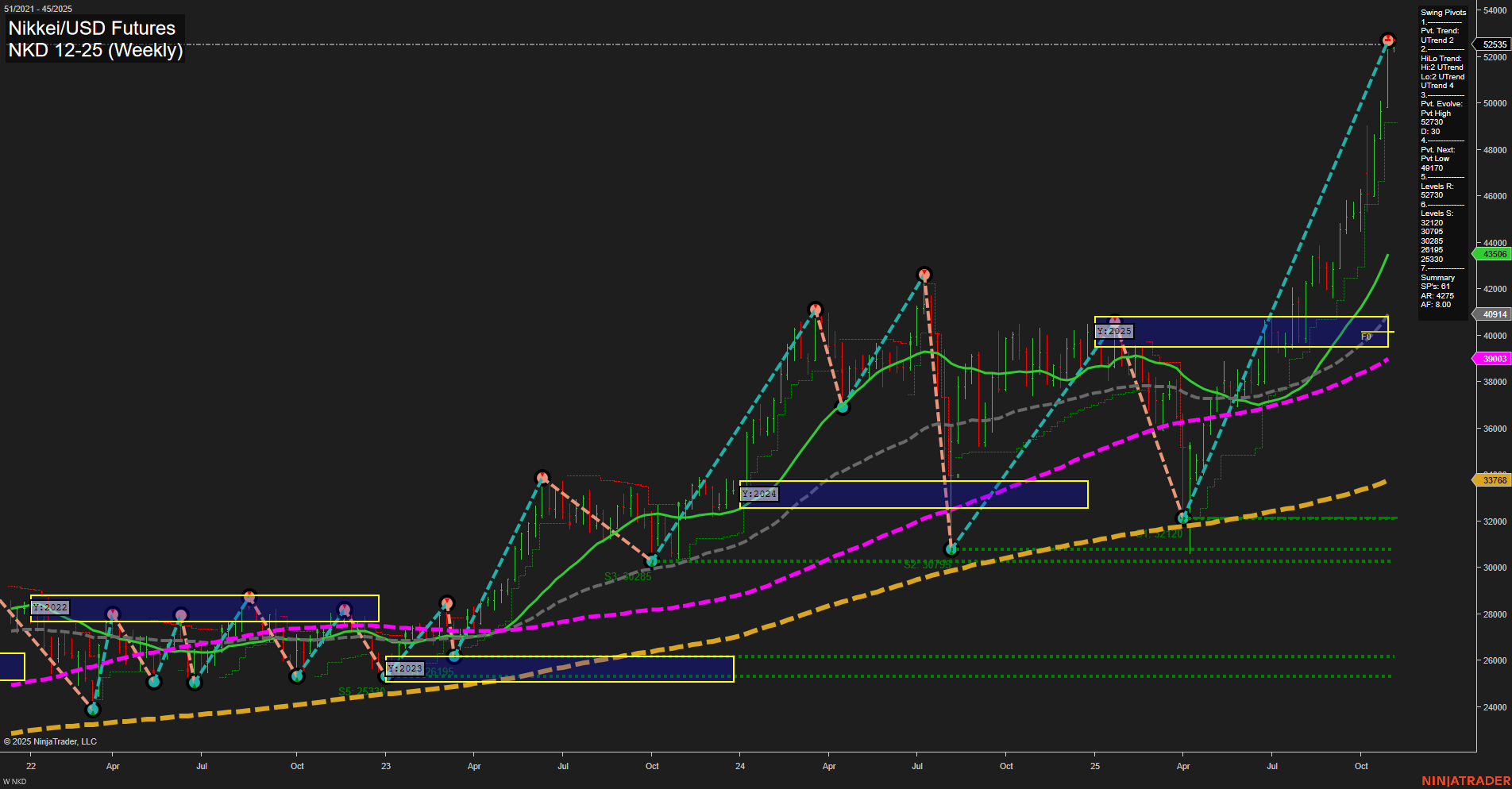

NKD Nikkei/USD Futures are exhibiting a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating aggressive buying and a potential breakout environment. The market is trading well above all key session Fib grid levels (weekly, monthly, yearly), with each grid showing a clear uptrend and price positioned above the NTZ (neutral zone) center lines, reinforcing the bullish bias. Swing pivot analysis confirms the uptrend, with the most recent pivot high at 52,535 and the next significant support at 41,710, followed by a series of lower support levels. All benchmark moving averages (from 5-week to 200-week) are trending upward, with price significantly above these averages, highlighting strong trend alignment and underlying market strength. Recent price action suggests a continuation of the rally, with higher highs and higher lows, and no immediate signs of reversal or exhaustion. The technical landscape is supportive of trend continuation, with no major resistance levels above the current price. The market has moved out of previous consolidation zones and is in a clear expansion phase, reflecting robust momentum and positive sentiment.