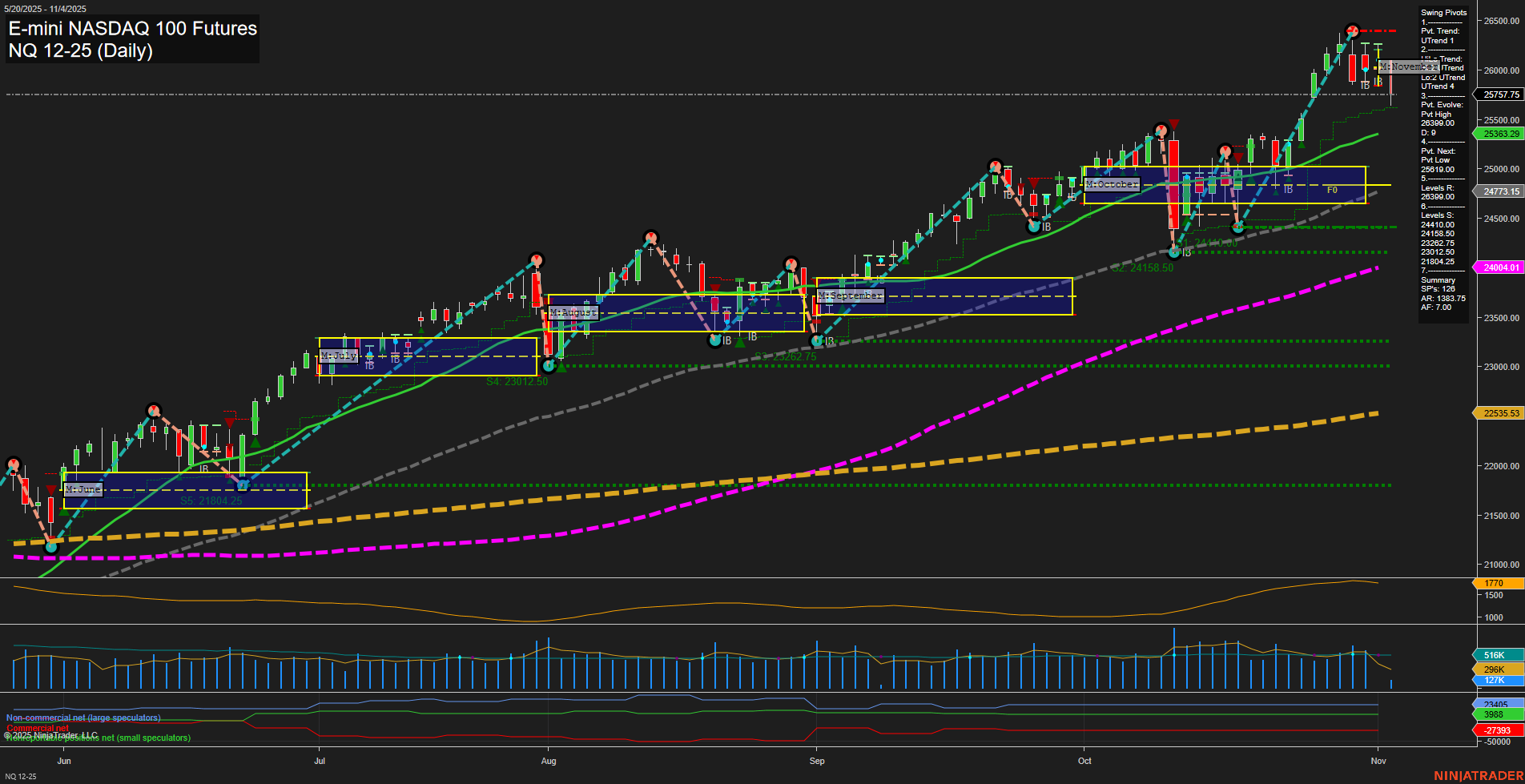

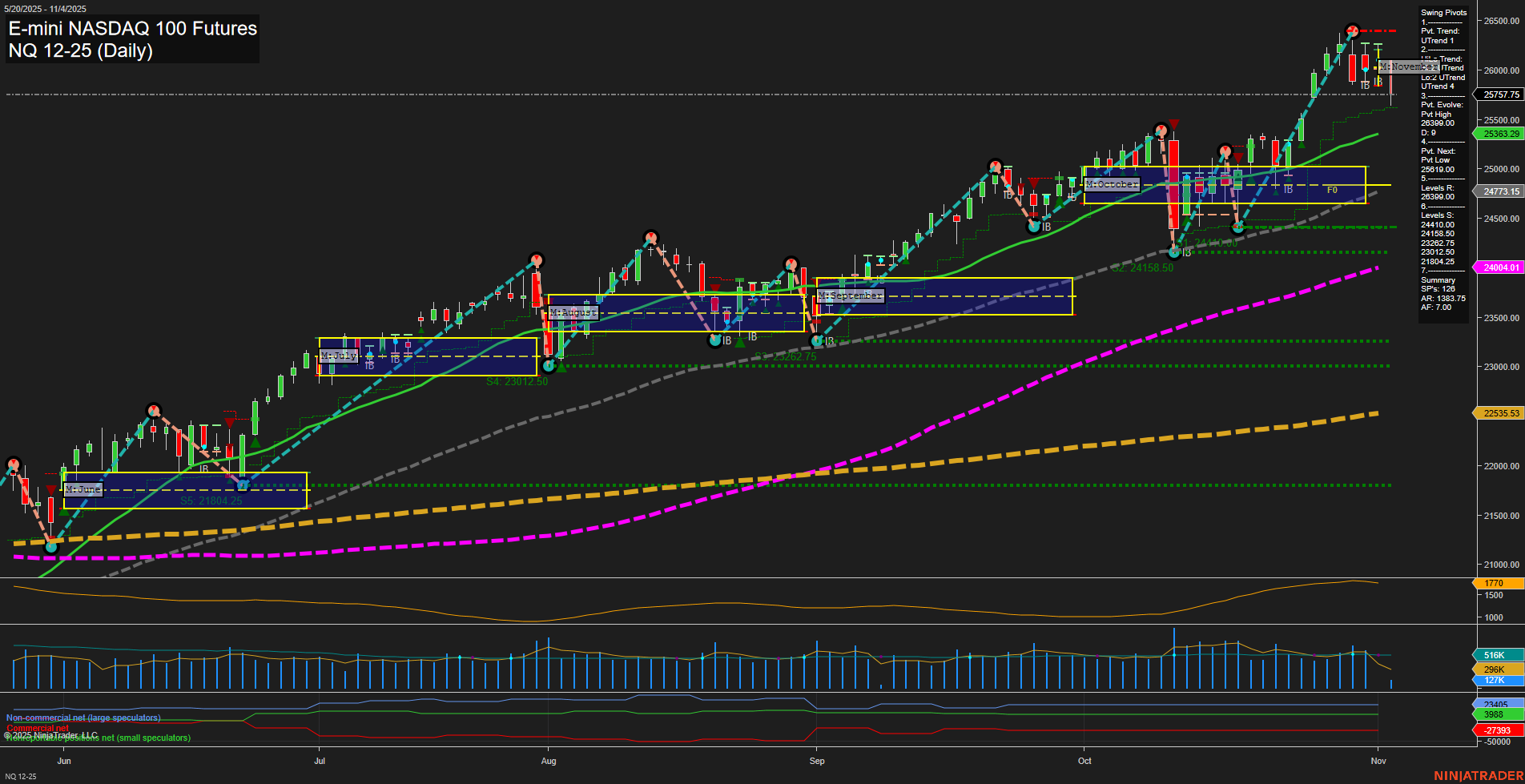

NQ E-mini NASDAQ 100 Futures Daily Chart Analysis: 2025-Nov-04 07:14 CT

Price Action

- Last: 25757.75,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: -30%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 71%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 96%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 25910.00,

- 4. Pvt. Next: Pvt Low 24900.00,

- 5. Levels R: 25910.00, 25611.00,

- 6. Levels S: 24900.00, 24158.50, 23842.75, 23012.50, 21804.25.

Daily Benchmarks

- (Short-Term) 5 Day: 25783.12 Up Trend,

- (Short-Term) 10 Day: 25563.29 Up Trend,

- (Intermediate-Term) 20 Day: 25363.29 Up Trend,

- (Intermediate-Term) 55 Day: 24004.01 Up Trend,

- (Long-Term) 100 Day: 22535.53 Up Trend,

- (Long-Term) 200 Day: 21933.75 Up Trend.

Additional Metrics

- ATR: 1618,

- VOLMA: 626746.

Recent Trade Signals

- 04 Nov 2025: Short NQ 12-25 @ 25822 Signals.USAR-WSFG

- 30 Oct 2025: Short NQ 12-25 @ 25991.75 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NQ E-mini NASDAQ 100 Futures daily chart shows a strong upward trend across intermediate and long-term timeframes, with all major moving averages trending higher and price well above key support levels. The short-term picture is more mixed: while the current swing pivot trend remains up, recent trade signals have triggered short entries, and the weekly session fib grid trend has turned down with price below the NTZ center. This suggests a potential short-term pullback or consolidation phase within a broader bullish structure. Volatility remains elevated (high ATR), and volume is robust, indicating active participation. The market has made a series of higher highs and higher lows, but the recent large bars and fast momentum hint at possible exhaustion or a corrective phase before the uptrend resumes. Overall, the structure favors bulls on longer horizons, but short-term traders should be alert to possible retracements or choppy price action as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-11-04 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.