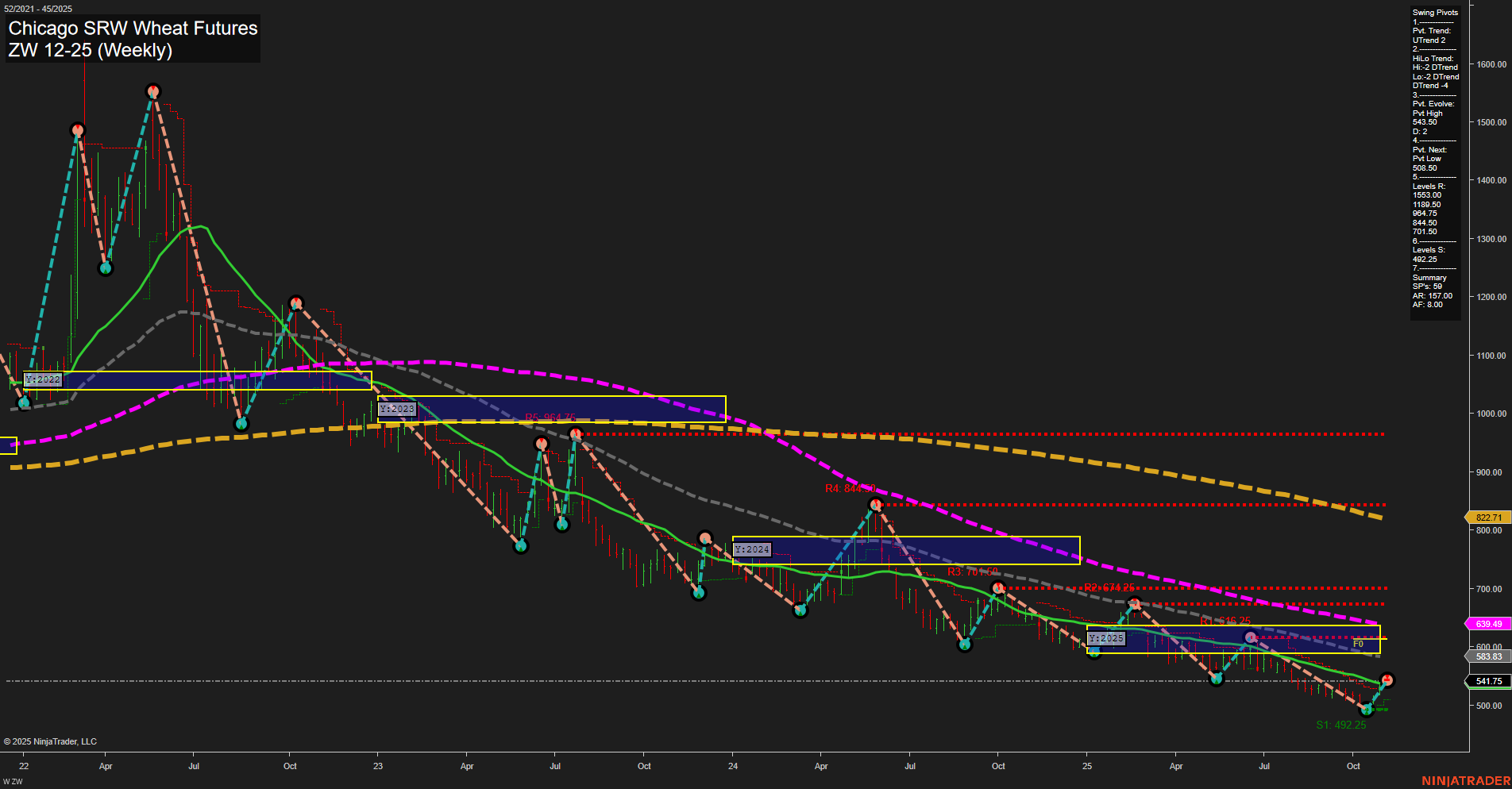

The ZW Chicago SRW Wheat Futures weekly chart shows a market that has been in a persistent long-term downtrend, as evidenced by all major moving averages (20, 55, 100, 200 week) trending lower and price trading well below these benchmarks. The yearly session fib grid (YSFG) trend remains down, with price below the NTZ center, confirming the dominant bearish structure. However, short-term and intermediate-term session fib grids (WSFG, MSFG) have shifted to an uptrend, with price currently above their respective NTZ centers, suggesting a possible short-term bounce or retracement within the broader downtrend. Swing pivots indicate a recent short-term uptrend (UTrend) but the intermediate-term trend (HiLo) remains down, with resistance levels far above current price and only one nearby support at 492.25. The most recent trade signal was a short entry, aligning with the prevailing longer-term bearish bias. Overall, the market is experiencing a counter-trend rally within a larger bearish cycle, with price action characterized by slow momentum and medium-sized bars, indicating a potential pause or consolidation phase after an extended decline. Swing traders should note the potential for short-term volatility and retracement, but the primary trend remains downward.