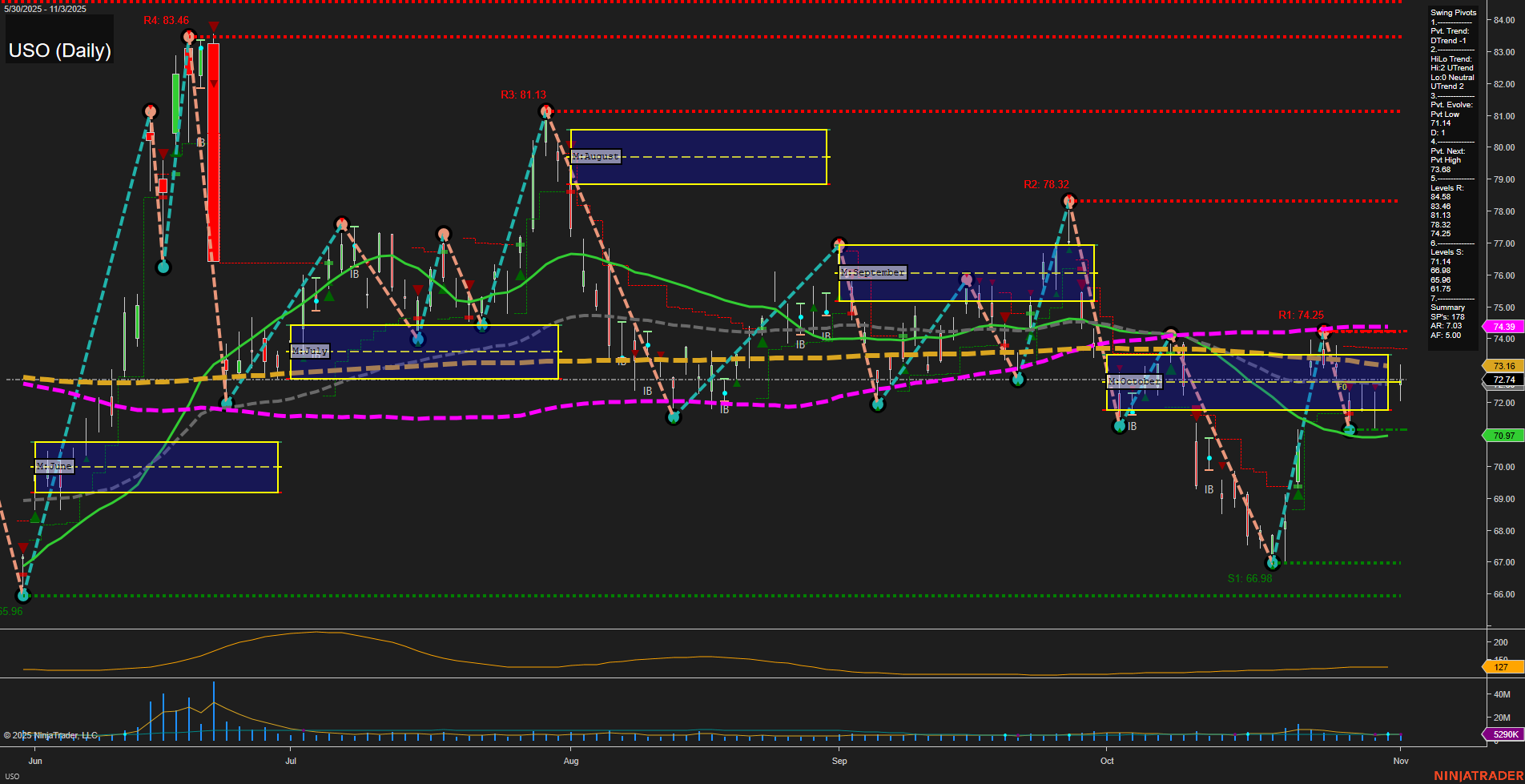

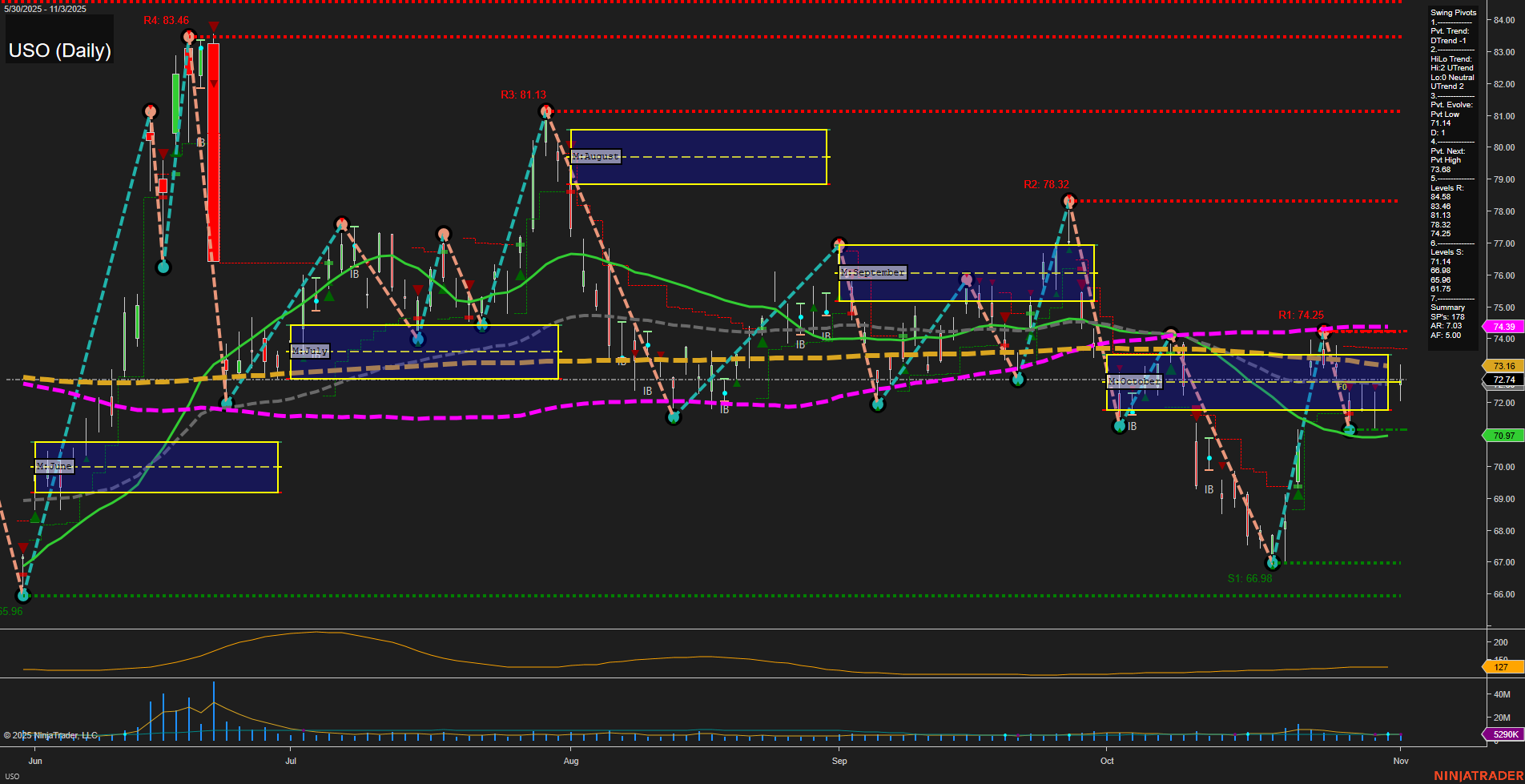

USO United States Oil Fund LP Daily Chart Analysis: 2025-Nov-04 07:21 CT

Price Action

- Last: 74.39,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 71.11,

- 4. Pvt. Next: Pvt high 73.68,

- 5. Levels R: 83.46, 81.13, 78.32, 74.25,

- 6. Levels S: 66.98, 65.96.

Daily Benchmarks

- (Short-Term) 5 Day: 73.16 Down Trend,

- (Short-Term) 10 Day: 72.74 Down Trend,

- (Intermediate-Term) 20 Day: 70.97 Up Trend,

- (Intermediate-Term) 55 Day: 74.44 Down Trend,

- (Long-Term) 100 Day: 75.00 Down Trend,

- (Long-Term) 200 Day: 74.00 Down Trend.

Additional Metrics

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

USO is currently trading in a consolidation phase, with price action showing medium-sized bars and average momentum. The short-term swing pivot trend is down, but the intermediate-term HiLo trend remains up, indicating a mixed environment. Price is hovering near the 74.39 level, just below several key resistance levels (notably 74.25 and 78.32), while support is well-defined lower at 66.98 and 65.96. All major session fib grid trends (weekly, monthly, yearly) are neutral, and the moving averages are mixed: short-term and long-term benchmarks are in downtrends, while the 20-day intermediate-term MA is in an uptrend. ATR and volume metrics suggest moderate volatility and participation. Overall, the chart reflects a market in transition, with no clear directional bias, and a tendency toward range-bound or choppy trading as the market digests recent moves and awaits a new catalyst.

Chart Analysis ATS AI Generated: 2025-11-04 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.