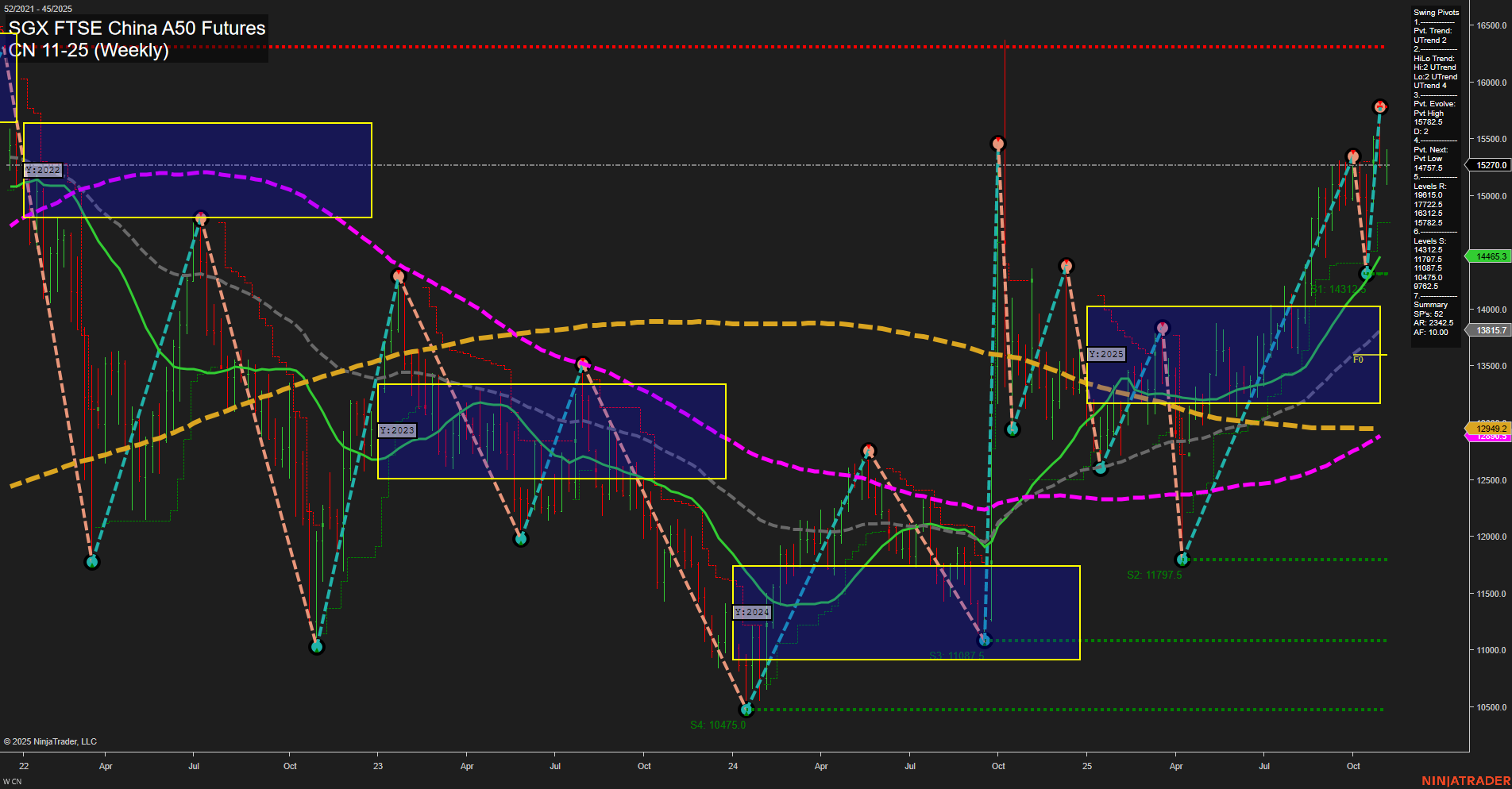

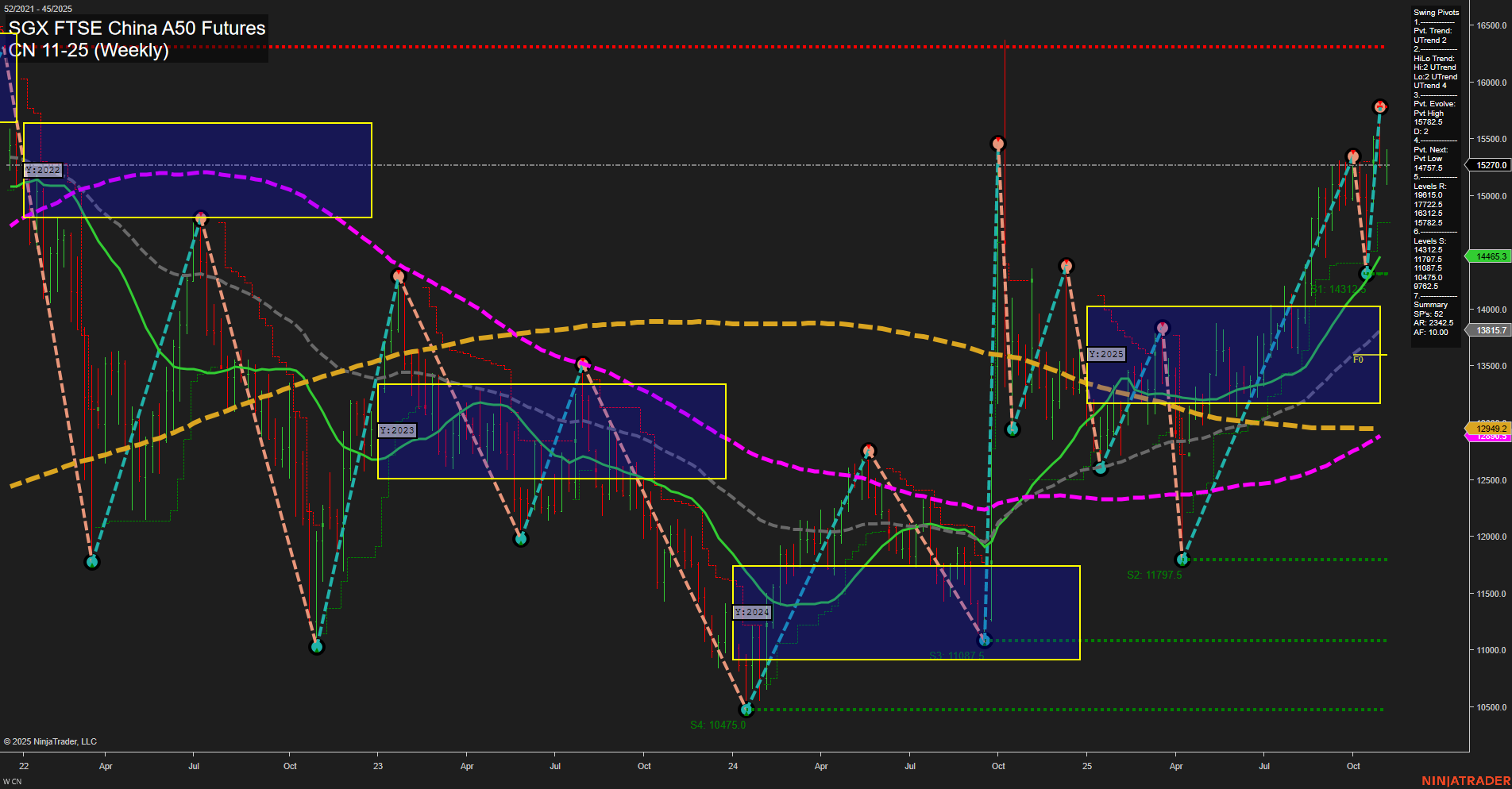

CN SGX FTSE China A50 Futures Weekly Chart Analysis: 2025-Nov-05 07:05 CT

Price Action

- Last: 15,270,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 15,275,

- 4. Pvt. Next: Pvt low 14,317.5,

- 5. Levels R: 16,500, 15,475.5, 15,275,

- 6. Levels S: 14,317.5, 11,977.5, 10,475.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 14,865.5 Up Trend,

- (Intermediate-Term) 10 Week: 14,311.5 Up Trend,

- (Long-Term) 20 Week: 13,817.5 Up Trend,

- (Long-Term) 55 Week: 12,949.2 Up Trend,

- (Long-Term) 100 Week: 12,004.9 Down Trend,

- (Long-Term) 200 Week: 13,232.5 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The CN SGX FTSE China A50 Futures weekly chart shows a strong bullish momentum in the short and intermediate term, with price recently making a significant swing high at 15,275. The large bars and fast momentum indicate heightened volatility and strong directional conviction. Both the 5-week and 10-week moving averages are trending up, confirming the recent upward move, and the 20-week and 55-week long-term benchmarks have also turned upward, supporting the bullish case. However, the 100-week and 200-week moving averages remain in a downtrend, suggesting that the longer-term structure is still in transition and not fully supportive of a sustained bull market yet. Key resistance levels are at 15,475.5 and 16,500, while support is found at 14,317.5 and lower at 11,977.5. The overall technical structure points to a market in the midst of a strong recovery phase, with the potential for further upside if resistance levels are breached, but with the need to monitor for possible pullbacks or consolidations as the longer-term trend base is still forming.

Chart Analysis ATS AI Generated: 2025-11-05 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.