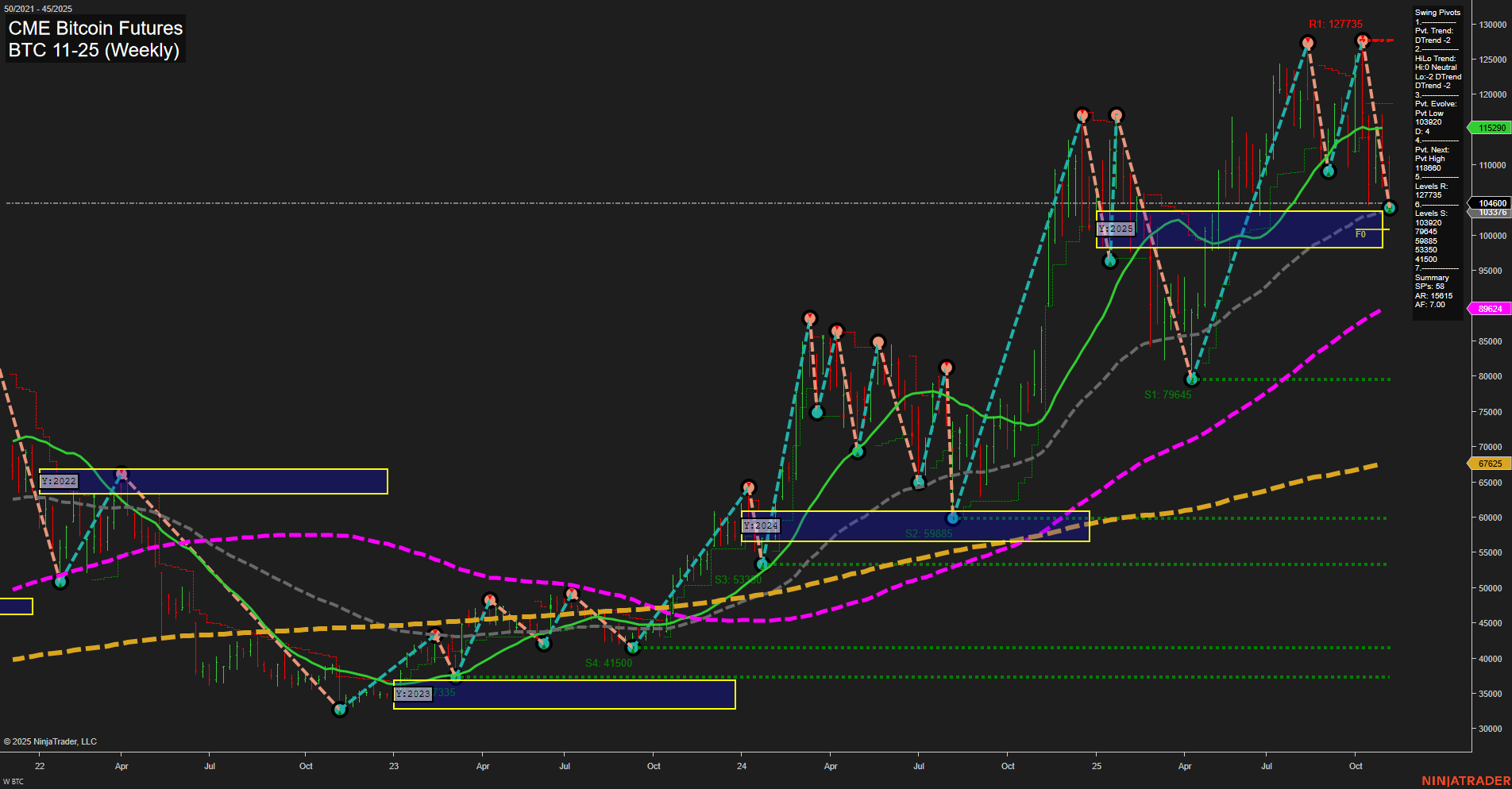

The current weekly chart for CME Bitcoin Futures shows a clear divergence between short/intermediate-term and long-term trends. Price action is consolidating with medium-sized bars and slow momentum, indicating a pause or potential transition after recent volatility. Both the Weekly and Monthly Session Fib Grids (WSFG, MSFG) are trending down, with price below their respective NTZ/F0% levels, confirming a bearish bias in the short and intermediate timeframes. Swing pivots reinforce this, with both short-term and intermediate-term trends in a downtrend, and the most recent pivot low at 103200 acting as a key support. Resistance is stacked above at 118680 and 127735, suggesting overhead supply. Weekly benchmarks show short and intermediate-term moving averages turning down, while all long-term moving averages (20, 55, 100, 200 week) remain in strong uptrends, reflecting the underlying bullish structure from a macro perspective. Recent trade signals have shifted to short, aligning with the prevailing short-term and intermediate-term bearish momentum. However, the yearly session grid remains positive, with price above the yearly NTZ/F0% and the long-term trend up, indicating that the broader bull cycle is intact despite the current pullback. In summary, the market is experiencing a corrective phase within a larger uptrend. Short and intermediate-term traders are facing a bearish environment with potential for further downside or consolidation, while long-term participants may view this as a retracement within a bullish cycle. Key levels to watch are the support at 103200 and resistance at 118680/127735, as breaks of these could signal the next directional move.