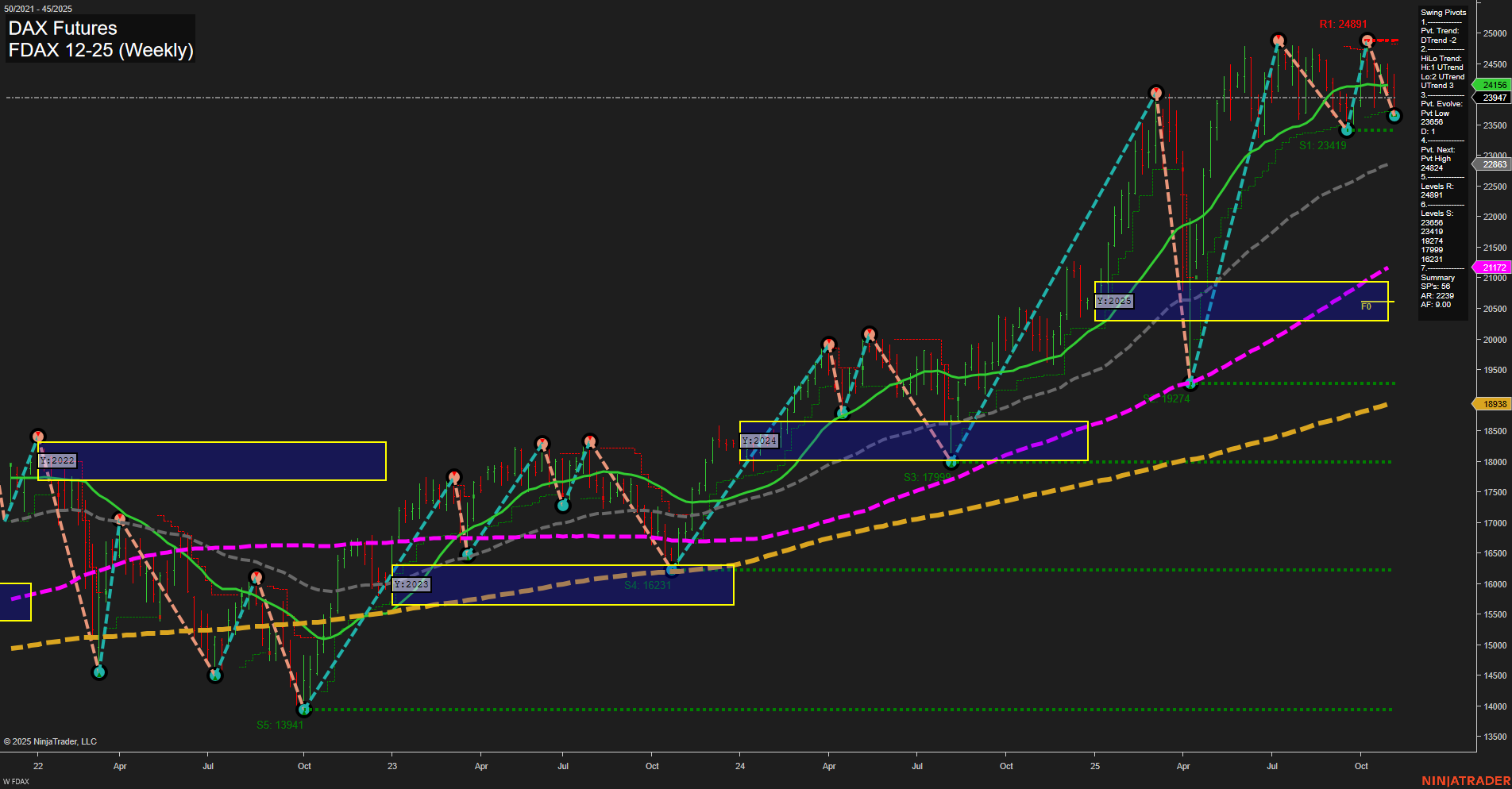

The FDAX DAX Futures weekly chart shows a clear divergence between short/intermediate-term and long-term trends. Price action is currently subdued with medium-sized bars and slow momentum, reflecting a period of consolidation or mild retracement after recent highs. Both the Weekly and Monthly Session Fib Grids (WSFG, MSFG) indicate price is below their respective NTZ/F0% levels, confirming a short- and intermediate-term downtrend. This is reinforced by the swing pivot summary, which shows both the short-term pivot trend and intermediate HiLo trend as down, with the most recent pivot low at 23066 and resistance at 24824 and 24891. All short- and intermediate-term moving averages (5, 10, 20 week) are trending down, further supporting the bearish bias in the near term. However, the long-term moving averages (55, 100, 200 week) remain in uptrends, and the Yearly Session Fib Grid (YSFG) shows price well above its NTZ/F0% level, indicating the broader uptrend is still intact. Recent trade signals have all been to the short side, aligning with the current short/intermediate-term weakness. Overall, the market is experiencing a corrective phase within a larger bullish structure. The current environment is characterized by a pullback or retracement against the prevailing long-term uptrend, with key support levels to watch at 23419 and 19274. The next major resistance is at 24824 and 24891, and a break above these could signal a resumption of the long-term uptrend. For now, the short- and intermediate-term outlook remains bearish, while the long-term trend is still bullish.