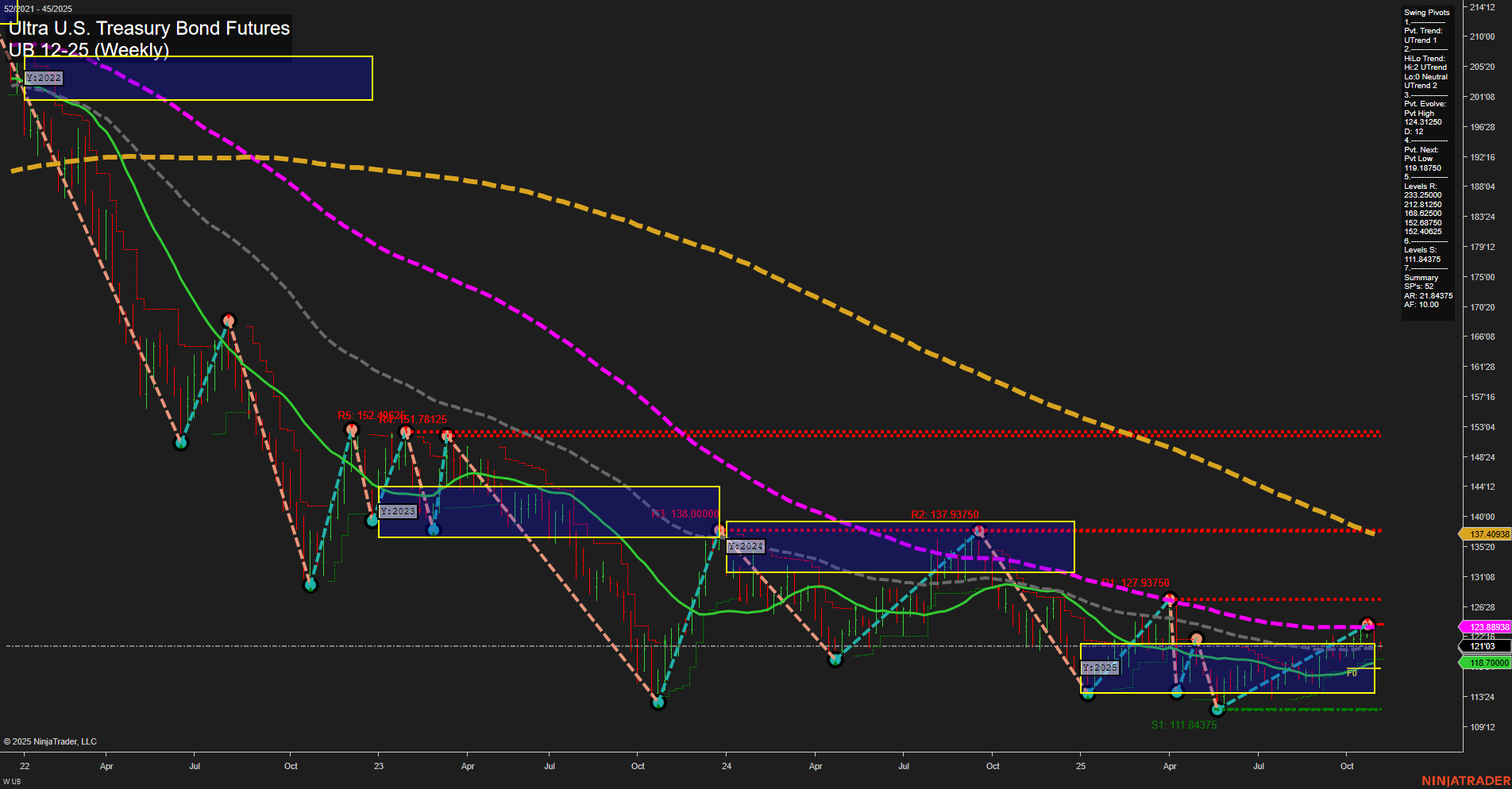

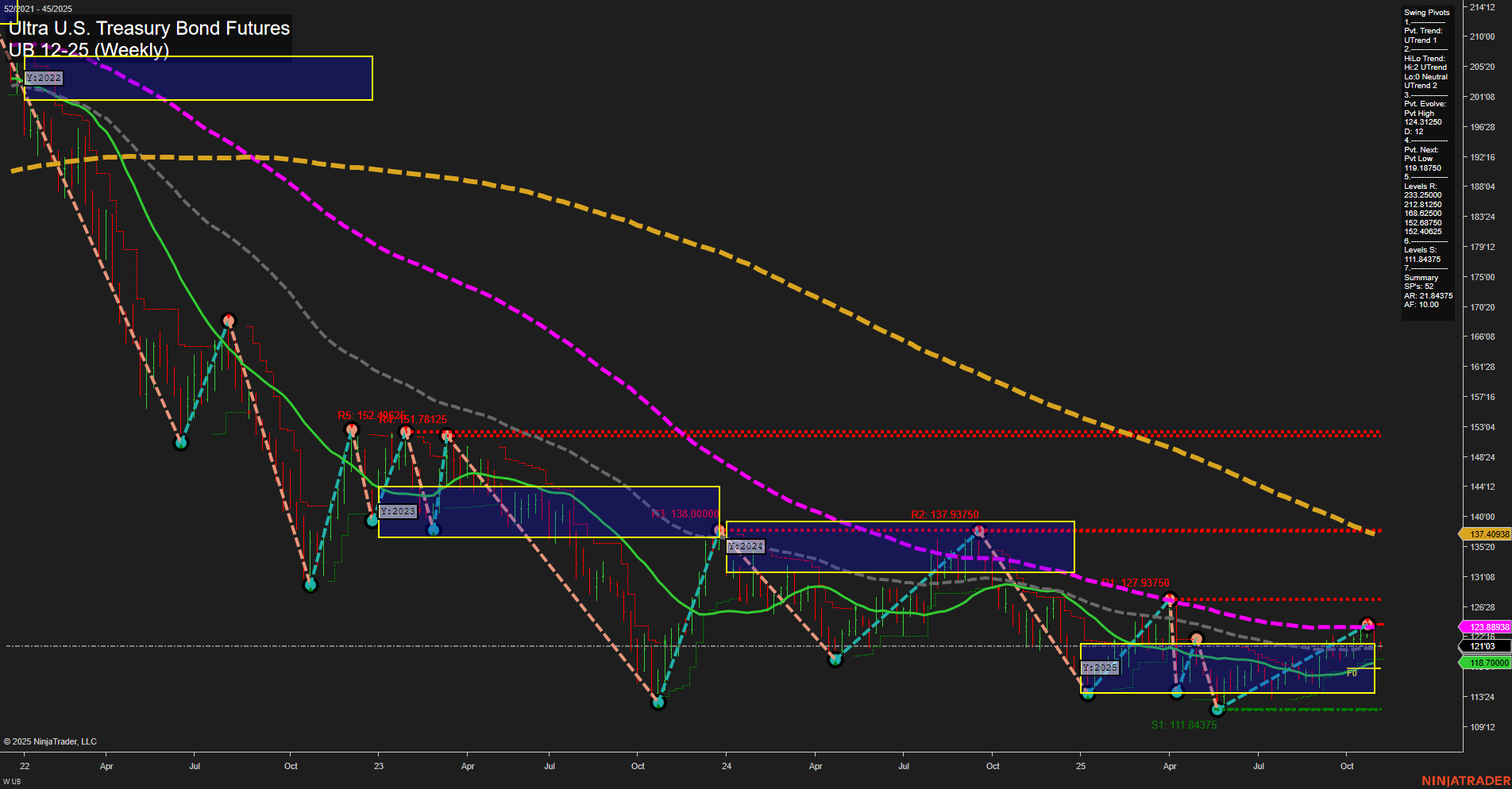

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Nov-04 07:21 CT

Price Action

- Last: 121'03,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -20%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 19%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 9%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 124'13.25,

- 4. Pvt. Next: Pvt low 119'18.75,

- 5. Levels R: 152'48.25, 151'78.125, 138'00, 137'93.75, 123'89.375,

- 6. Levels S: 121'03, 118'70, 111'84.375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 121'03 Up Trend,

- (Intermediate-Term) 10 Week: 121'03 Up Trend,

- (Long-Term) 20 Week: 123'89.375 Down Trend,

- (Long-Term) 55 Week: 121'03 Down Trend,

- (Long-Term) 100 Week: 137'93.75 Down Trend,

- (Long-Term) 200 Week: 137'40.938 Down Trend.

Recent Trade Signals

- 04 Nov 2025: Short UB 12-25 @ 121.125 Signals.USAR-WSFG

- 31 Oct 2025: Short UB 12-25 @ 121.375 Signals.USAR.TR720

- 29 Oct 2025: Short UB 12-25 @ 122.46875 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a complex interplay of trends across timeframes. Short-term price action is under pressure, with the WSFG indicating a downward trend and recent short signals confirming a bearish bias. However, both the swing pivot and HiLo trends have shifted to an uptrend, suggesting a possible countertrend rally or a period of consolidation after a prolonged decline. Intermediate-term metrics, including the MSFG and moving averages, are turning bullish, hinting at a potential recovery or at least a stabilization phase. Long-term indicators remain bearish, with all major moving averages trending down and price well below key resistance levels. The market is currently trading near support, with significant resistance overhead, indicating that any rallies may face strong headwinds. Overall, the chart reflects a market in transition, with short-term weakness, intermediate-term strength, and persistent long-term bearishness, typical of a market attempting to form a base after an extended downtrend.

Chart Analysis ATS AI Generated: 2025-11-04 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.