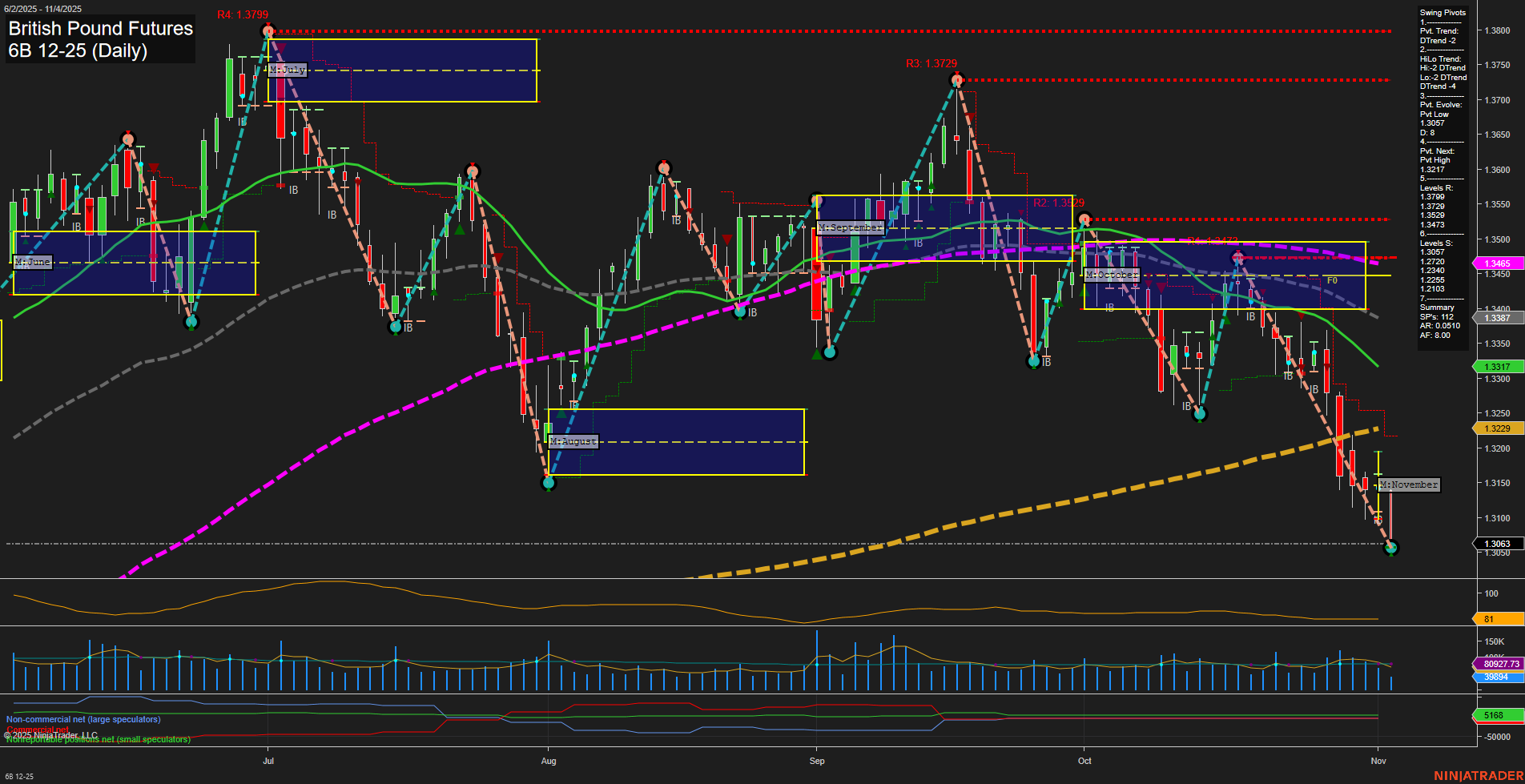

The British Pound Futures (6B) are exhibiting pronounced bearish momentum in both the short- and intermediate-term timeframes, as evidenced by large, fast-moving bars and a decisive break below key support levels. The price is trading well below the NTZ/F0% levels on both the weekly and monthly session fib grids, reinforcing the prevailing downtrend. All benchmark moving averages from short to long-term are trending down, with price currently below every major average, highlighting broad-based weakness. Swing pivot analysis confirms a dominant downtrend, with the most recent pivot low established at 1.3063 and the next potential reversal only above 1.3237. Resistance levels are stacked well above current price, while immediate support is at the new swing low. Recent trade signals have also aligned with the bearish trend, with consecutive short entries triggered. Despite the long-term yearly fib grid still showing an uptrend, the current price action and technical structure suggest the market is in a strong corrective or impulsive sell-off phase, possibly driven by macroeconomic or seasonal factors. Volatility remains elevated, and volume is robust, indicating active participation during this move. The overall environment is characterized by trend continuation to the downside, with no immediate signs of reversal.