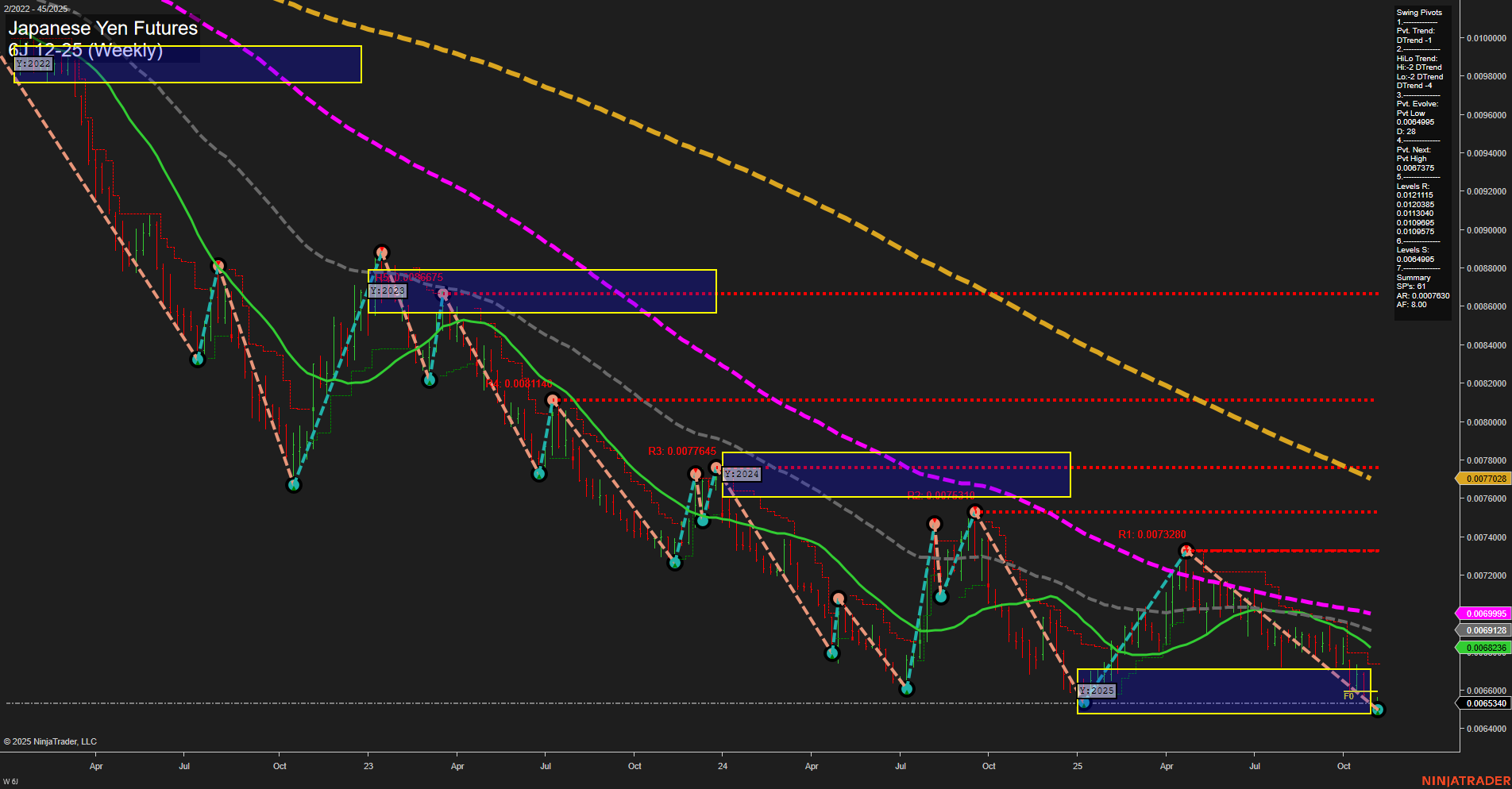

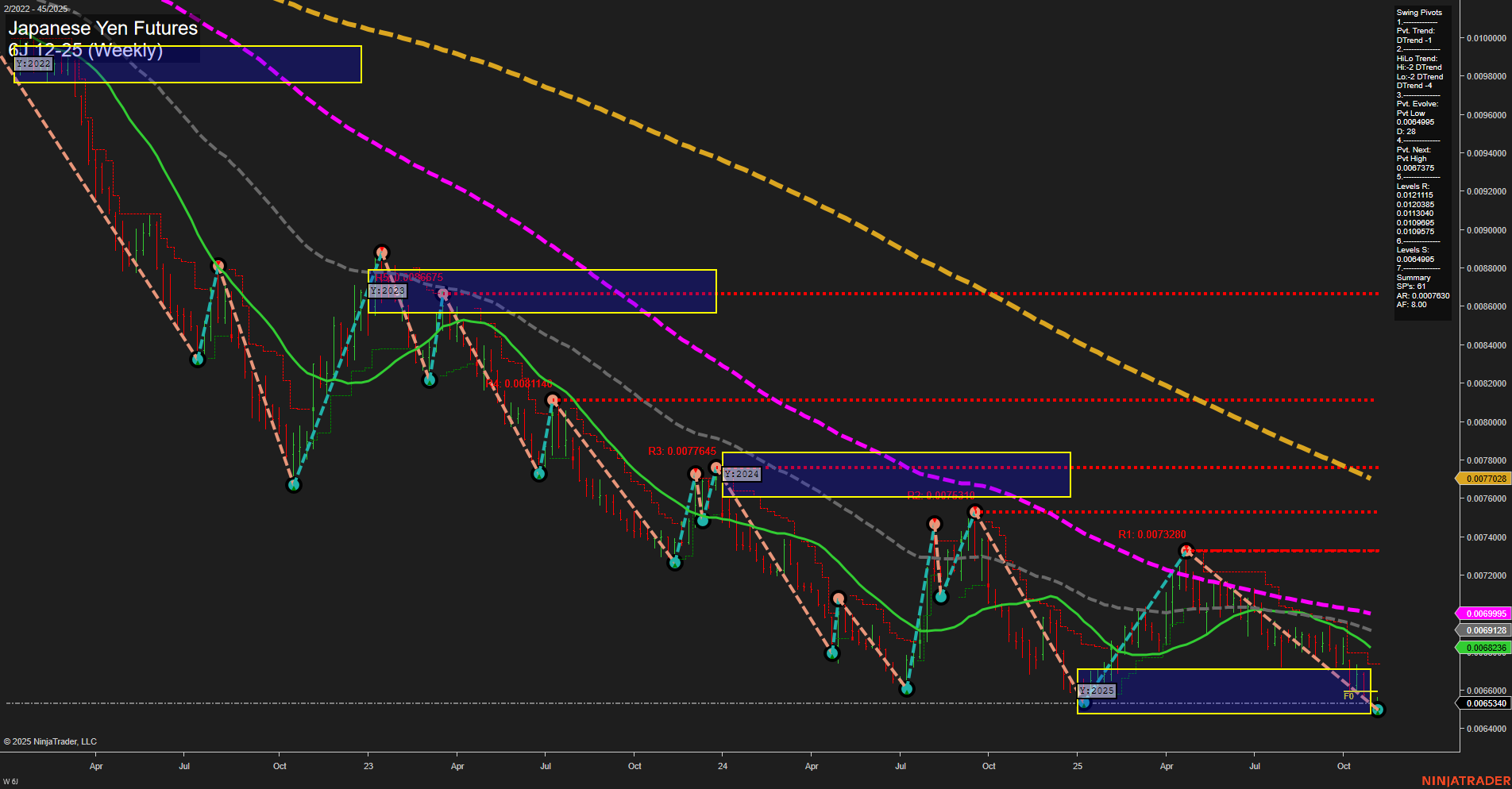

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Nov-05 07:02 CT

Price Action

- Last: 0.0065340,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -126%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.0064095,

- 4. Pvt. Next: Pvt High 0.0067375,

- 5. Levels R: 0.0122115, 0.0120345, 0.0113048, 0.0101875, 0.0100985, 0.0077645, 0.0073280,

- 6. Levels S: 0.0064095.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0069236 Down Trend,

- (Intermediate-Term) 10 Week: 0.0069128 Down Trend,

- (Long-Term) 20 Week: 0.0069955 Down Trend,

- (Long-Term) 55 Week: 0.0077508 Down Trend,

- (Long-Term) 100 Week: 0.0077028 Down Trend,

- (Long-Term) 200 Week: 0.0081100 Down Trend.

Recent Trade Signals

- 05 Nov 2025: Long 6J 12-25 @ 0.0065385 Signals.USAR-WSFG

- 29 Oct 2025: Short 6J 12-25 @ 0.006579 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6J Japanese Yen Futures weekly chart shows a market that remains under significant long-term and intermediate-term pressure, with all major moving averages trending down and price trading below key yearly and monthly session fib grid levels. The short-term WSFG trend has turned up, and a recent long signal has emerged, but this is counter to the prevailing downtrend in both the swing pivots and the benchmarks. Price is currently near a major swing low support at 0.0064095, with resistance levels well above current price, indicating a wide range for potential retracement or bounce. The overall structure suggests the market is in a prolonged downtrend, with short-term attempts at reversal or consolidation, but no clear evidence yet of a sustained trend change. Volatility appears moderate, and the market is testing key support, which could lead to either a technical bounce or further breakdown if support fails.

Chart Analysis ATS AI Generated: 2025-11-05 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.