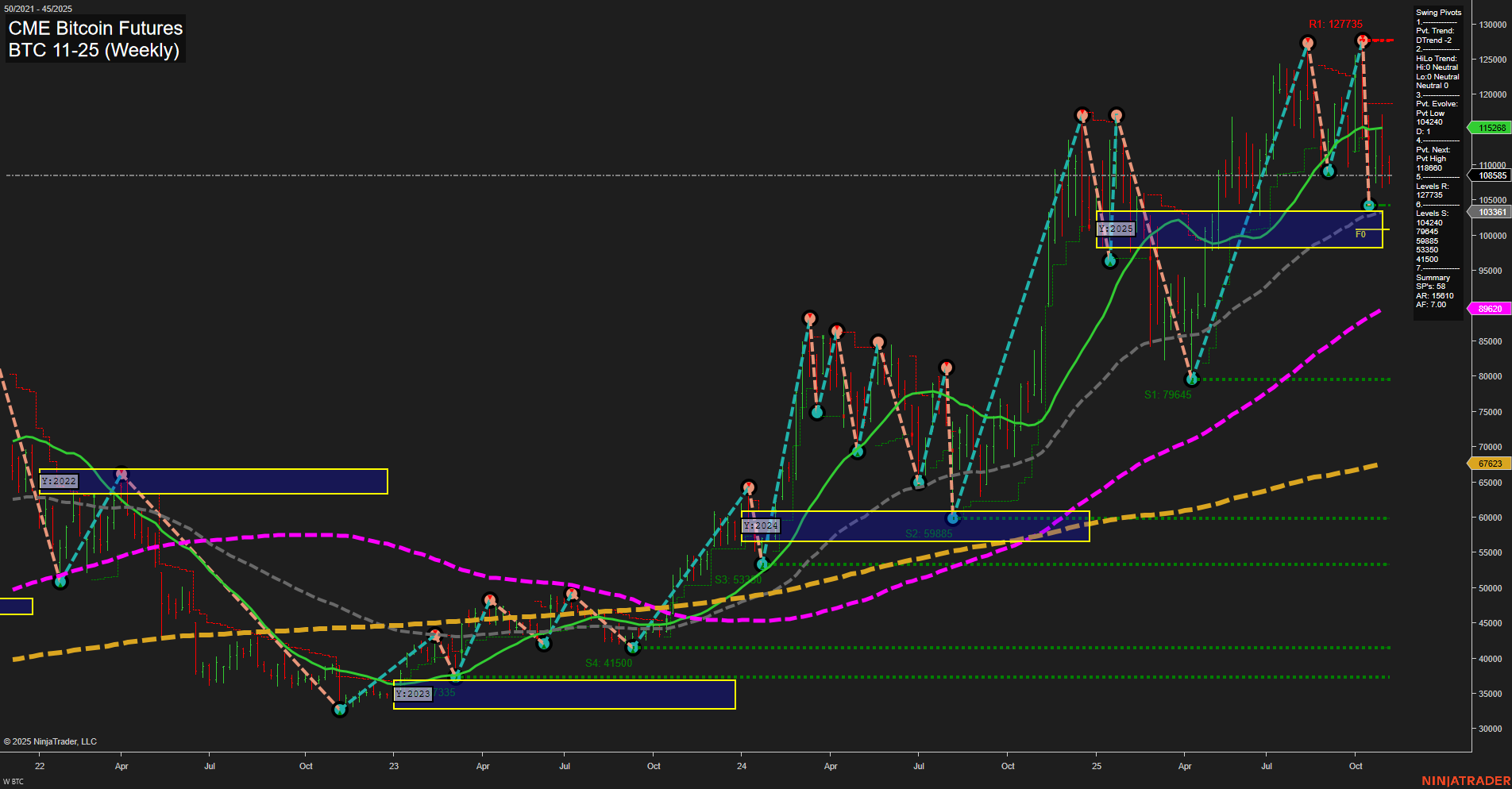

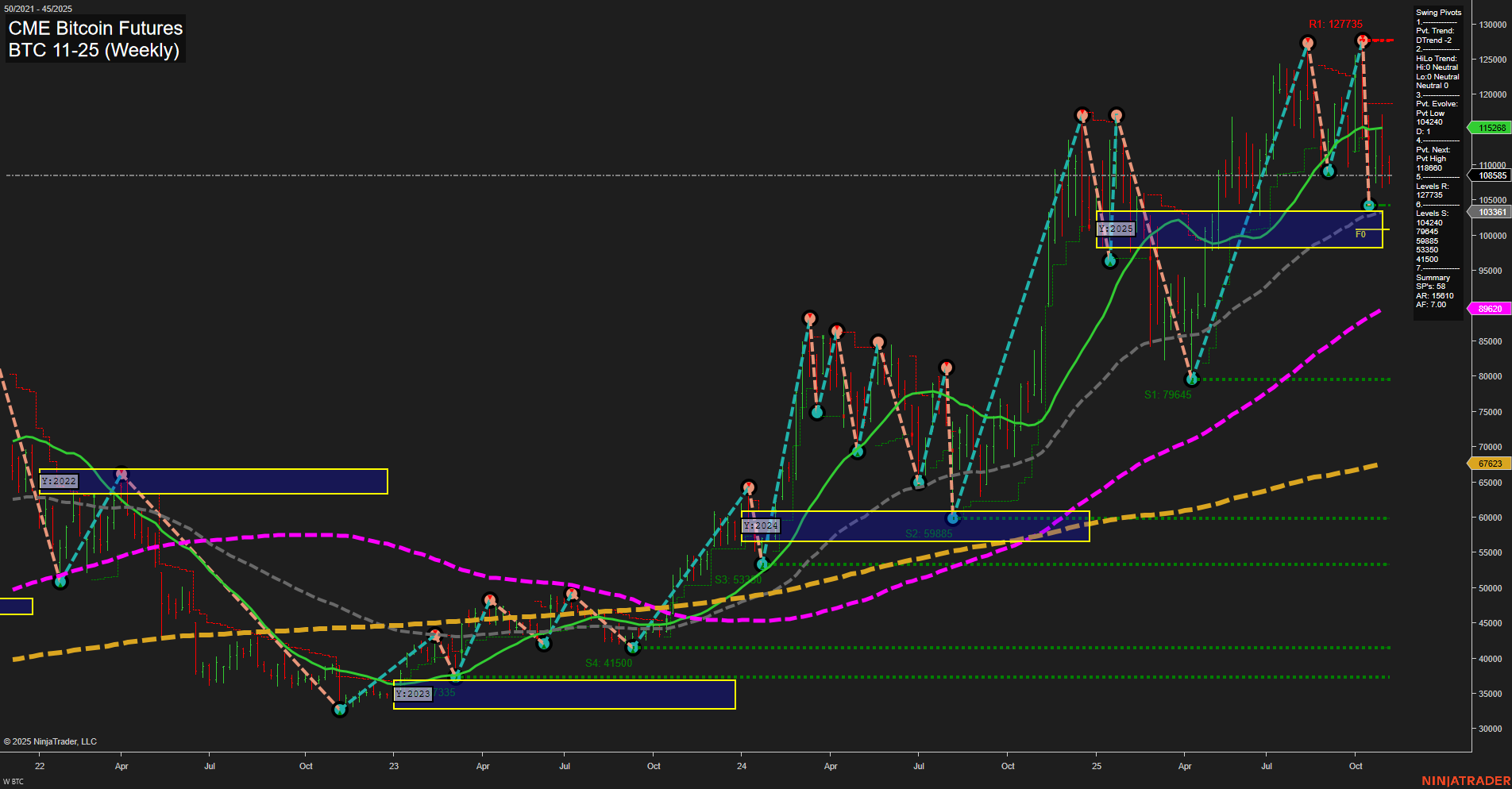

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Nov-03 07:04 CT

Price Action

- Last: 112568,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -19%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -49%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 28%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt low 104240,

- 4. Pvt. Next: Pvt high 118460,

- 5. Levels R: 127735, 118460, 112785,

- 6. Levels S: 103361, 79645, 59886, 53305, 41500.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115268 Down Trend,

- (Intermediate-Term) 10 Week: 113865 Down Trend,

- (Long-Term) 20 Week: 108585 Up Trend,

- (Long-Term) 55 Week: 99620 Up Trend,

- (Long-Term) 100 Week: 67623 Up Trend,

- (Long-Term) 200 Week: 59620 Up Trend.

Recent Trade Signals

- 29 Oct 2025: Short BTC 10-25 @ 112555 Signals.USAR.TR120

- 28 Oct 2025: Short BTC 10-25 @ 113145 Signals.USAR-MSFG

- 27 Oct 2025: Long BTC 10-25 @ 115395 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The current weekly chart for CME Bitcoin Futures shows a clear divergence between short/intermediate-term and long-term trends. Price action is consolidating below the NTZ center, with medium bars and average momentum, indicating a pause or pullback phase after recent volatility. Both the WSFG and MSFG trends are down, with price below their respective NTZ/F0% levels, and recent short signals reinforce a bearish bias for swing traders in the near term. The swing pivot trend is down, with the next key resistance at 118460 and support at 103361, suggesting a range-bound environment with downside risk. However, the long-term YSFG and all major long-term moving averages remain in uptrends, highlighting that the broader bull cycle is intact. This setup often reflects a corrective phase within a larger uptrend, where price is digesting gains and testing support levels. Swing traders may observe for signs of reversal or continuation at these key pivot and support zones, as the market could be setting up for the next directional move once the current consolidation resolves.

Chart Analysis ATS AI Generated: 2025-11-03 07:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.