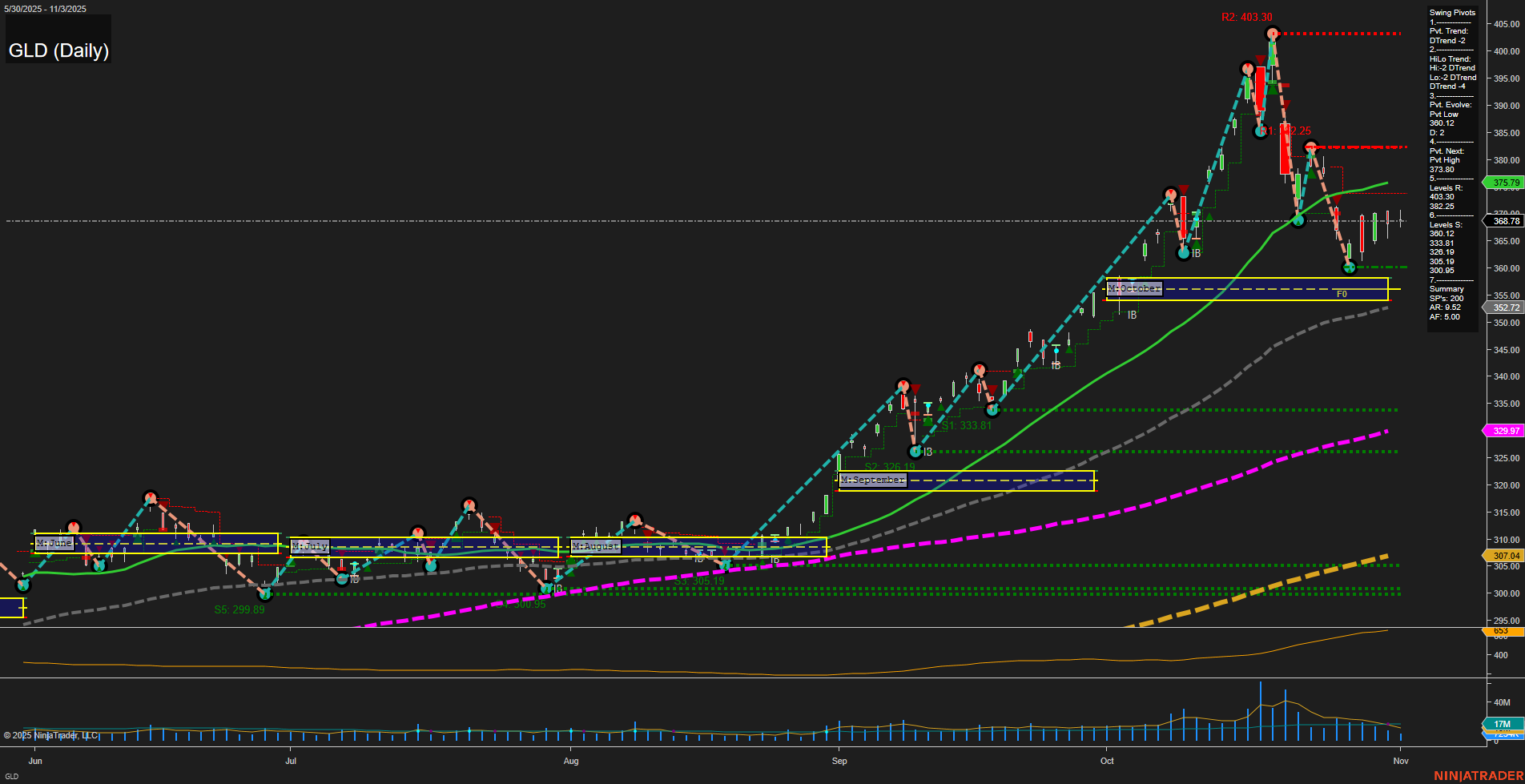

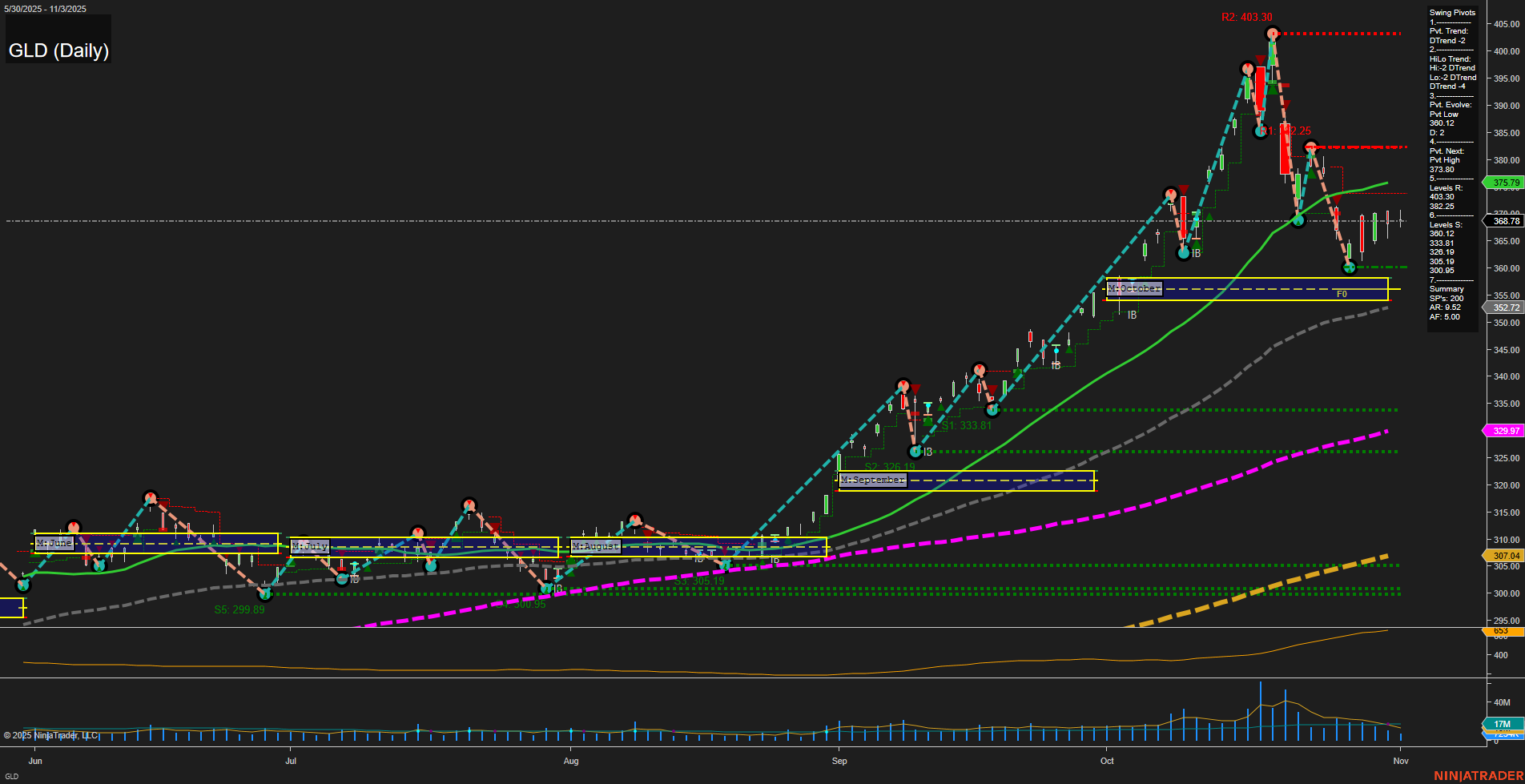

GLD SPDR Gold Shares Daily Chart Analysis: 2025-Nov-04 07:11 CT

Price Action

- Last: 368.78,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 362.12,

- 4. Pvt. Next: Pvt high 373.80,

- 5. Levels R: 403.30, 392.25, 382.25,

- 6. Levels S: 362.12, 333.81, 305.95, 299.89.

Daily Benchmarks

- (Short-Term) 5 Day: 368.78 Down Trend,

- (Short-Term) 10 Day: 368.78 Down Trend,

- (Intermediate-Term) 20 Day: 375.79 Down Trend,

- (Intermediate-Term) 55 Day: 368.78 Down Trend,

- (Long-Term) 100 Day: 329.97 Up Trend,

- (Long-Term) 200 Day: 307.04 Up Trend.

Additional Metrics

- ATR: 159,

- VOLMA: 7207880.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

GLD has recently experienced a sharp pullback from its highs, with price action now consolidating below the recent swing high resistance at 373.80 and above the swing low support at 362.12. The short- and intermediate-term trends are both down, as confirmed by the swing pivot structure and the downward-sloping 5, 10, 20, and 55-day moving averages. However, the long-term trend remains bullish, supported by the 100 and 200-day moving averages trending upward. Volatility, as measured by ATR, remains elevated, but volume has tapered off from the recent spike, indicating a pause after the recent selloff. The market is currently in a corrective phase, digesting the prior rally, with key support and resistance levels well-defined. The overall structure suggests a market in transition, with short-term momentum favoring the downside, but the broader uptrend still intact on a longer horizon.

Chart Analysis ATS AI Generated: 2025-11-04 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.