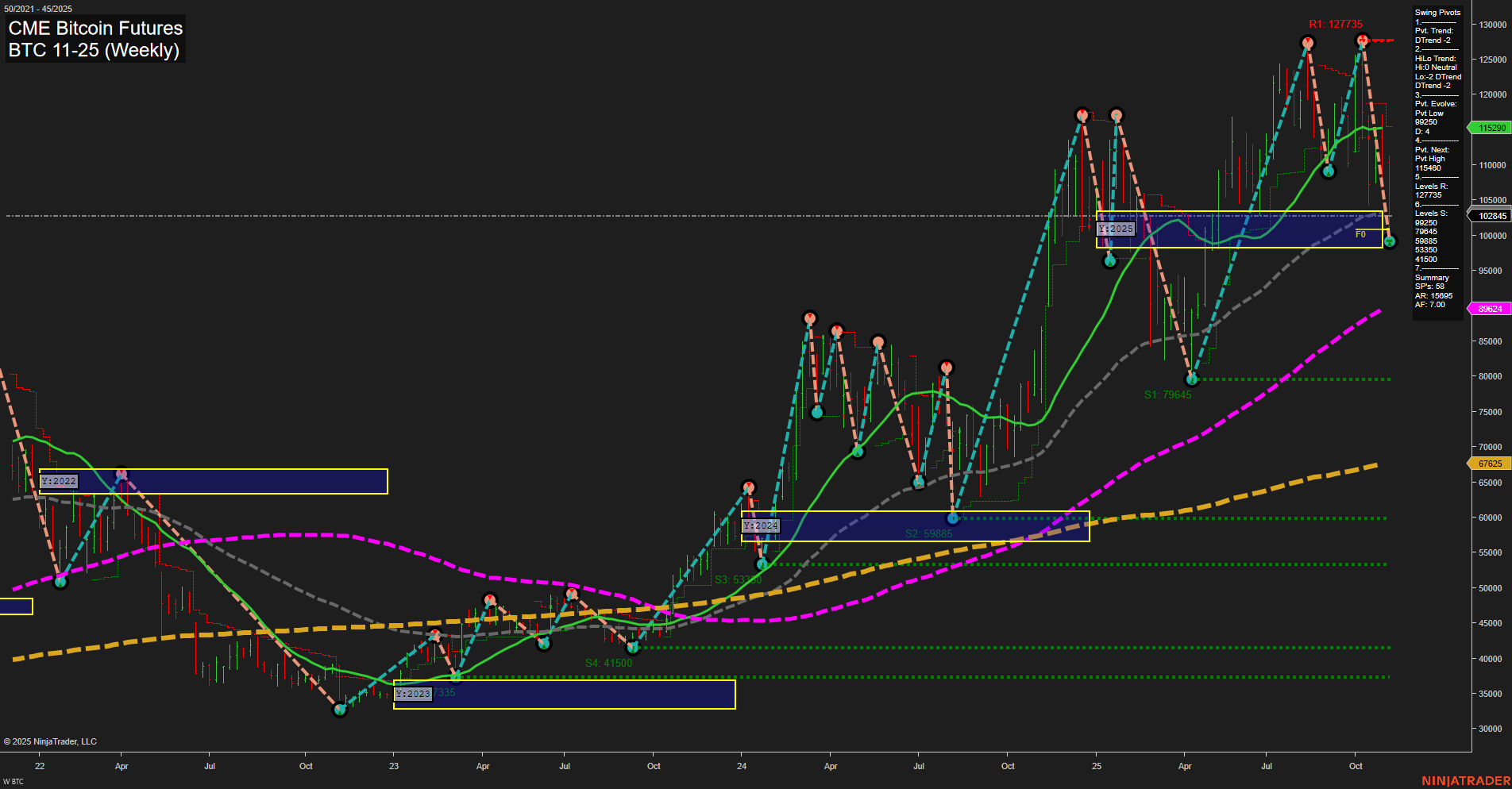

BTC CME Bitcoin Futures are experiencing a notable pullback on the weekly timeframe, with large, fast-moving bars indicating heightened volatility and momentum to the downside. Both the Weekly and Monthly Session Fib Grids (WSFG, MSFG) show price well below their respective NTZ/F0% levels, confirming a short- and intermediate-term downtrend. The swing pivot structure has shifted to a short-term downtrend, with the most recent pivot low at 115240 and the next resistance at the previous high of 127735. Intermediate-term trend is neutral, suggesting some indecision or potential for consolidation after the recent selloff. Benchmark moving averages reinforce this mixed outlook: short- and intermediate-term MAs (5 and 10 week) are trending down, while all long-term MAs (20, 55, 100, 200 week) remain in strong uptrends, reflecting the underlying bullish structure for 2025. The yearly session grid trend is still up, with price holding above the yearly NTZ/F0% level, suggesting that the broader bull market remains intact despite the current correction. Recent trade signals have triggered short entries, aligning with the prevailing short- and intermediate-term bearish momentum. Key support levels to watch are 79645 and 59886, while resistance is stacked at 127735 and 115640. Overall, the market is in a corrective phase within a larger uptrend, with the potential for further downside in the short term before a possible resumption of the long-term bullish trend.