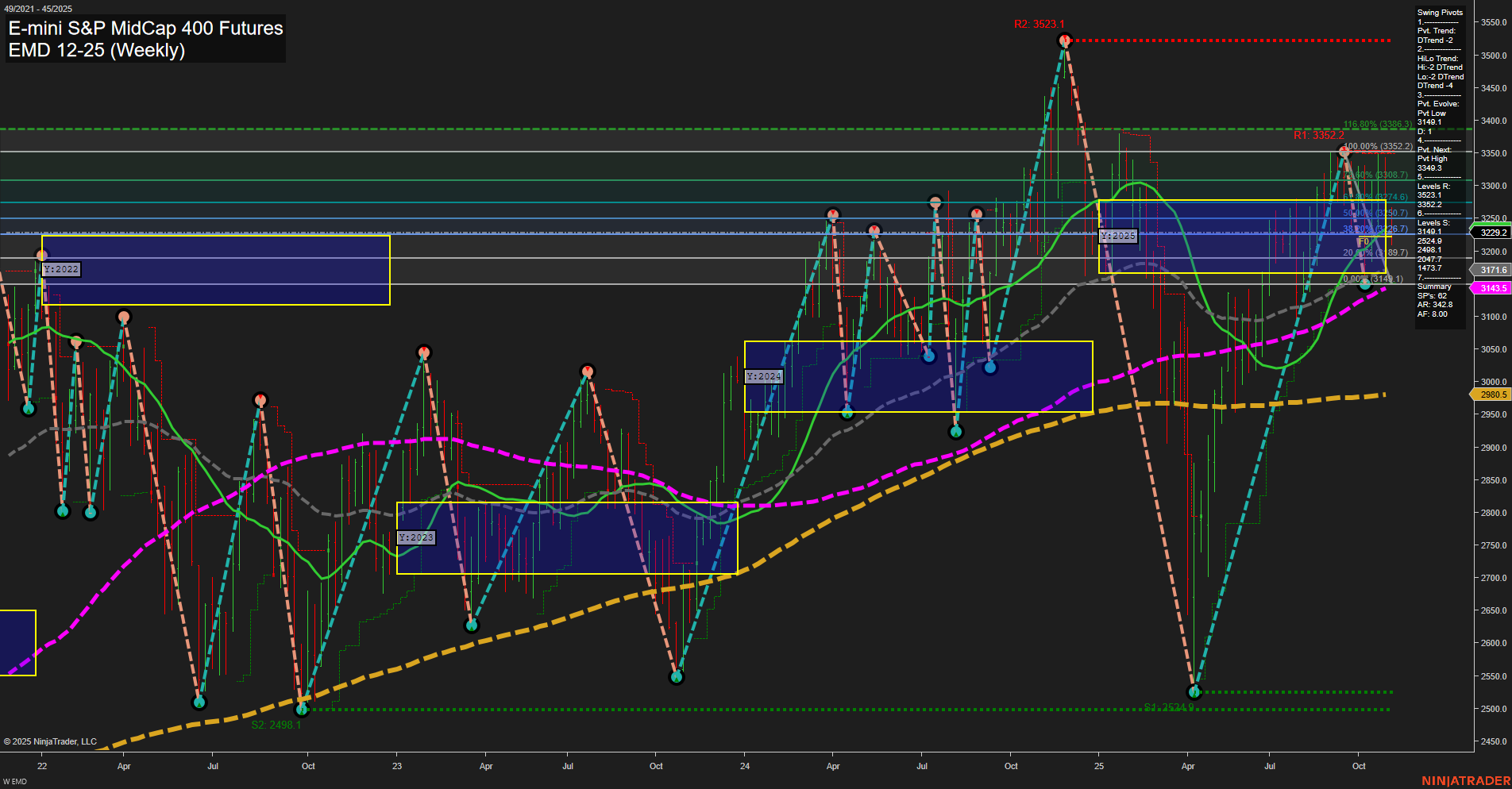

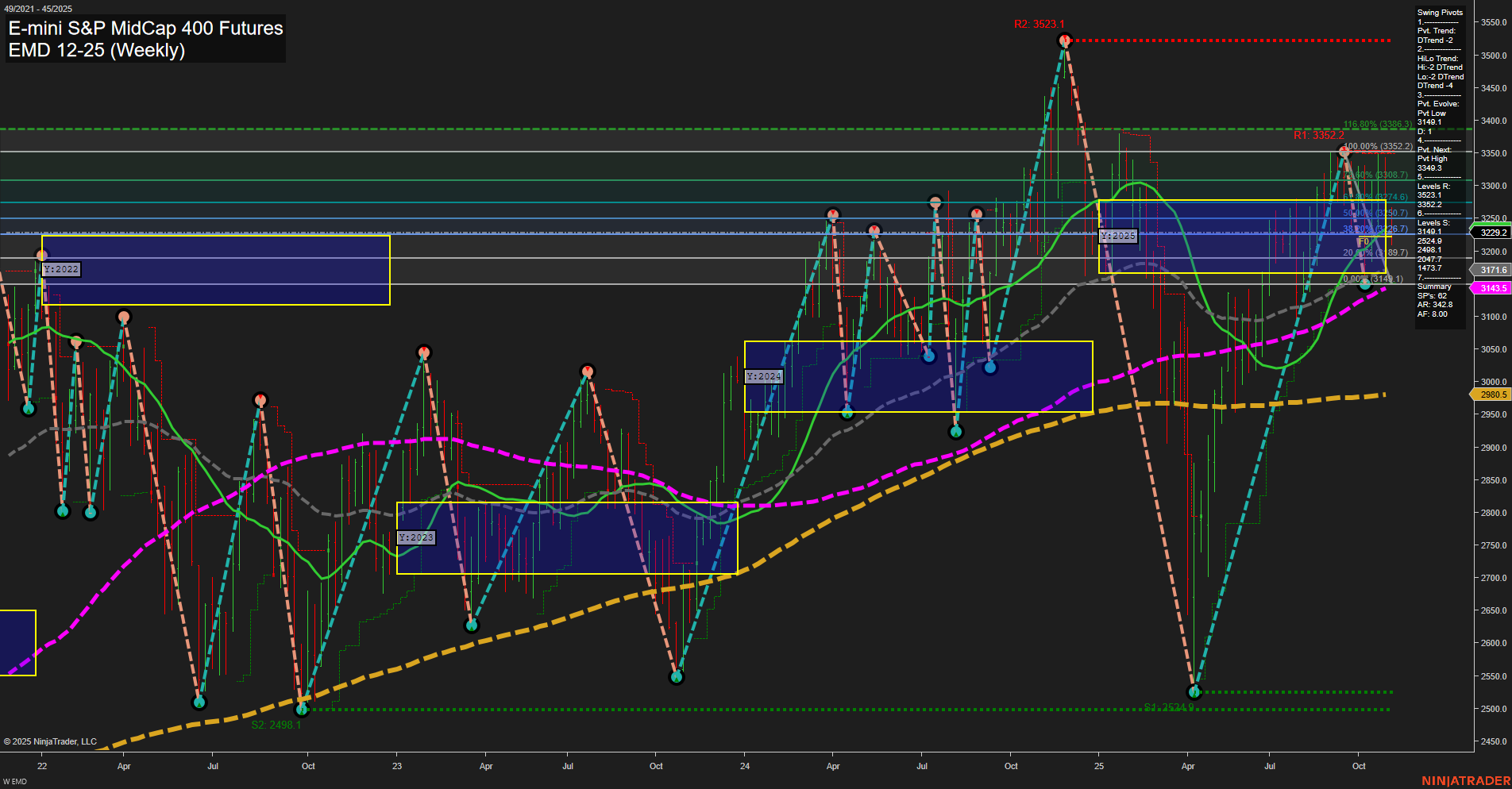

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2025-Nov-05 07:06 CT

Price Action

- Last: 3229.9,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -22%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -24%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 1%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 3140,

- 4. Pvt. Next: Pvt low 3140,

- 5. Levels R: 3523.1, 3352.2, 3349.3,

- 6. Levels S: 3140, 2524.4, 2498.1.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3292.7 Down Trend,

- (Intermediate-Term) 10 Week: 3284.8 Down Trend,

- (Long-Term) 20 Week: 3171.6 Up Trend,

- (Long-Term) 55 Week: 3145.3 Up Trend,

- (Long-Term) 100 Week: 3143.5 Up Trend,

- (Long-Term) 200 Week: 2885.0 Up Trend.

Recent Trade Signals

- 03 Nov 2025: Short EMD 12-25 @ 3234.6 Signals.USAR-WSFG

- 31 Oct 2025: Short EMD 12-25 @ 3244.3 Signals.USAR-MSFG

- 28 Oct 2025: Short EMD 12-25 @ 3300.6 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures weekly chart shows a clear divergence between short/intermediate-term and long-term trends. Price action is currently below both the weekly and monthly session fib grid neutral zones, with slow momentum and medium-sized bars, indicating a lack of strong directional conviction in the short run. Both the short-term and intermediate-term swing pivot trends are down, supported by recent short trade signals and declining 5- and 10-week moving averages. Key resistance levels are clustered above at 3352 and 3523, while immediate support sits at 3140, with much lower levels at 2524 and 2498. Despite this short-term weakness, the long-term trend remains up, as evidenced by price holding above the 20-, 55-, 100-, and 200-week moving averages, all of which are trending higher. This suggests that while the market is experiencing a corrective phase or pullback within a broader uptrend, the underlying long-term structure remains constructive. The current environment is characterized by a retracement or consolidation phase, with the potential for further downside testing of support before any resumption of the primary uptrend.

Chart Analysis ATS AI Generated: 2025-11-05 07:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.