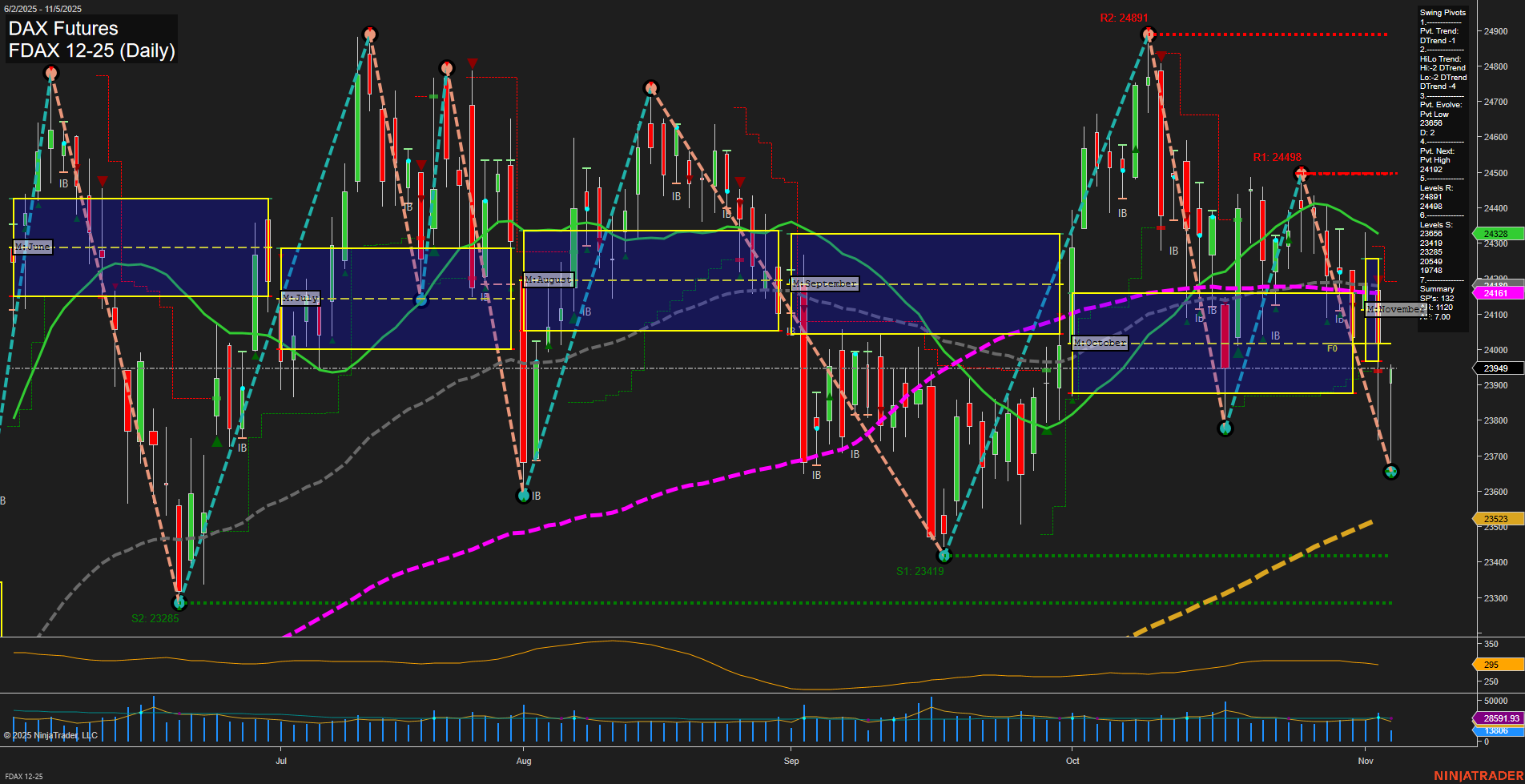

The FDAX daily chart is currently dominated by a short-term and intermediate-term bearish structure, as evidenced by the downward trends in both the weekly and monthly session fib grids (WSFG, MSFG), and confirmed by the swing pivot trend (DTrend) and a series of recent short trade signals. Price is trading below the key NTZ/F0% levels for both the week and month, and all short- and intermediate-term moving averages are trending down, reinforcing the prevailing downside momentum. The most recent swing pivot is a low at 23865, with the next potential reversal at the previous high of 24498, while resistance is stacked above at 24498 and 24891, and support is found at 23419 and 23285. Despite the short- and intermediate-term bearishness, the long-term trend remains up, as shown by the yearly session fib grid and the 200-day moving average, suggesting the broader bull cycle is intact. However, the current environment is characterized by slow momentum and moderate volatility (ATR 230), with volume slightly elevated. The market appears to be in a corrective phase within a larger uptrend, with price action showing lower highs and lower lows, and a possible test of support levels below. Swing traders will note the potential for further downside in the near term, but should remain aware of the underlying long-term bullish structure, which could set the stage for a reversal or bounce once the current correction exhausts.