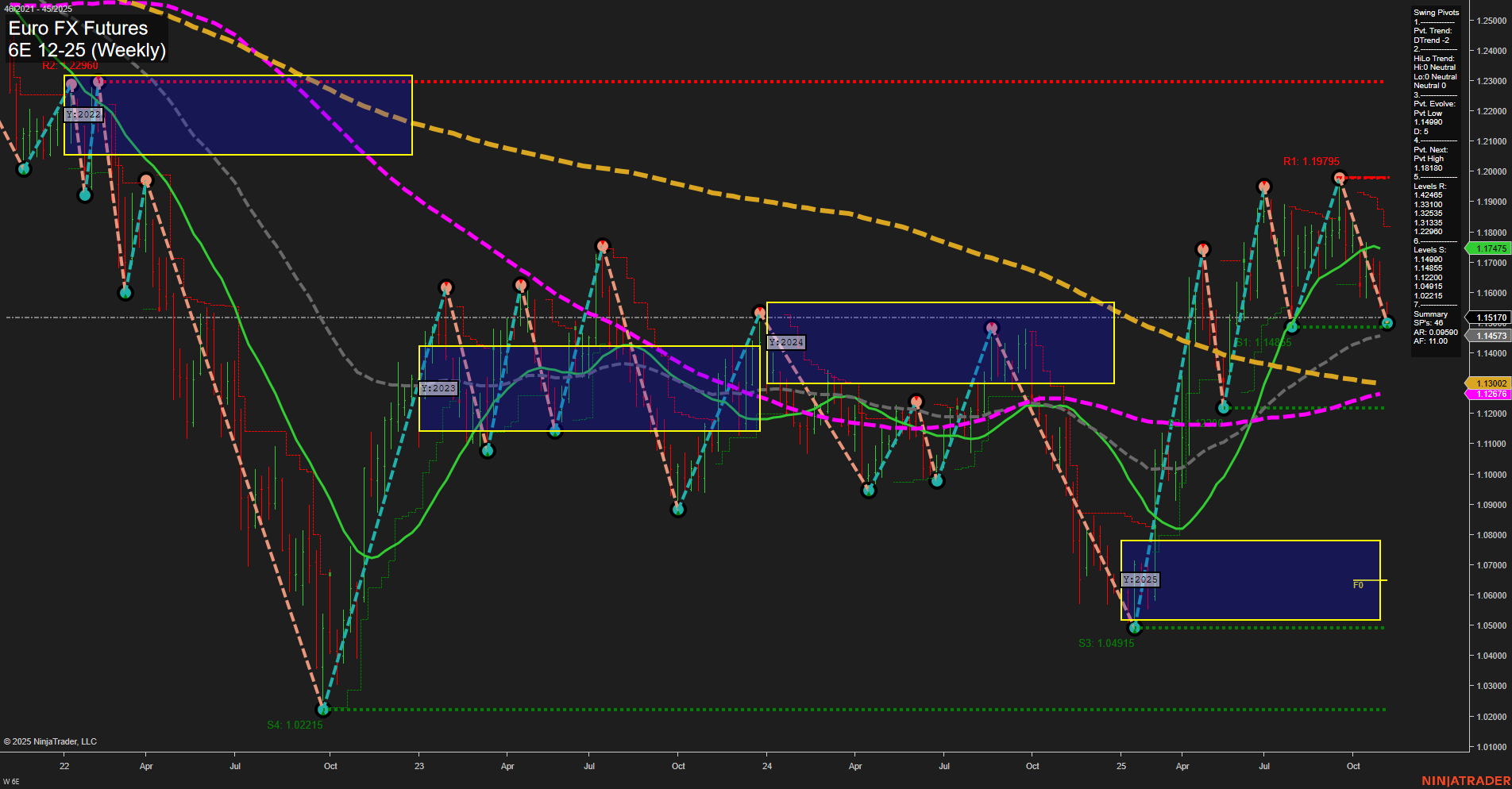

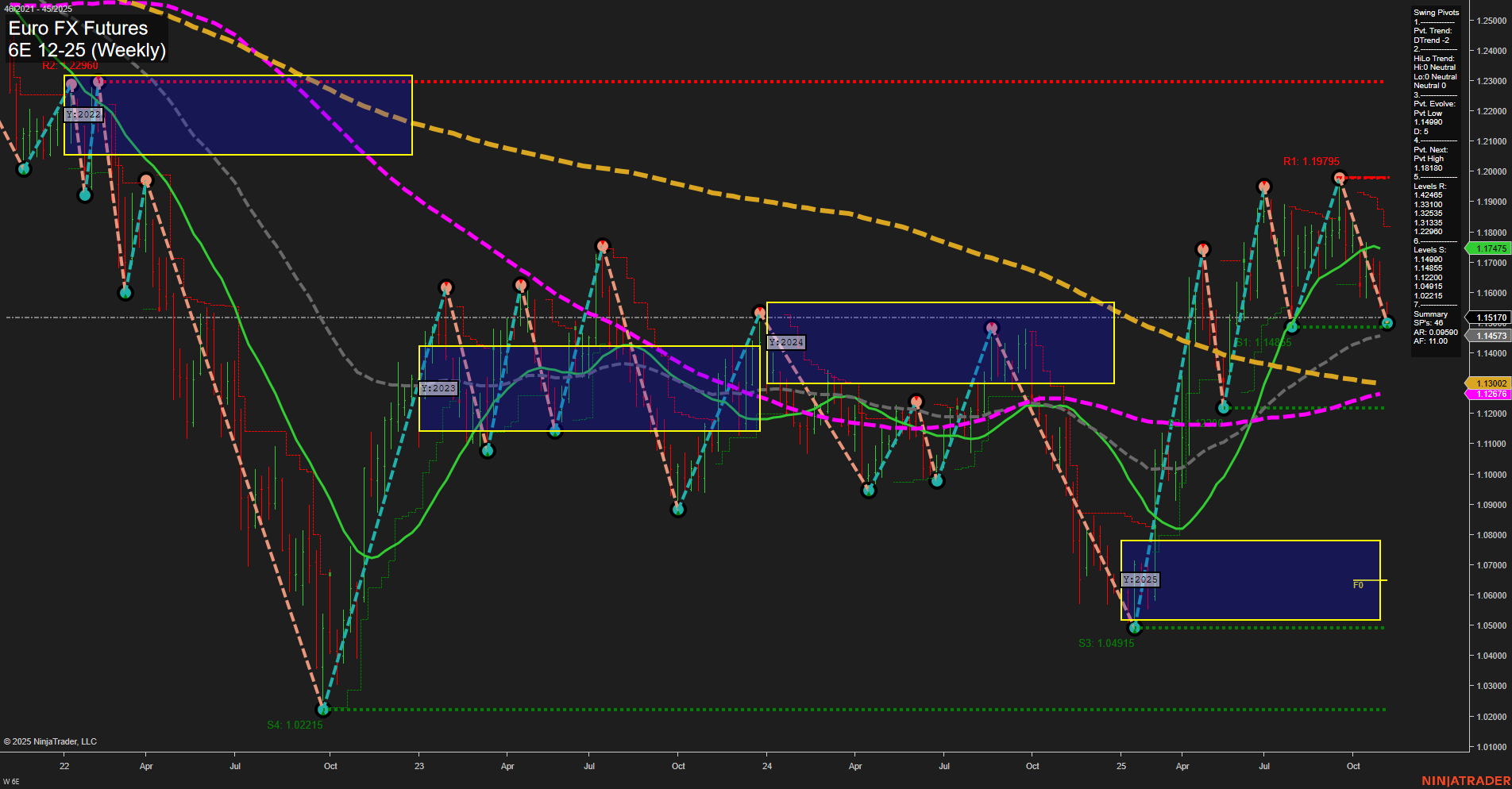

6E Euro FX Futures Weekly Chart Analysis: 2025-Nov-05 07:02 CT

Price Action

- Last: 1.15170,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -31%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -79%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 68%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.15170,

- 4. Pvt. Next: Pvt high 1.19795,

- 5. Levels R: 1.19795, 1.18310, 1.16315, 1.15405,

- 6. Levels S: 1.11405, 1.04915, 1.02215.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.15473 Down Trend,

- (Intermediate-Term) 10 Week: 1.14573 Down Trend,

- (Long-Term) 20 Week: 1.17745 Up Trend,

- (Long-Term) 55 Week: 1.13026 Up Trend,

- (Long-Term) 100 Week: 1.13276 Down Trend,

- (Long-Term) 200 Week: 1.23060 Down Trend.

Recent Trade Signals

- 04 Nov 2025: Short 6E 12-25 @ 1.15405 Signals.USAR-WSFG

- 29 Oct 2025: Short 6E 12-25 @ 1.16315 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a clear short-term and intermediate-term bearish structure, with price action below both the weekly and monthly session fib grid NTZs and recent swing pivots confirming a downward trend. Momentum is slow, and the last two trade signals have triggered shorts, reinforcing the prevailing downside bias. Both the 5- and 10-week moving averages are trending down, supporting the bearish outlook in the near to intermediate term. However, the yearly session fib grid remains in an uptrend, and the 20- and 55-week moving averages are still up, suggesting that the longer-term structure is more neutral, with some underlying support. Key resistance levels are clustered above at 1.15405, 1.16315, 1.18310, and 1.19795, while support is found at 1.11405, 1.04915, and 1.02215. The market appears to be in a corrective phase within a broader consolidation, with the potential for further downside tests before any significant reversal or continuation of the longer-term trend.

Chart Analysis ATS AI Generated: 2025-11-05 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.