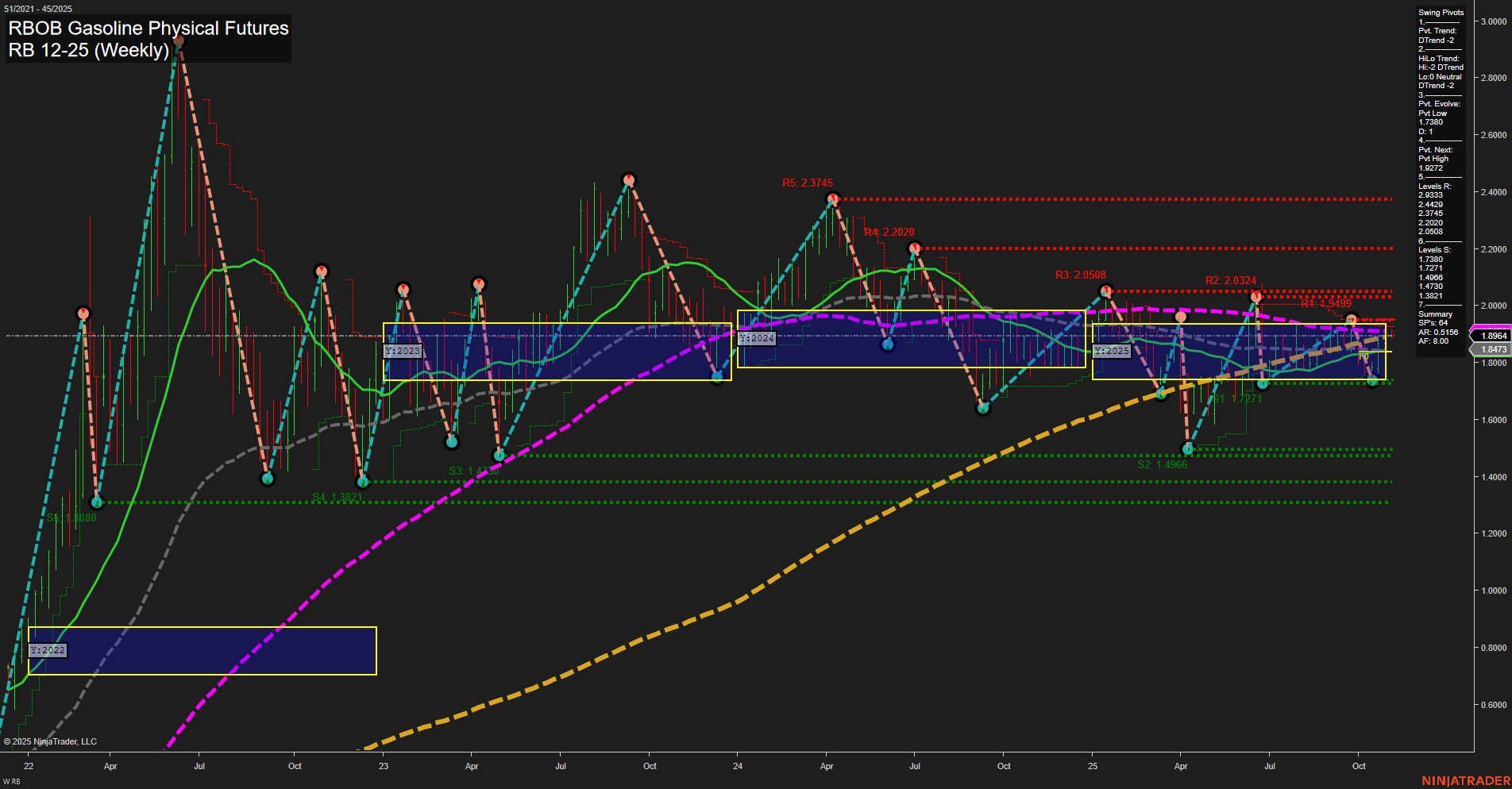

The RBOB Gasoline futures market is currently experiencing a mixed technical environment. Short-term momentum is slow, with price action showing medium-sized bars and the last price sitting just below the 20-week moving average. The Weekly Session Fib Grid (WSFG) trend is down, and both the short-term and intermediate-term swing pivot trends are in a downtrend, indicating recent weakness and a lack of bullish conviction in the near term. However, the Monthly and Yearly Session Fib Grids (MSFG and YSFG) both show price above their respective NTZ centers and are trending up, suggesting underlying strength on higher timeframes. Key resistance levels are clustered between 1.95 and 2.37, while support is found at 1.7380 and lower. The 5, 10, 55, and 100-week moving averages are all trending down, reinforcing the short- to intermediate-term bearish bias, but the 200-week moving average remains in an uptrend, supporting a longer-term bullish outlook. Recent trade signals have triggered long entries, reflecting attempts to capture potential reversals or bounces off support. Overall, the market is in a consolidation phase with a bearish short-term bias, neutral intermediate-term outlook, and a bullish long-term structure. Price is oscillating within a broad range, with lower highs and higher lows suggesting indecision and potential for volatility as the market awaits a decisive breakout or breakdown.