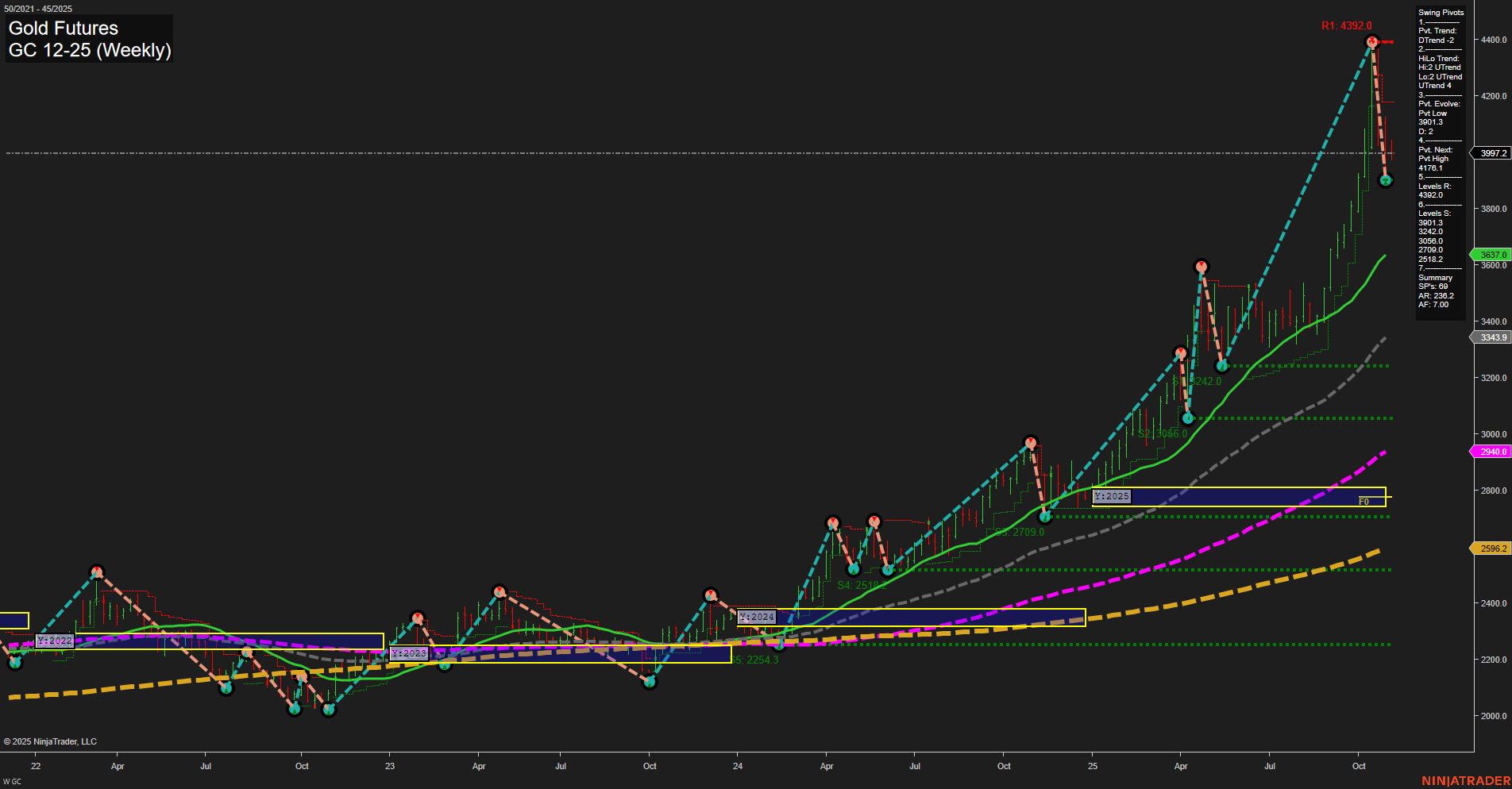

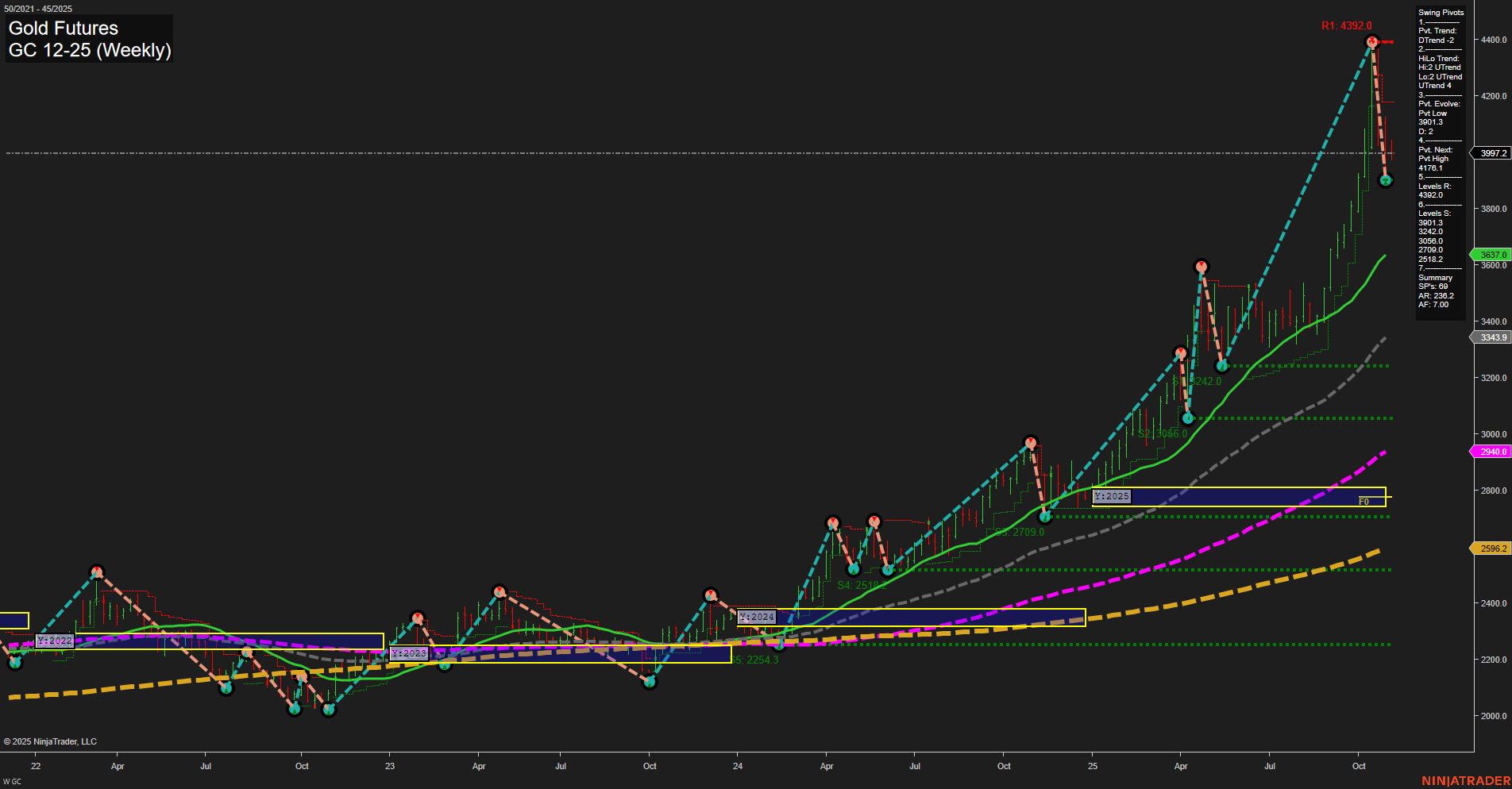

GC Gold Futures Weekly Chart Analysis: 2025-Nov-04 07:11 CT

Price Action

- Last: 3997.2,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 41%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 350%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 3901.3,

- 4. Pvt. Next: Pvt High 4711.5,

- 5. Levels R: 4392.0,

- 6. Levels S: 3901.3, 3637.0, 3306.0, 3065.0, 2940.0, 2709.0, 2510.0, 2254.3.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 4048.7 Down Trend,

- (Intermediate-Term) 10 Week: 3982.1 Down Trend,

- (Long-Term) 20 Week: 3637.0 Up Trend,

- (Long-Term) 55 Week: 3343.9 Up Trend,

- (Long-Term) 100 Week: 2940.0 Up Trend,

- (Long-Term) 200 Week: 2596.2 Up Trend.

Recent Trade Signals

- 04 Nov 2025: Short GC 12-25 @ 3982.1 Signals.USAR-WSFG

- 31 Oct 2025: Long GC 12-25 @ 4048.7 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Gold futures have experienced a sharp rally over the past year, with price action showing large, fast-moving bars and momentum peaking at new highs. The short-term trend has shifted bearish, as indicated by the WSFG trend and recent swing pivot direction, with price currently below the weekly NTZ and both 5- and 10-week moving averages turning down. However, the intermediate- and long-term outlooks remain bullish, supported by strong uptrends in the monthly and yearly session fib grids, as well as all long-term moving averages. The most recent swing pivot low at 3901.3 is a key support, while resistance is marked at the recent high of 4392.0. The market is currently in a corrective phase within a broader uptrend, suggesting a pullback or consolidation after an extended rally. Volatility remains elevated, and the structure shows a classic retracement after a parabolic move, with higher lows and higher highs still intact on the larger timeframes.

Chart Analysis ATS AI Generated: 2025-11-04 07:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.