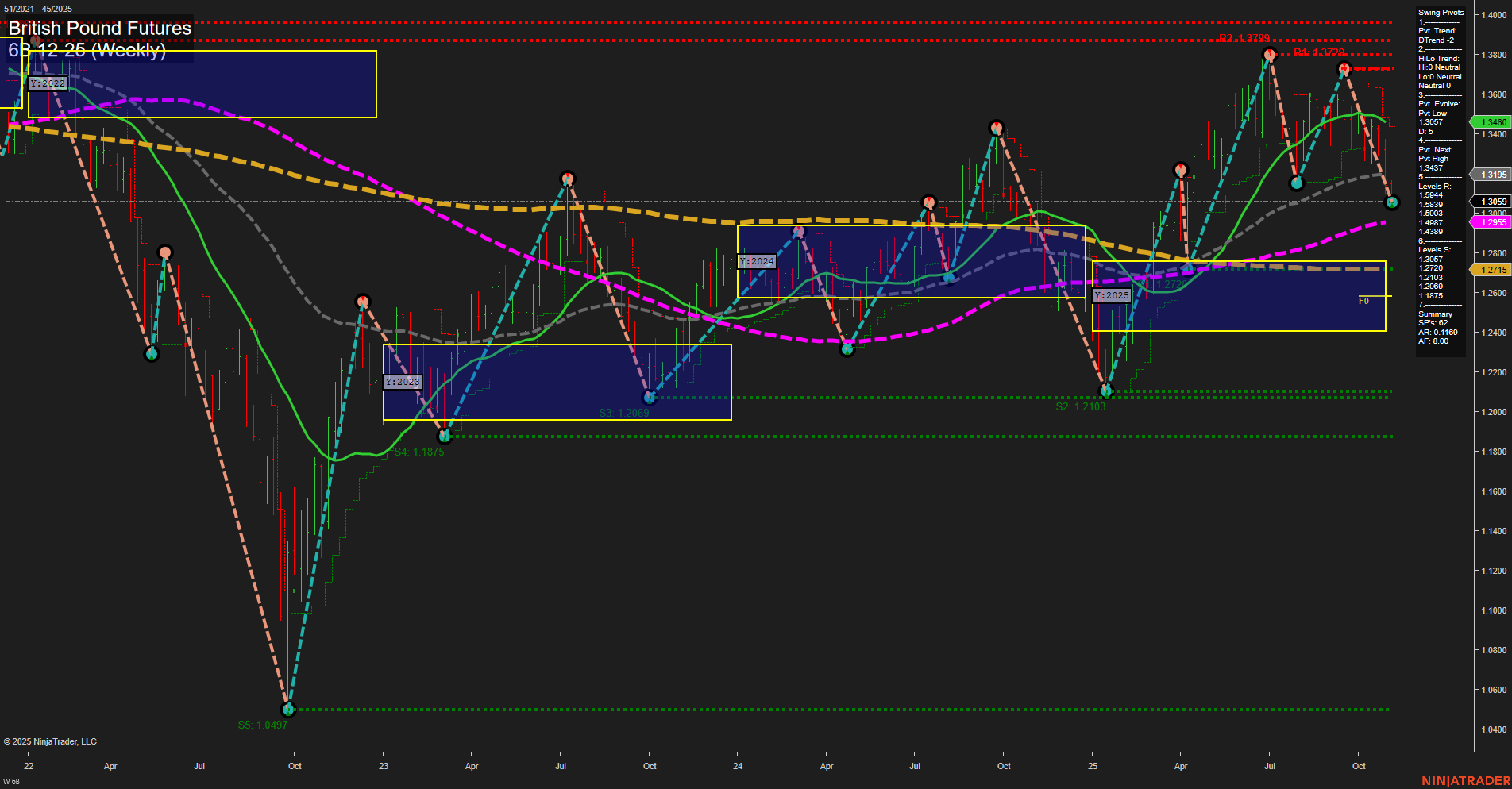

The British Pound Futures (6B) weekly chart shows a clear divergence between short/intermediate-term and long-term trends. Price action is currently in a medium bar range with average momentum, and the last price sits at 1.3195. Both the Weekly and Monthly Session Fib Grids (WSFG, MSFG) indicate a downward trend, with price below their respective NTZ/F0% levels, confirming short- and intermediate-term bearishness. This is reinforced by the swing pivot trends, which are both down, and recent short trade signals. Resistance is clustered above at 1.3471, 1.3799, and 1.3928, while support is layered below at 1.3097, 1.2877, and 1.2715, with deeper levels at 1.2069 and 1.0497. However, the Yearly Session Fib Grid (YSFG) and all long-term moving averages (20, 55, 100, 200 week) remain in uptrends, suggesting the broader structure is still bullish. This sets up a classic swing environment where the market is experiencing a corrective pullback within a larger uptrend. The current price is testing intermediate support levels, and the next key pivot low is at 1.3097. The market is in a retracement phase, with potential for further downside in the short term, but the long-term uptrend remains intact, hinting at possible future recovery or bounce once the correction exhausts. Volatility is moderate, and the chart structure suggests a choppy, corrective environment rather than a full trend reversal at this stage.