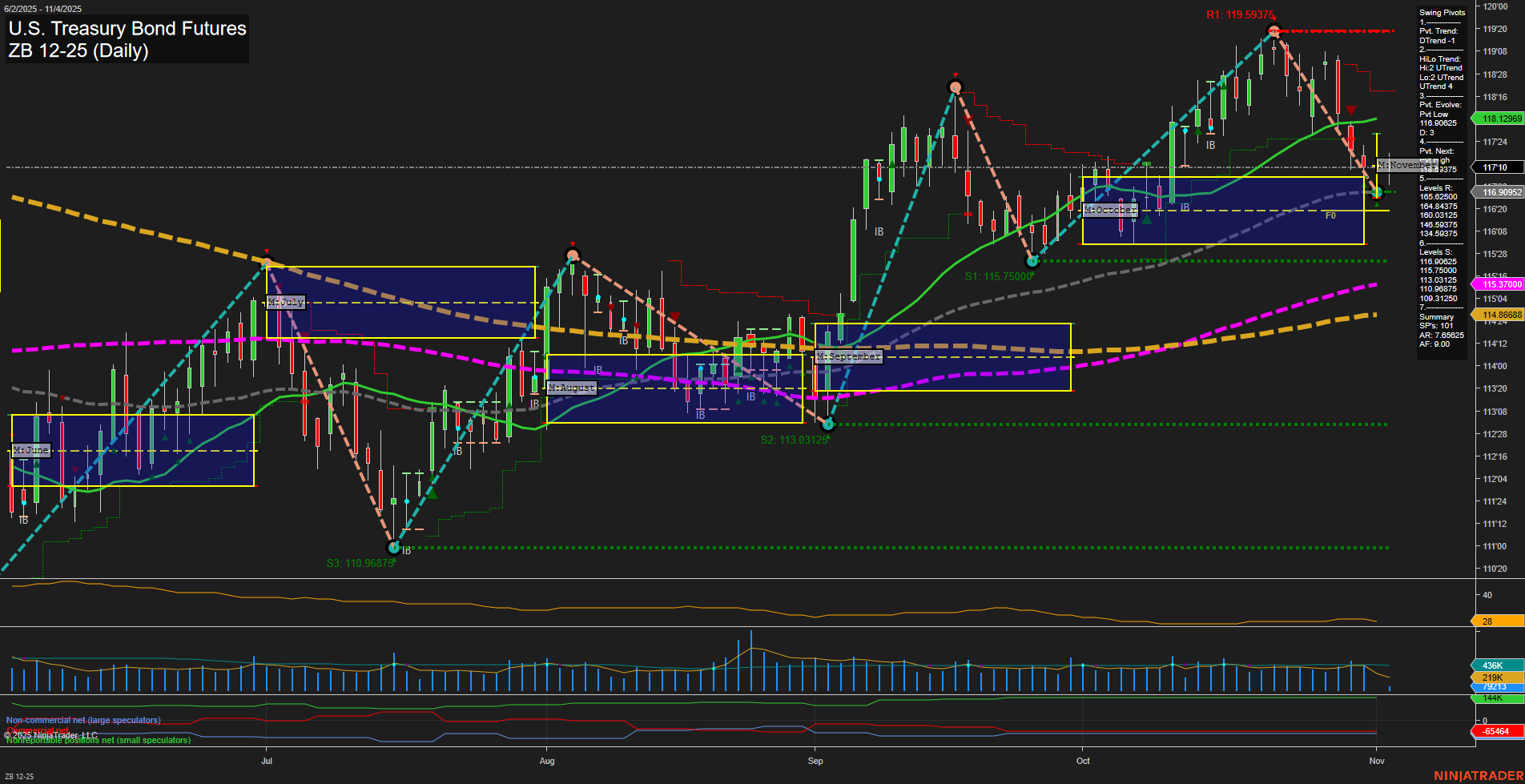

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in a corrective phase after a recent swing high. Price action shows medium-sized bars with slow momentum, indicating a lack of strong directional conviction. Both the short-term and intermediate-term swing pivot trends are down, with the most recent pivot low at 117'01 and the next potential reversal at the pivot high of 118'29. Resistance is layered above at 119'59 and 118'29, while support is found at 115'75 and lower at 113'03 and 110'31. All short-term and intermediate-term moving averages (5, 10, and 20 day) are trending down, reinforcing the bearish tone in the near term. However, the longer-term benchmarks (55, 100, and 200 day) remain in uptrends, suggesting that the broader structure is still neutral and that the current move may be a retracement within a larger consolidation or base-building phase. ATR and volume metrics indicate moderate volatility and steady participation, but not at extremes. The market is consolidating near the lower end of the recent range, with price action inside the Monthly Session Fib Grid's neutral zone, and no clear breakout or breakdown from key levels. This setup is typical of a market digesting prior gains, with potential for either a continuation lower if support fails, or a reversal if buyers step in at key support. Overall, the technical landscape is short- and intermediate-term bearish, but the long-term structure remains neutral, awaiting a decisive move to establish a new trend direction.