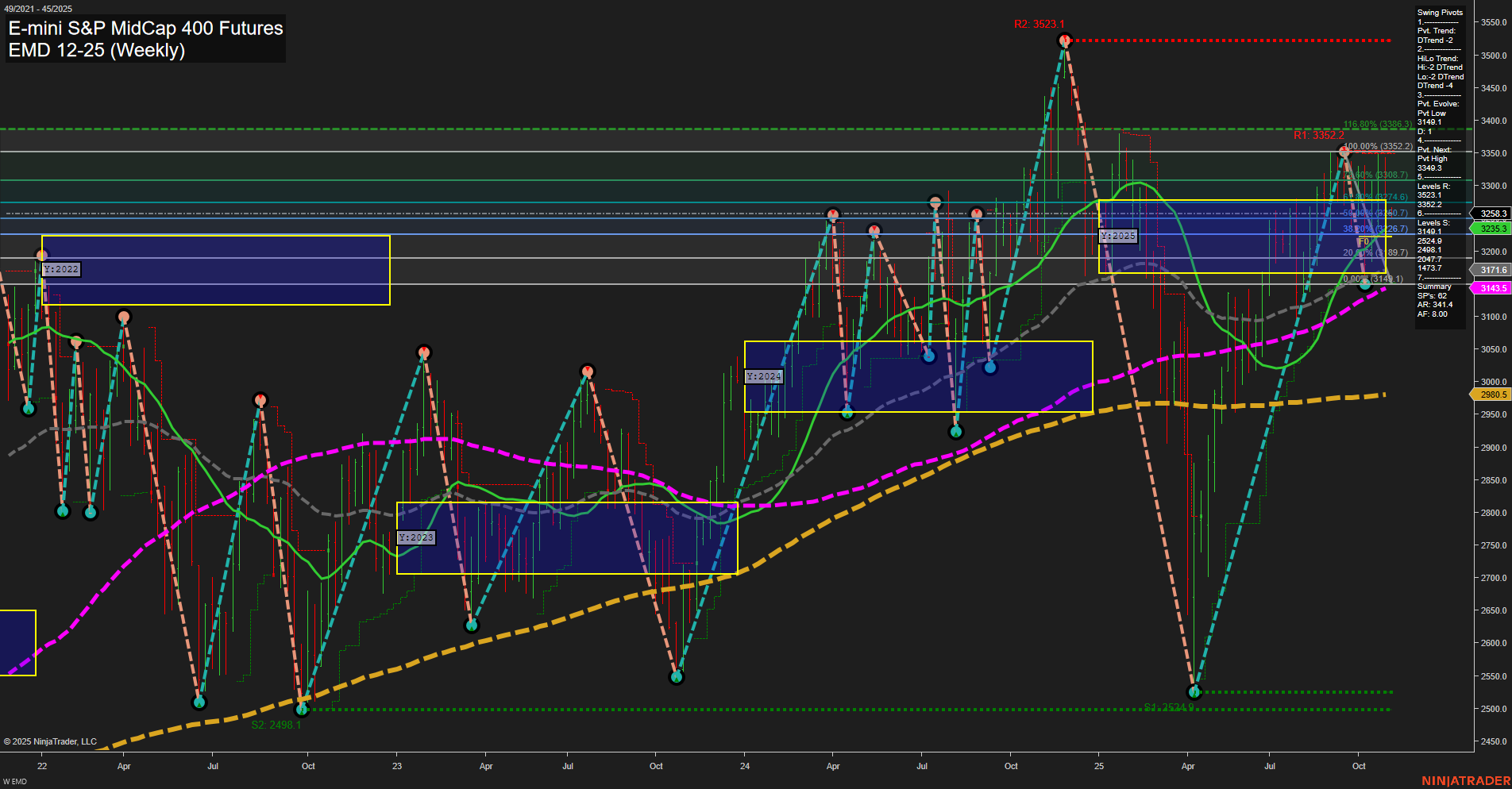

The EMD futures weekly chart shows a clear divergence between short/intermediate-term and long-term trends. Price action is currently subdued with medium bars and slow momentum, reflecting a period of consolidation or mild retracement after recent declines. Both the Weekly and Monthly Session Fib Grids (WSFG, MSFG) indicate price is below their respective NTZ/F0% levels, confirming a short- and intermediate-term downtrend, which is reinforced by the swing pivot trends (DTrend) and recent short trade signals. Resistance is clustered near 3350, while support is found at 3140 and lower at 3117.6 and 2985. Despite this, the long-term outlook remains bullish, as the yearly session grid trend is up and price is above the yearly NTZ/F0%. The 20, 55, 100, and 200 week moving averages are all trending up, suggesting the broader uptrend is intact. This setup often signals a corrective phase within a larger bull market, with the market currently testing support zones and possibly setting up for a future bounce or trend continuation. Volatility has moderated, and the market is in a pullback phase, with the potential for a reversal if support holds and momentum returns. The overall structure suggests swing traders should be attentive to signs of stabilization or reversal at key support levels, while respecting the prevailing short-term bearish momentum.