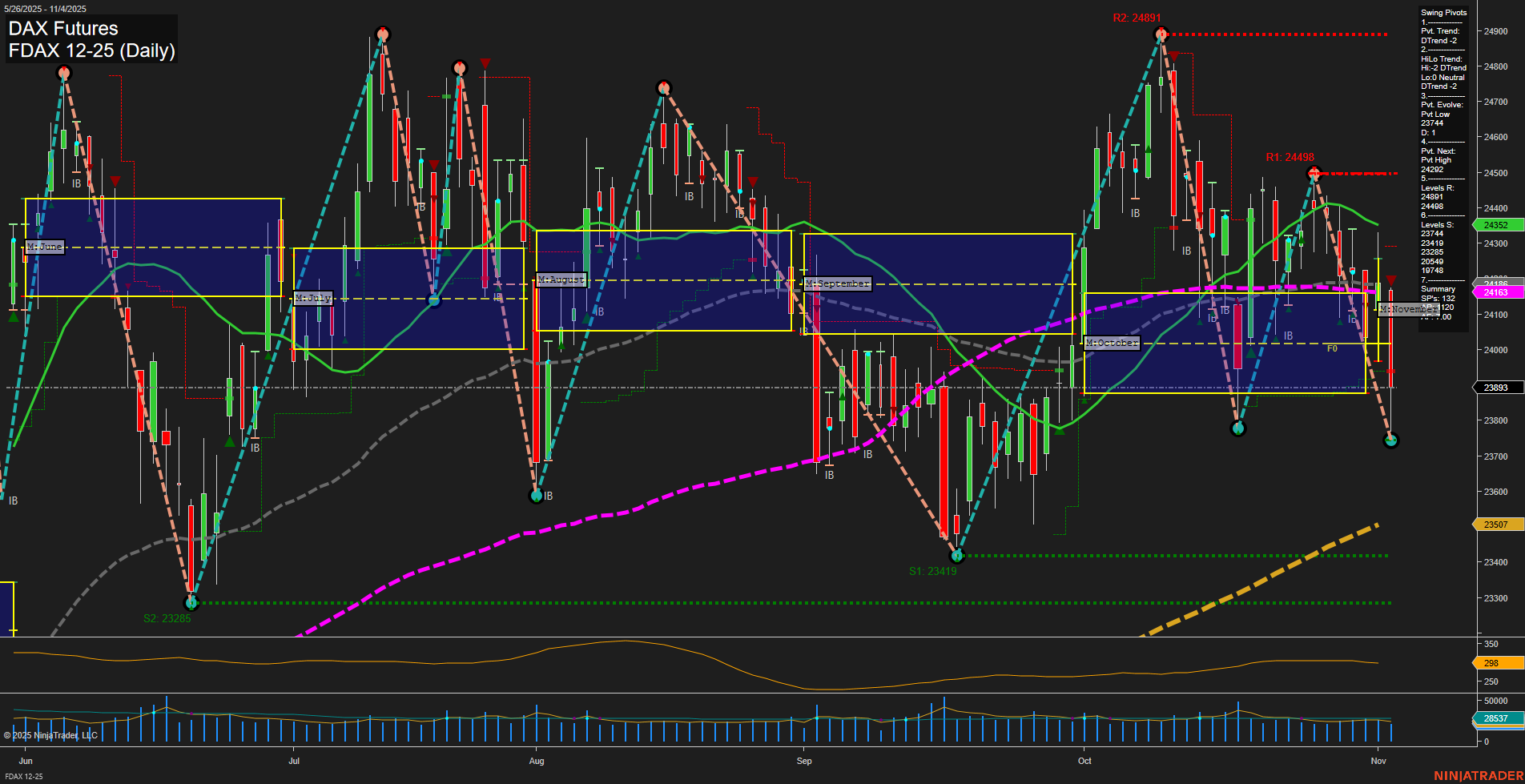

The FDAX is currently experiencing a pronounced short- and intermediate-term downtrend, as confirmed by both the weekly and monthly session fib grids (WSFG and MSFG) and the swing pivot structure, which shows a sequence of lower highs and lower lows. Price is trading below the NTZ (neutral trading zone) on both the weekly and monthly grids, reinforcing the bearish bias for these timeframes. All key short- and intermediate-term moving averages (5, 10, 20, 55, 100-day) are trending down and are above the current price, further supporting the downside momentum. The most recent swing pivot is a low at 23,714, with the next significant resistance at 24,498 and support at 23,714 and 23,419. Despite the prevailing short-term weakness, the long-term yearly fib grid (YSFG) remains in an uptrend, and the 200-day moving average is still rising, suggesting that the broader bull market structure is intact. However, the current price action is characterized by slow momentum and medium-sized bars, indicating a controlled but persistent sell-off rather than panic or capitulation. Volatility (ATR) and volume (VOLMA) are moderate, not signaling extreme conditions. Recent trade signals have all triggered short entries, aligning with the dominant short- and intermediate-term trends. The market appears to be in a corrective phase within a larger uptrend, with the potential for further downside until a significant support or reversal pattern emerges. The technical landscape suggests a market in retracement mode, with lower highs and lower lows, and no immediate signs of reversal, but with long-term bullish undercurrents still present.