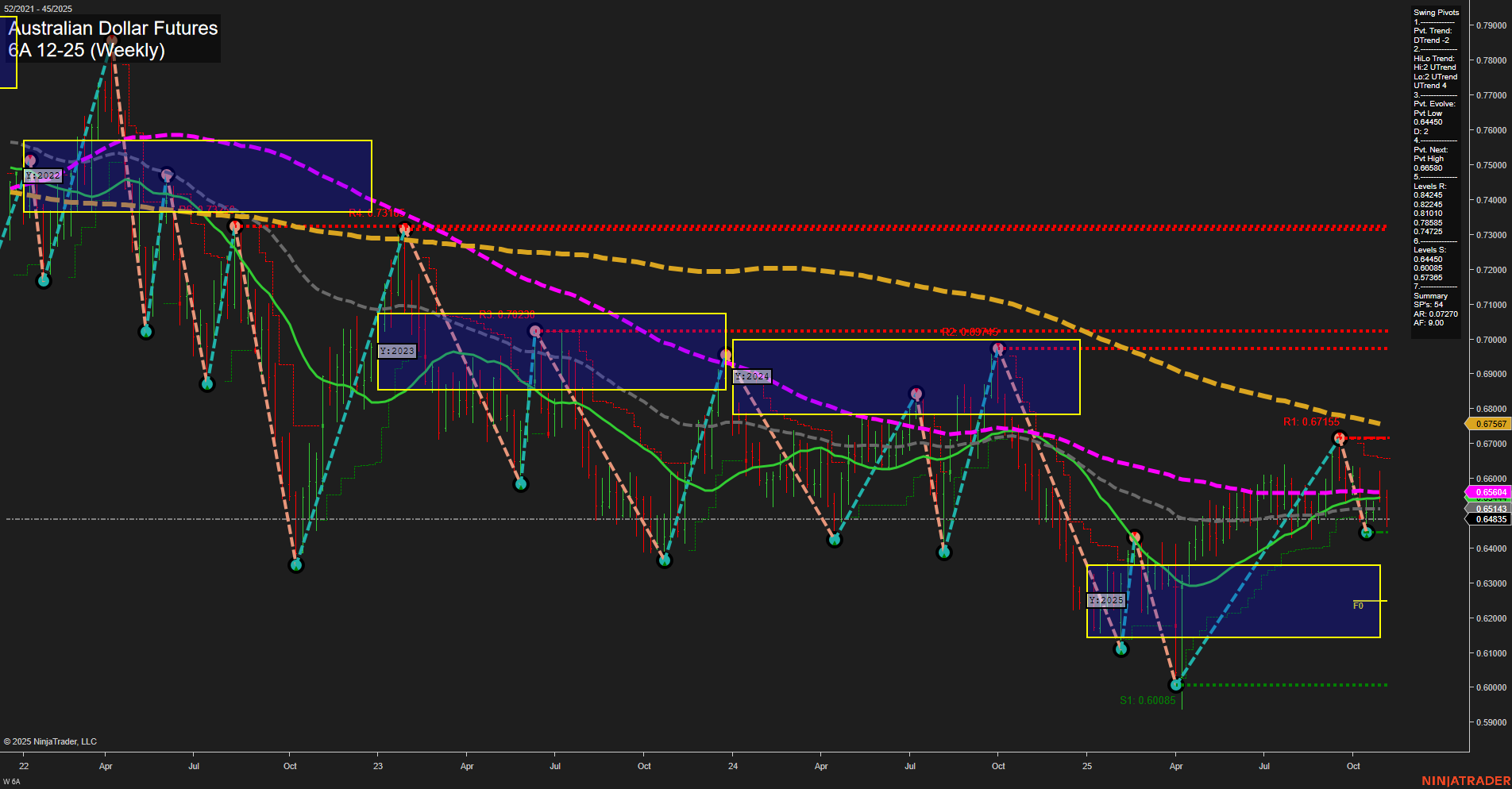

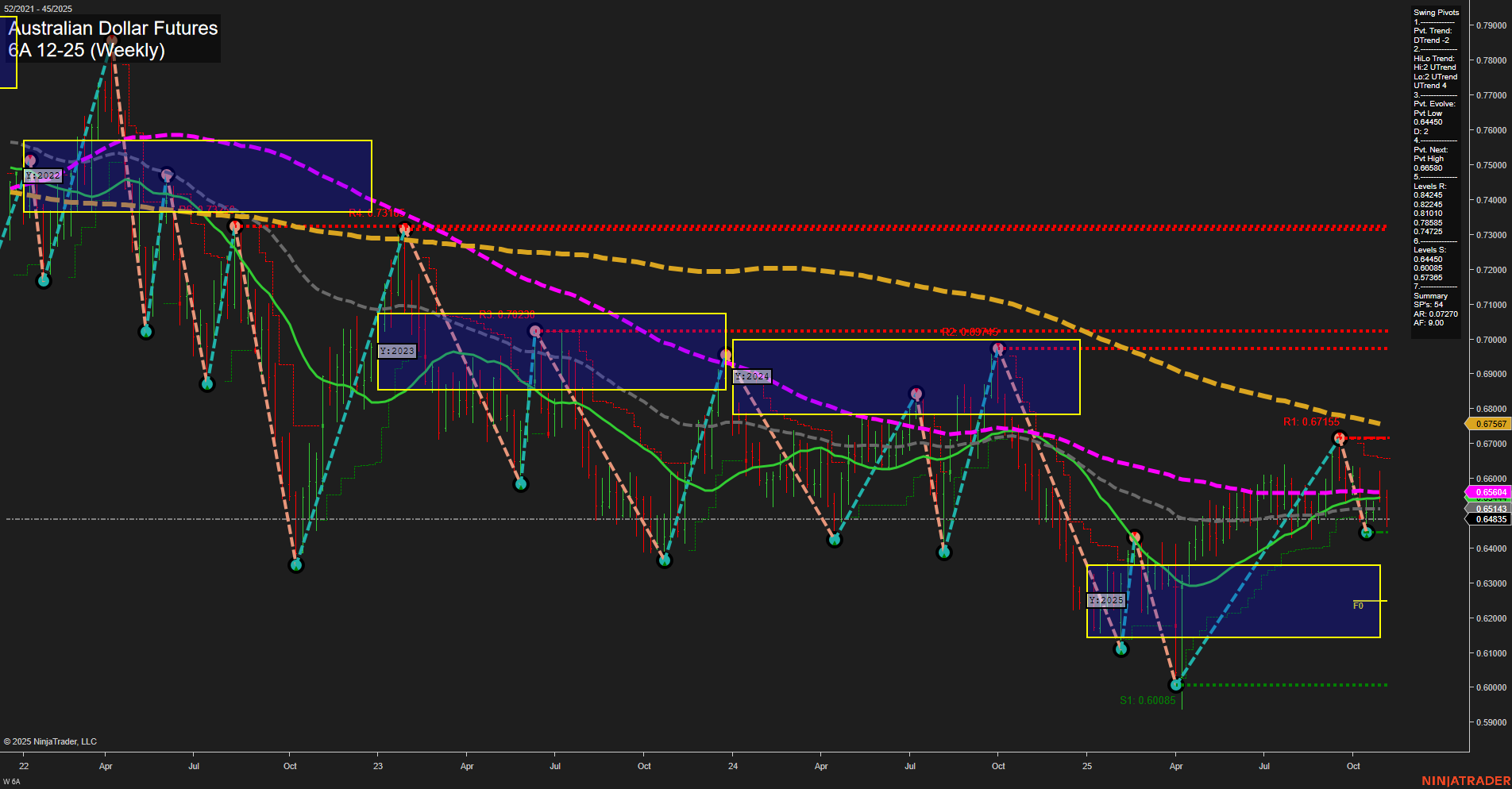

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Nov-05 07:00 CT

Price Action

- Last: 0.64945,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.64315,

- 4. Pvt. Next: Pvt high 0.67155,

- 5. Levels R: 0.67155, 0.68425, 0.70805, 0.72845, 0.74285,

- 6. Levels S: 0.64315, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65504 Down Trend,

- (Intermediate-Term) 10 Week: 0.65413 Down Trend,

- (Long-Term) 20 Week: 0.65554 Down Trend,

- (Long-Term) 55 Week: 0.66504 Down Trend,

- (Long-Term) 100 Week: 0.68425 Down Trend,

- (Long-Term) 200 Week: 0.70805 Down Trend.

Recent Trade Signals

- 05 Nov 2025: Short 6A 12-25 @ 0.64945 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bearish.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart is showing a clear bearish structure across all timeframes. Price action is currently at 0.64945, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction but a persistent downward bias. All major moving averages (5, 10, 20, 55, 100, and 200 week) are trending down, reinforcing the prevailing bearish sentiment. Both short-term and intermediate-term swing pivot trends are down, with the most recent pivot low at 0.64315 and the next resistance at 0.67155. The price is trading below all key resistance levels and above the major support at 0.64315, with a deeper support at 0.60085. The neutral stance of the session fib grids (WSFG, MSFG, YSFG) suggests a lack of strong counter-trend forces or consolidation, but the recent short trade signal aligns with the dominant downtrend. Overall, the market is in a sustained downtrend, with no immediate signs of reversal or significant bullish momentum, and is currently in a phase of trend continuation rather than a corrective bounce or consolidation.

Chart Analysis ATS AI Generated: 2025-11-05 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.