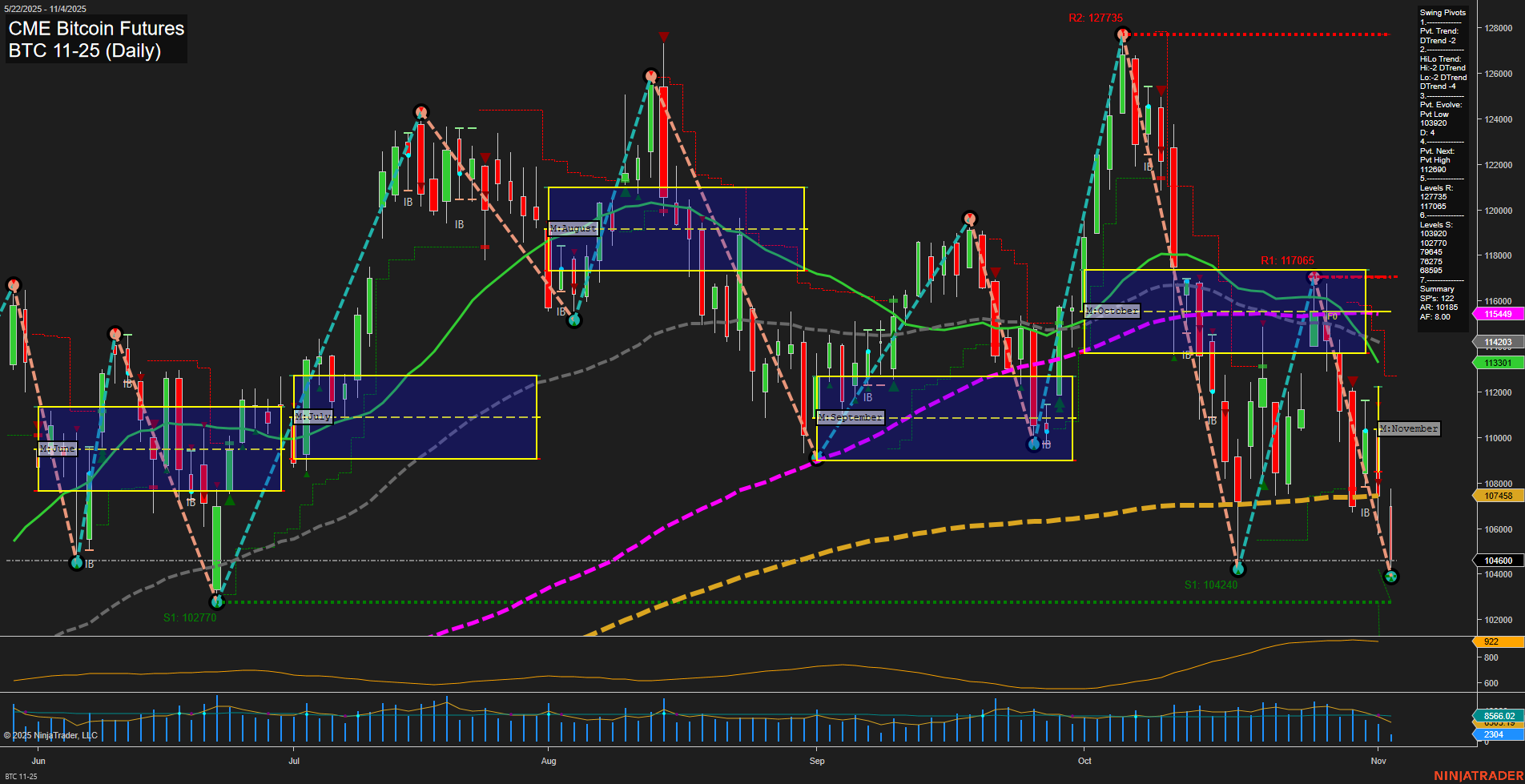

BTC CME Bitcoin Futures are exhibiting pronounced downside momentum, with large daily bars and fast momentum confirming a strong sell-off. Both the weekly and monthly session fib grids (WSFG and MSFG) show price well below their respective NTZ/F0% levels, reinforcing a short-term and intermediate-term downtrend. The swing pivot structure is in a clear DTrend (downtrend) on both short and intermediate timeframes, with the most recent pivot low at 104200 and the next potential reversal only above 112690. Resistance levels are stacked above, with significant overhead supply at 115690, 117065, and 127735, while support is concentrated at the recent swing low. All benchmark moving averages from short to long-term are trending down, with price trading below every key average, further confirming the prevailing bearish structure. The ATR remains elevated, indicating persistent volatility, while volume metrics suggest active participation during this decline. Recent trade signals have shifted decisively to the short side, aligning with the technical picture. Despite the long-term YSFG trend still holding up, the current price action is dominated by aggressive selling, with no immediate signs of reversal. The market is in a corrective phase, with lower highs and lower lows, and is testing key support levels. Any bounce would need to overcome multiple resistance layers to shift the bias. The environment is characterized by high volatility, trend continuation to the downside, and a lack of bullish catalysts in the near term.